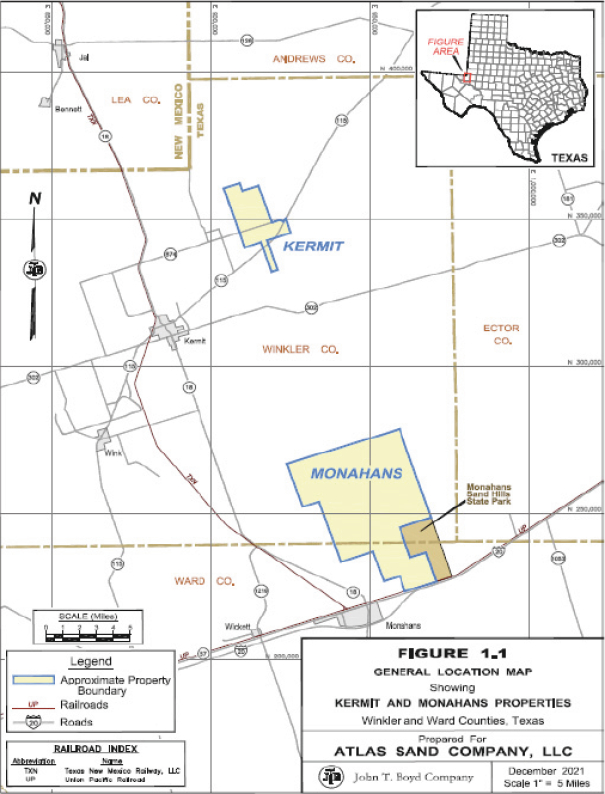

in rivers and other bodies of water for use in the desert of West Texas. Our reserves benefit from a naturally occurring water table near the surface of our mines, which is unique in the Winkler Sand Trend and provides an ample natural supply of costless water for dredge and wash plant operations while minimizing the impact on regional aquifers.

Additionally, the results of a study commissioned by us with an independent research agency (the “Transportation Study”), when integrated with our management’s internal analysis, support our estimate that our planned Dune Express sand conveyor system could significantly reduce emissions that would otherwise be produced by trucking-related activities associated with the delivery of proppant from the mines of Permian Basin providers to end users. Our estimates project that the system will result in an approximate 70% reduction in carbon dioxide emissions and other emissions, including pollutants that are harmful to humans. See the subsection titled “—Growth and Technology Initiatives—Dune Express” below for additional information regarding the Dune Express.

The graphic below summarizes our estimates of the percentage reduction in the truck miles driven and associated emissions and emission costs attributable to the anticipated operation of our inaugural Dune Express conveyor system as compared to current, traditional practices.

Our management team has been proactive with respect to the protection of the dunes sagebrush lizard (“DSL”) and its habitat in an effort to reduce the risk that our business and operations will be materially interrupted in the event that the DSL is listed under the Endangered Species Act (“ESA”). We have adopted numerous best practices to promote active conservation measures for the benefit of the DSL, including our identification of up to 17,000 acres of land for potential set asides, our pursuit of more environmentally friendly mining practices and our participation in the Candidate Conservation Agreement with Assurances (“CCAA”) for the DSL. See the subsection titled “—Competitive Strengths—Proactive approach to the well-being of the environment and our employees” below. In January 2021, the CCAA was approved by the U.S. Fish and Wildlife Service (“USFWS”) to provide a framework for entry into voluntary conservation agreements between the USFWS and stakeholder participants, under which the parties work together to identify threats to the DSL, design and implement conservation measures to address these threats and monitor their effectiveness, among other things. Atlas has been a supporter of the CCAA since its inception and was the first proppant producer to apply for a permit under, and be accepted into, the CCAA. Due to our participation in the CCAA and other conservation measures that we have voluntarily adopted, we do not anticipate that a listing of the DSL as an endangered species would materially reduce sand production at our Kermit and Monahans facilities. We are currently only one of three companies participating in the CCAA. In the event that the DSL is listed as an endangered species under the ESA, it is possible that companies that are not participants in the CCAA at the time of a future ESA listing would see a disruption to their operations.

4