6-1

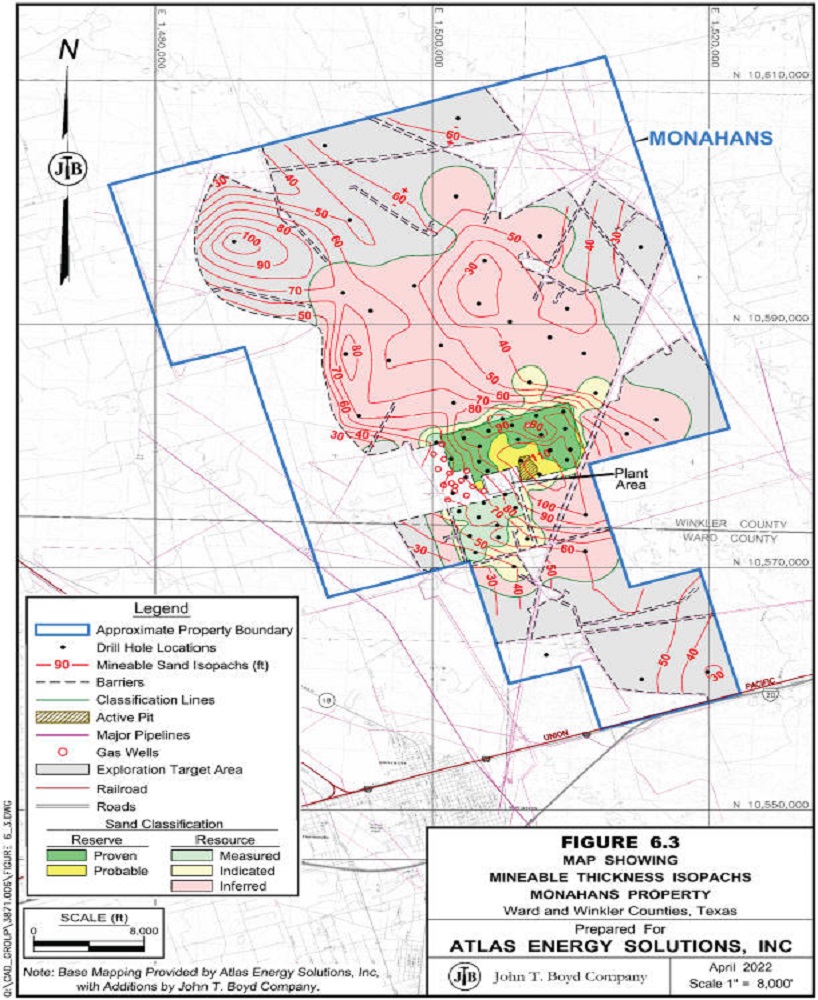

6.0 FRAC SAND RESOURCES AND RESERVES

| 6.1 |

Applicable Standards and Definitions |

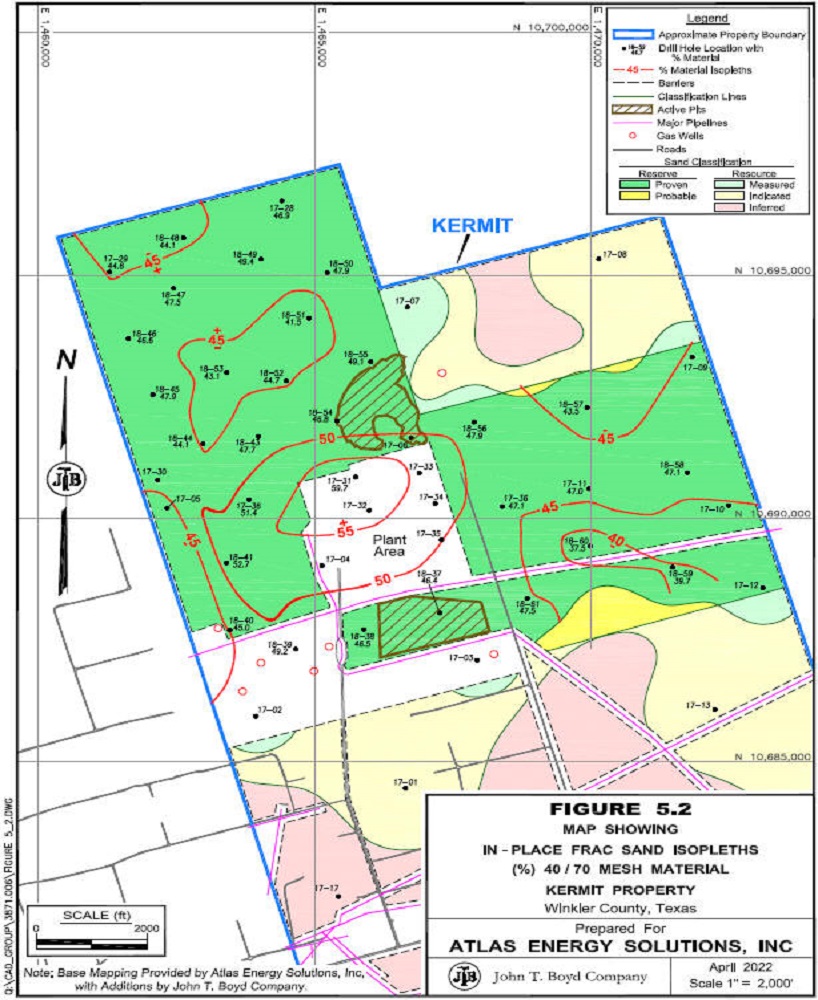

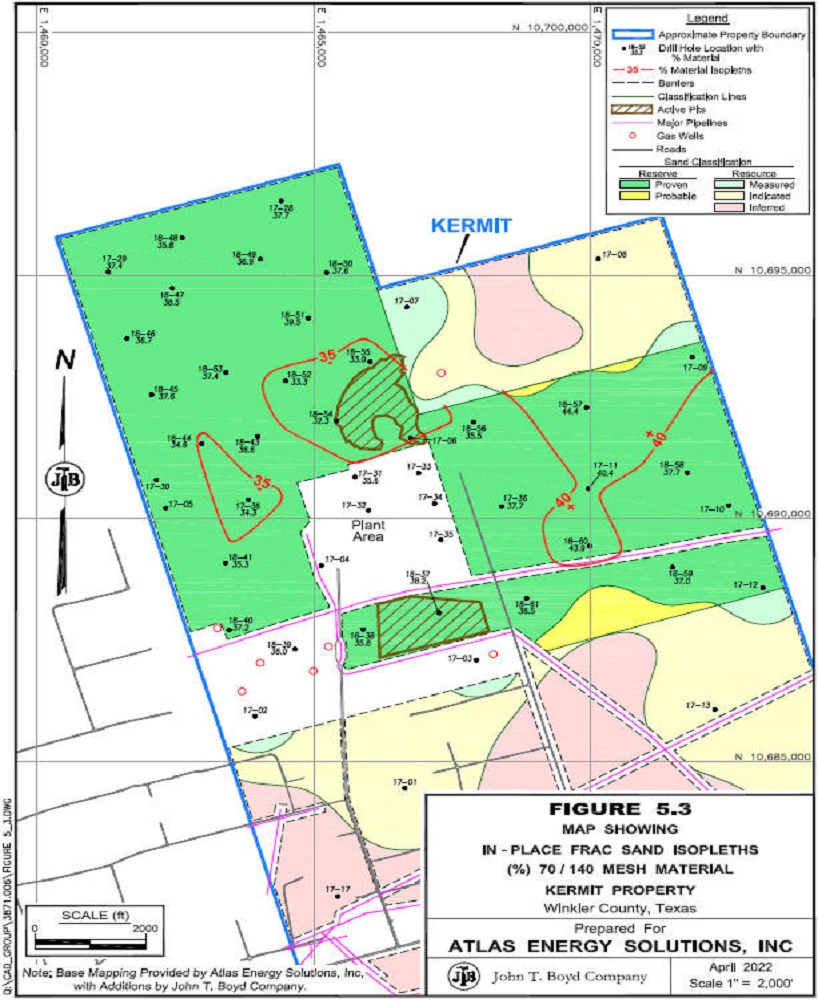

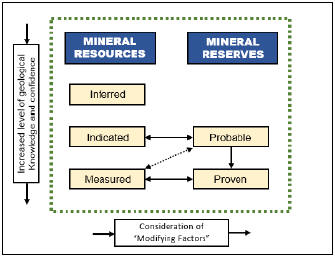

Unless otherwise stated, frac sand resource and frac sand reserve estimates disclosed herein are completed in accordance with the standards and definitions

provided by S-K 1300. It should be noted that BOYD considers the terms “mineral” and “frac sand” to be generally interchangeable within the relevant sections of S-K 1300.

Estimates of any mineral resources and reserves are always subject to a degree of uncertainty. The level of

confidence that can be applied to a particular estimate is a function of, among other things: the amount, quality, and completeness of exploration data; the geological complexity of the deposit; and economic, legal, social, and environmental factors

associated with mining the resource/reserve. By assignment, BOYD used the definitions provided in S-K 1300 to describe the degree of uncertainty associated with the estimates reported herein.

The definition of mineral (frac sand) resource provided by S-K 1300 is:

Mineral resource is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or

quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade,

likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization

drilled or sampled.

Estimates of frac sand resources are subdivided to reflect different levels of geological confidence into measured (highest

geologic assurance), indicated, and inferred (lowest geologic assurance)

The definition of mineral (frac sand) reserve provided by S-K 1300 is:

Mineral reserve is an estimate of tonnage and grade or quality of indicated and measured

mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting

materials and allowances for losses that may occur when the material is mined or extracted.

JOHN T. BOYD COMPANY