Investor Presentation October 2023 NYSE: AESI Goldman Sachs Energy, Clean Tech & Utilities Conference January 2024 Exhibit 99.1

Important Disclosures Forward-Looking Statements This Presentation contains “forward-looking statements” of Atlas Energy Solutions Inc. (“Atlas,” the “Company,” “AESI,” “we,” “us” or “our”) within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are predictive or prospective in nature, that depend upon or refer to future events or conditions or that include the words “may,” “assume,” “forecast,” “position,” “strategy,” “potential,” “continue,” “could,” “will,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include statements about our business strategy, industry, future operations and profitability, expected capital expenditures and the impact of such expenditures on our performance, our recent corporate reorganization transaction (the "Up-C Simplification"), our financial position, production, revenues and losses, our capital programs, management changes, current and potential future long-term contracts and our future business and financial performance. Although forward-looking statements reflect our good faith beliefs at the time they are made, we caution you that these forward-looking statements are subject to a number of risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, commodity price volatility stemming from geopolitical instability due to the ongoing Israel-Hamas and Russia-Ukraine military conflicts, adverse developments affecting the financial services industry, our ability to complete growth projects, including the Dune Express, on time and on budget, the expected benefits of the Up-C Simplification and the related impact on existing stakeholders, estimates regarding future market capitalization and the anticipated financial impact of the Up-C Simplification, actions of OPEC+ to set and maintain oil production levels, the level of production of crude oil, natural gas and other hydrocarbons and the resultant market prices of crude oil, inflation, environmental risks, operating risks, regulatory changes, lack of demand, market share growth, the uncertainty inherent in projecting future rates of reserves, production, cash flow, access to capital, the timing of development expenditures and other factors discussed or referenced in our filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”), including those discussed in our prospectus, dated September 11, 2023, filed with the SEC pursuant to Rule 424(b) under the Securities Act of 1933, as amended on September 12, 2023 in connection with our Up-C Simplification, and any subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this Presentation. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty and do not intend to update any forward-looking statements to reflect events or circumstances after the date of this Presentation. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Free Cash Flow, Adjusted Free Cash Flow Margin, Adjusted Free Cash Flow Conversion and Maintenance Capital Expenditures are non-GAAP supplemental financial measures used by our management and by external users of our financial statements such as investors, research analysts and others, in the case of Adjusted EBITDA, to assess our operating performance on a consistent basis across periods by removing the effects of development activities, provide views on capital resources available to organically fund growth projects and, in the case of Adjusted Free Cash Flow, to assess the financial performance of our assets and their ability to sustain dividends over the long term without regard to financing methods, capital structure, levels of reinvestment or historical cost basis. These measures do not represent and should not be considered alternatives to, or more meaningful than, net income, income from operations, net cash provided by operating activities, or any other measure of financial performance presented in accordance with GAAP as measures of our financial performance. Adjusted EBITDA and Adjusted Free Cash Flow have important limitations as analytical tools because they exclude some but not all items that affect net income, the most directly comparable GAAP financial measure. Our computation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Free Cash Flow, Adjusted Free Cash Flow Margin, Adjusted Free Cash Flow Conversion and Maintenance Capital Expenditures may differ from computations of similarly titled measures of other companies. We define Adjusted EBITDA as net income before depreciation, depletion and accretion, interest expense, income tax expense, stock and unit-based compensation, loss on extinguishment of debt, unrealized commodity derivative gain (loss), and non-recurring transaction cost. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by total sales. We define Adjusted Free Cash Flow as Adjusted EBITDA less Maintenance Capital Expenditures. We define Maintenance Capital Expenditures as capital expenditures less growth capital expenditures. We define Adjusted Free Cash Flow Margin as Adjusted Free Cash Flow divided by total sales. We define Adjusted Free Cash Flow Conversion as Adjusted Free Cash Flow divided by Adjusted EBITDA. Reserves This Presentation includes frac sand reserve and resource estimates based on engineering, economic and geological data assembled and analyzed by our mining engineers, which are reviewed periodically by outside firms. However, frac sand reserve estimates are by nature imprecise and depend to some extent on statistical inferences drawn from available drilling data, which may prove unreliable. There are numerous uncertainties inherent in estimating quantities and qualities of frac sand reserves and non-reserve frac sand deposits and costs to mine recoverable reserves, many of which are beyond our control and any of which could cause actual results to differ materially from our expectations. These uncertainties include: geological and mining conditions that may not be fully identified by available data or that may differ from experience; assumptions regarding the effectiveness of our mining, quality control and training programs; assumptions concerning future prices of frac sand, operating costs, mining technology improvements, development costs and reclamation costs; and assumptions concerning future effects of regulation, including the issuance of required permits and taxes by governmental agencies. Trademarks and Trade Names The Company owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with the Company, or an endorsement or sponsorship by or of the Company. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensor to these trademarks, service marks and trade names. Industry and Market Data This Presentation has been prepared by the Company and includes market data and certain other statistical information from third-party sources, including independent industry publications, government publications, and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the third-party sources described above. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in these third-party publications. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only; there can be no assurance that such conditions will actually occur. Please also see “Forward-Looking Statements” disclaimer above.

(1) Source: Bloomberg. Reflects 3Q’23 financial information and reflects a share price as of 27-December-2023. Enterprise value calculated as market capitalization, plus debt, less cash & equivalents. | (2) Q3 2023 dividend payment date of 16-November-2023 to holders of record as of 09-November-2023. Reflects a base dividend of $0.15 per share and variable dividend of $0.05 per share. | (3) Resource life calculated as (reserves + resources) / 15mmtpy of annual production capacity. | Video link https://vimeo.com/894205858. Atlas Energy Solutions (NYSE: AESI) at a Glance Market Capitalization (1) $1.8B Headquarters Austin, Texas Resource Life (3) 100+ years Quarterly Dividend (2) $0.20 / share Employees ~490 Enterprise Value (1) $1.7B Stock Symbol NYSE: AESI 4Q’23 Dune Express Update Video ctrl + click to play

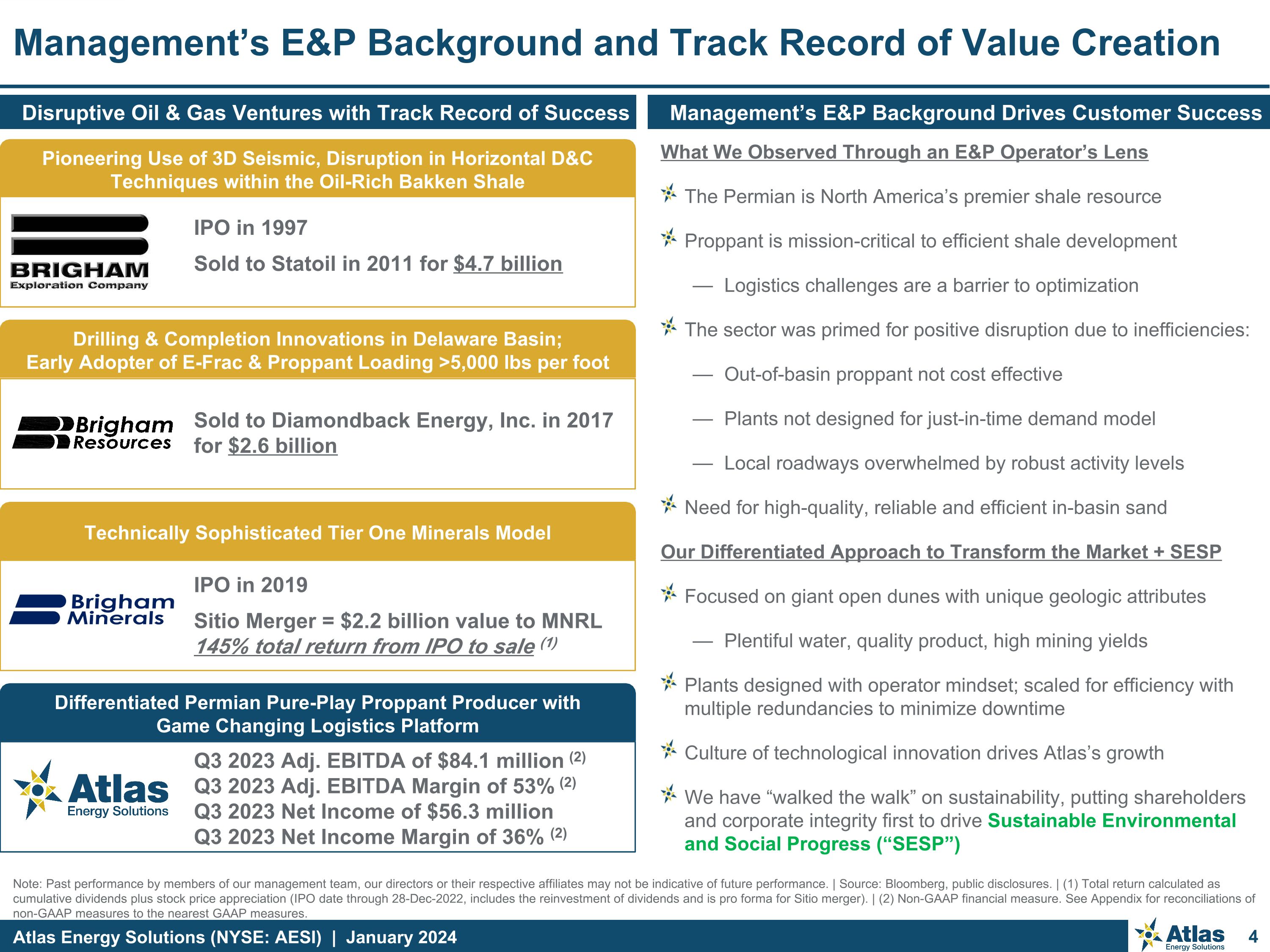

Note: Past performance by members of our management team, our directors or their respective affiliates may not be indicative of future performance. | Source: Bloomberg, public disclosures. | (1) Total return calculated as cumulative dividends plus stock price appreciation (IPO date through 28-Dec-2022, includes the reinvestment of dividends and is pro forma for Sitio merger). | (2) Non-GAAP financial measure. See Appendix for reconciliations of non-GAAP measures to the nearest GAAP measures. Management’s E&P Background and Track Record of Value Creation Disruptive Oil & Gas Ventures with Track Record of Success What We Observed Through an E&P Operator’s Lens The Permian is North America’s premier shale resource Proppant is mission-critical to efficient shale development Logistics challenges are a barrier to optimization The sector was primed for positive disruption due to inefficiencies: Out-of-basin proppant not cost effective Plants not designed for just-in-time demand model Local roadways overwhelmed by robust activity levels Need for high-quality, reliable and efficient in-basin sand Our Differentiated Approach to Transform the Market + SESP Focused on giant open dunes with unique geologic attributes Plentiful water, quality product, high mining yields Plants designed with operator mindset; scaled for efficiency with multiple redundancies to minimize downtime Culture of technological innovation drives Atlas’s growth We have “walked the walk” on sustainability, putting shareholders and corporate integrity first to drive Sustainable Environmental and Social Progress (“SESP”) Management’s E&P Background Drives Customer Success Pioneering Use of 3D Seismic, Disruption in Horizontal D&C Techniques within the Oil-Rich Bakken Shale IPO in 1997 Sold to Statoil in 2011 for $4.7 billion Drilling & Completion Innovations in Delaware Basin; Early Adopter of E-Frac & Proppant Loading >5,000 lbs per foot Sold to Diamondback Energy, Inc. in 2017 for $2.6 billion Technically Sophisticated Tier One Minerals Model IPO in 2019 Sitio Merger = $2.2 billion value to MNRL 145% total return from IPO to sale (1) Differentiated Permian Pure-Play Proppant Producer with Game Changing Logistics Platform Q3 2023 Adj. EBITDA of $84.1 million (2) Q3 2023 Adj. EBITDA Margin of 53% (2) Q3 2023 Net Income of $56.3 million Q3 2023 Net Income Margin of 36% (2)

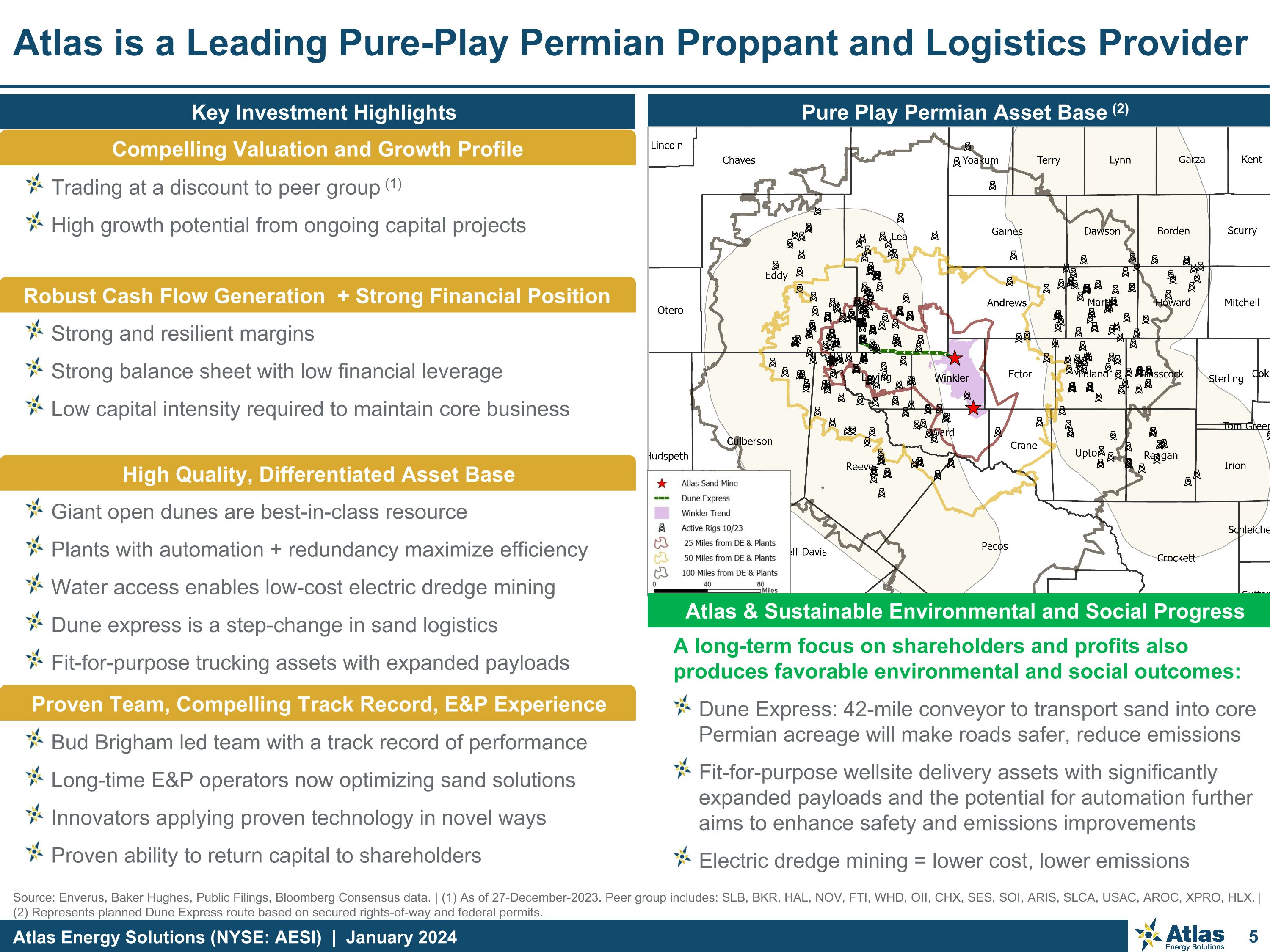

Source: Enverus, Baker Hughes, Public Filings, Bloomberg Consensus data. | (1) As of 27-December-2023. Peer group includes: SLB, BKR, HAL, NOV, FTI, WHD, OII, CHX, SES, SOI, ARIS, SLCA, USAC, AROC, XPRO, HLX. | (2) Represents planned Dune Express route based on secured rights-of-way and federal permits. Atlas is a Leading Pure-Play Permian Proppant and Logistics Provider Pure Play Permian Asset Base (2) Key Investment Highlights A long-term focus on shareholders and profits also produces favorable environmental and social outcomes: Dune Express: 42-mile conveyor to transport sand into core Permian acreage will make roads safer, reduce emissions Fit-for-purpose wellsite delivery assets with significantly expanded payloads and the potential for automation further aims to enhance safety and emissions improvements Electric dredge mining = lower cost, lower emissions Trading at a discount to peer group (1) High growth potential from ongoing capital projects Compelling Valuation and Growth Profile Strong and resilient margins Strong balance sheet with low financial leverage Low capital intensity required to maintain core business High Quality, Differentiated Asset Base Robust Cash Flow Generation + Strong Financial Position Proven Team, Compelling Track Record, E&P Experience Giant open dunes are best-in-class resource Plants with automation + redundancy maximize efficiency Water access enables low-cost electric dredge mining Dune express is a step-change in sand logistics Fit-for-purpose trucking assets with expanded payloads Bud Brigham led team with a track record of performance Long-time E&P operators now optimizing sand solutions Innovators applying proven technology in novel ways Proven ability to return capital to shareholders Atlas & Sustainable Environmental and Social Progress

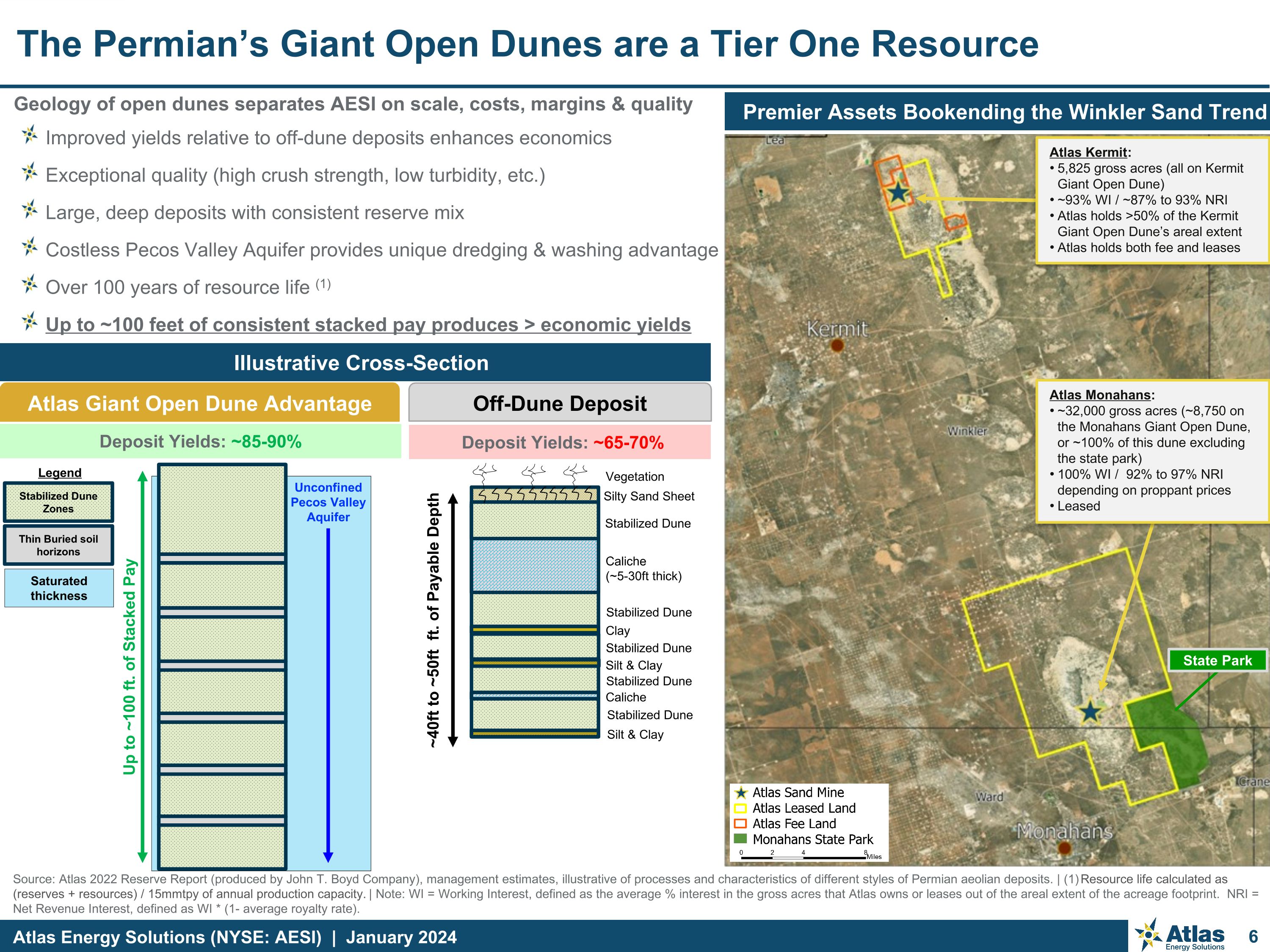

Geology of open dunes separates AESI on scale, costs, margins & quality Improved yields relative to off-dune deposits enhances economics Exceptional quality (high crush strength, low turbidity, etc.) Large, deep deposits with consistent reserve mix Costless Pecos Valley Aquifer provides unique dredging & washing advantage Over 100 years of resource life (1) Up to ~100 feet of consistent stacked pay produces > economic yields The Permian’s Giant Open Dunes are a Tier One Resource Source: Atlas 2022 Reserve Report (produced by John T. Boyd Company), management estimates, illustrative of processes and characteristics of different styles of Permian aeolian deposits. | (1) Resource life calculated as (reserves + resources) / 15mmtpy of annual production capacity. | Note: WI = Working Interest, defined as the average % interest in the gross acres that Atlas owns or leases out of the areal extent of the acreage footprint. NRI = Net Revenue Interest, defined as WI * (1- average royalty rate). Premier Assets Bookending the Winkler Sand Trend Atlas Kermit: 5,825 gross acres (all on Kermit Giant Open Dune) ~93% WI / ~87% to 93% NRI Atlas holds >50% of the Kermit Giant Open Dune’s areal extent Atlas holds both fee and leases Atlas Monahans: ~32,000 gross acres (~8,750 on the Monahans Giant Open Dune, or ~100% of this dune excluding the state park) 100% WI / 92% to 97% NRI depending on proppant prices Leased State Park Illustrative Cross-Section Unconfined Pecos Valley Aquifer Up to ~100 ft. of Stacked Pay Deposit Yields: ~85-90% Deposit Yields: ~65-70% Atlas Giant Open Dune Advantage Off-Dune Deposit Legend Thin Buried soil horizons Saturated thickness Stabilized Dune Zones Caliche (~5-30ft thick) Clay Caliche Silt & Clay Silty Sand Sheet Stabilized Dune ~40ft to ~50ft ft. of Payable Depth Vegetation Silt & Clay Stabilized Dune Stabilized Dune Stabilized Dune Stabilized Dune

The Atlas Energy Solutions Advantage Premium Giant Open Dune Geology 100+ years of resource life at 15.0 mmtpy of production Lack of organics and impurities result in higher mining yields Premium quality product with high crush strength Advantaged Water Access Ample costless water provides Atlas with the distinct advantage of deploying the Permian’s only electric dredge mining assets Results in lower mining cost and is more environmentally sustainable than traditional mining methods utilizing yellow iron Next Generation Plant Design Redundancies maximize utilization rates Plants designed to enable automation, remote operations leading to the realization of lower labor intensity Logistics Differentiation High-capacity trailers & multi-trailer configuration allow Atlas to exceed industry standard payloads by to 3x – 4x Remote command center ensures superior in-field customer service with the industry’s fastest response times

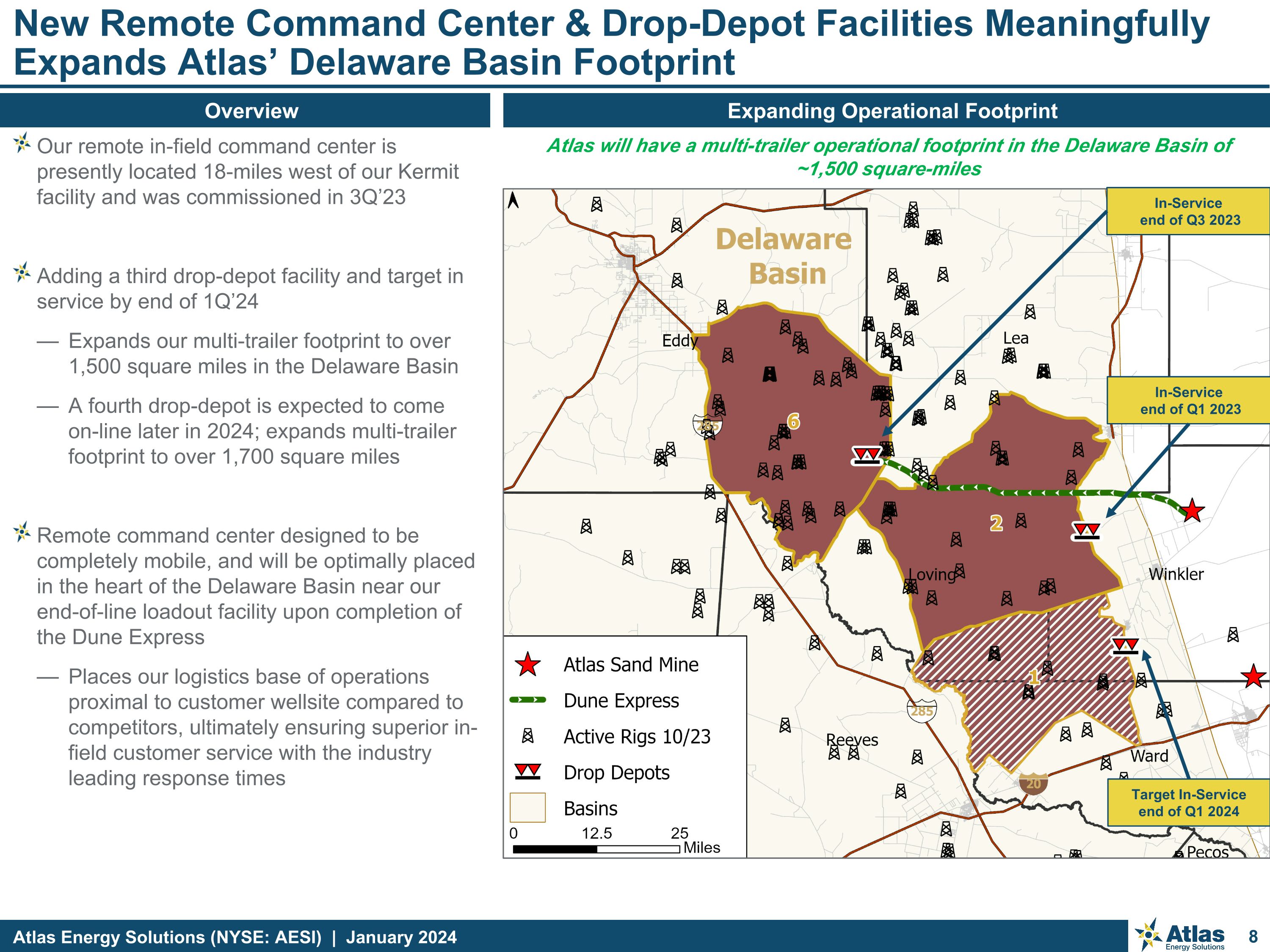

New Remote Command Center & Drop-Depot Facilities Meaningfully Expands Atlas’ Delaware Basin Footprint Overview Our remote in-field command center is presently located 18-miles west of our Kermit facility and was commissioned in 3Q’23 Adding a third drop-depot facility and target in service by end of 1Q’24 Expands our multi-trailer footprint to over 1,500 square miles in the Delaware Basin A fourth drop-depot is expected to come on-line later in 2024; expands multi-trailer footprint to over 1,700 square miles Remote command center designed to be completely mobile, and will be optimally placed in the heart of the Delaware Basin near our end-of-line loadout facility upon completion of the Dune Express Places our logistics base of operations proximal to customer wellsite compared to competitors, ultimately ensuring superior in-field customer service with the industry leading response times Atlas will have a multi-trailer operational footprint in the Delaware Basin of ~1,500 square-miles Expanding Operational Footprint In-Service end of Q3 2023 In-Service end of Q1 2023 Target In-Service end of Q1 2024

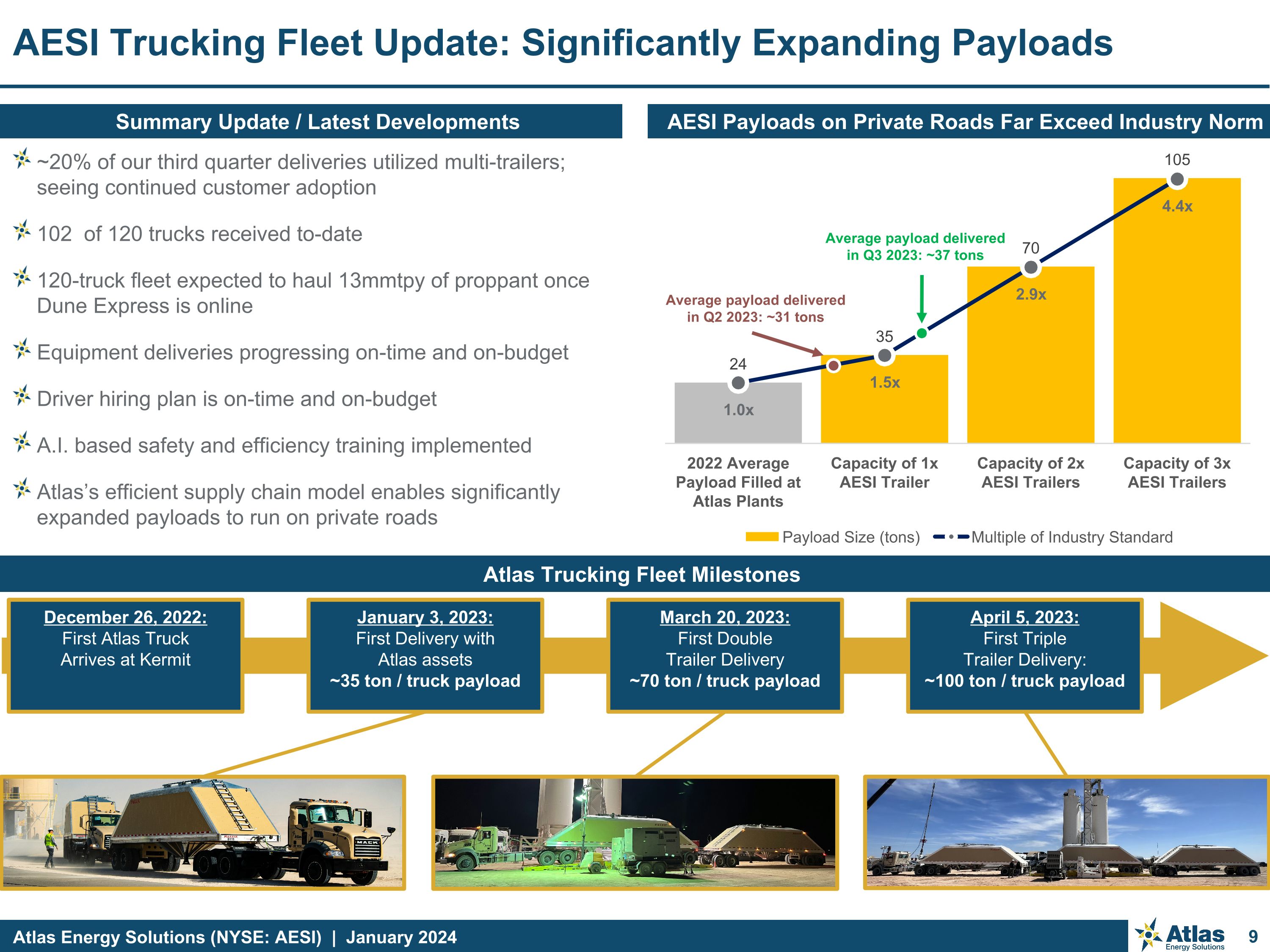

AESI Trucking Fleet Update: Significantly Expanding Payloads AESI Payloads on Private Roads Far Exceed Industry Norm Summary Update / Latest Developments ~20% of our third quarter deliveries utilized multi-trailers; seeing continued customer adoption 102 of 120 trucks received to-date 120-truck fleet expected to haul 13mmtpy of proppant once Dune Express is online Equipment deliveries progressing on-time and on-budget Driver hiring plan is on-time and on-budget A.I. based safety and efficiency training implemented Atlas’s efficient supply chain model enables significantly expanded payloads to run on private roads January 3, 2023: First Delivery with Atlas assets ~35 ton / truck payload : March 20, 2023: First Double Trailer Delivery ~70 ton / truck payload April 5, 2023: First Triple Trailer Delivery: ~100 ton / truck payload December 26, 2022: First Atlas Truck Arrives at Kermit Atlas Trucking Fleet Milestones Average payload delivered in Q3 2023: ~37 tons Average payload delivered in Q2 2023: ~31 tons

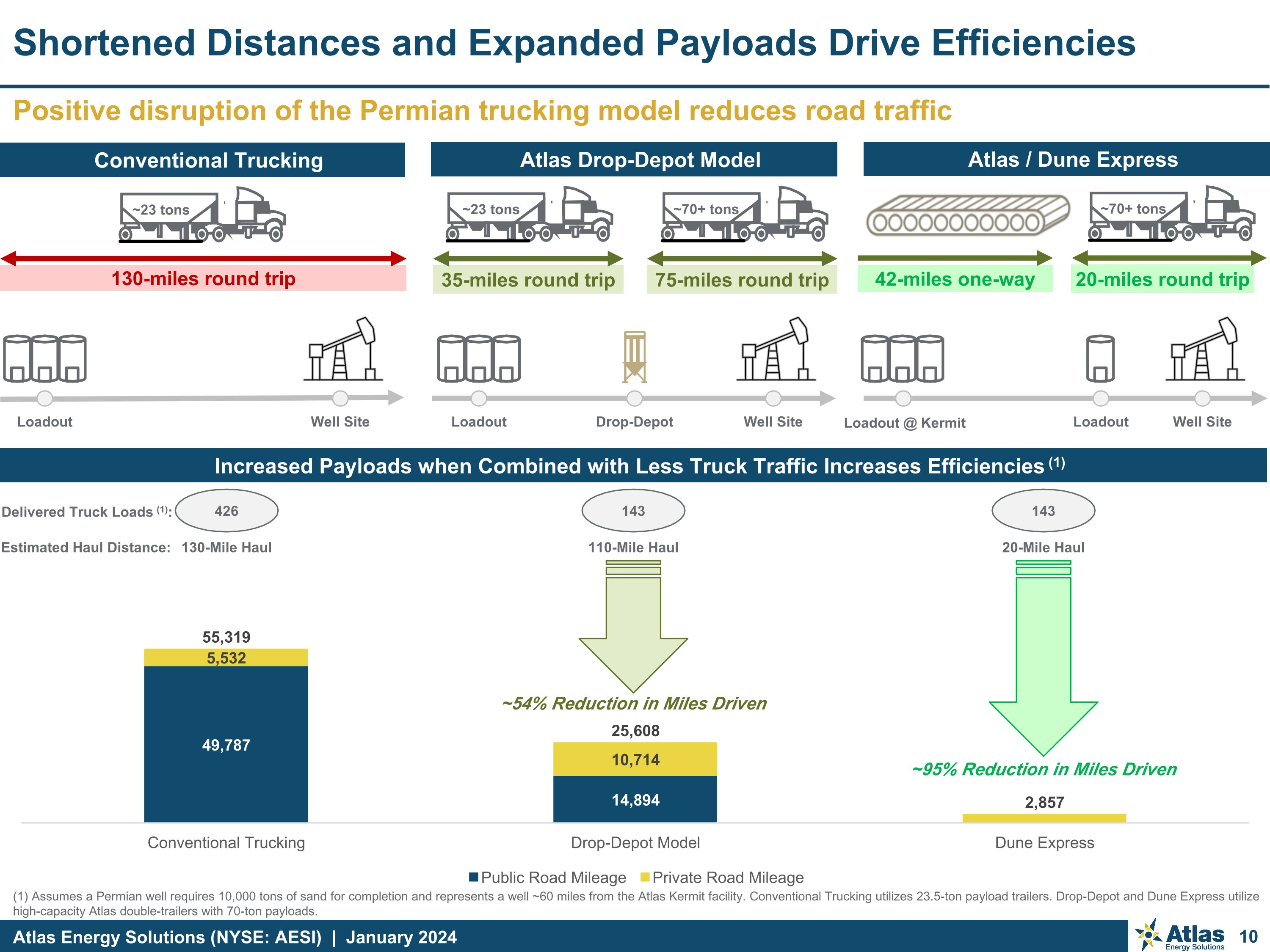

(1) Assumes a Permian well requires 10,000 tons of sand for completion and represents a well ~60 miles from the Atlas Kermit facility. Conventional Trucking utilizes 23.5-ton payload trailers. Drop-Depot and Dune Express utilize high-capacity Atlas double-trailers with 70-ton payloads. Shortened Distances and Expanded Payloads Drive Efficiencies Conventional Trucking Positive disruption of the Permian trucking model reduces road traffic Loadout Well Site Loadout @ Kermit Well Site Loadout Well Site Drop-Depot Atlas Drop-Depot Model Atlas / Dune Express Loadout 130-miles round trip 35-miles round trip 75-miles round trip ~23 tons ~23 tons ~70+ tons ~70+ tons 20-miles round trip 42-miles one-way Increased Payloads when Combined with Less Truck Traffic Increases Efficiencies (1) Delivered Truck Loads (1): 143 143 426 ~95% Reduction in Miles Driven ~54% Reduction in Miles Driven 130-Mile Haul 110-Mile Haul 20-Mile Haul Estimated Haul Distance:

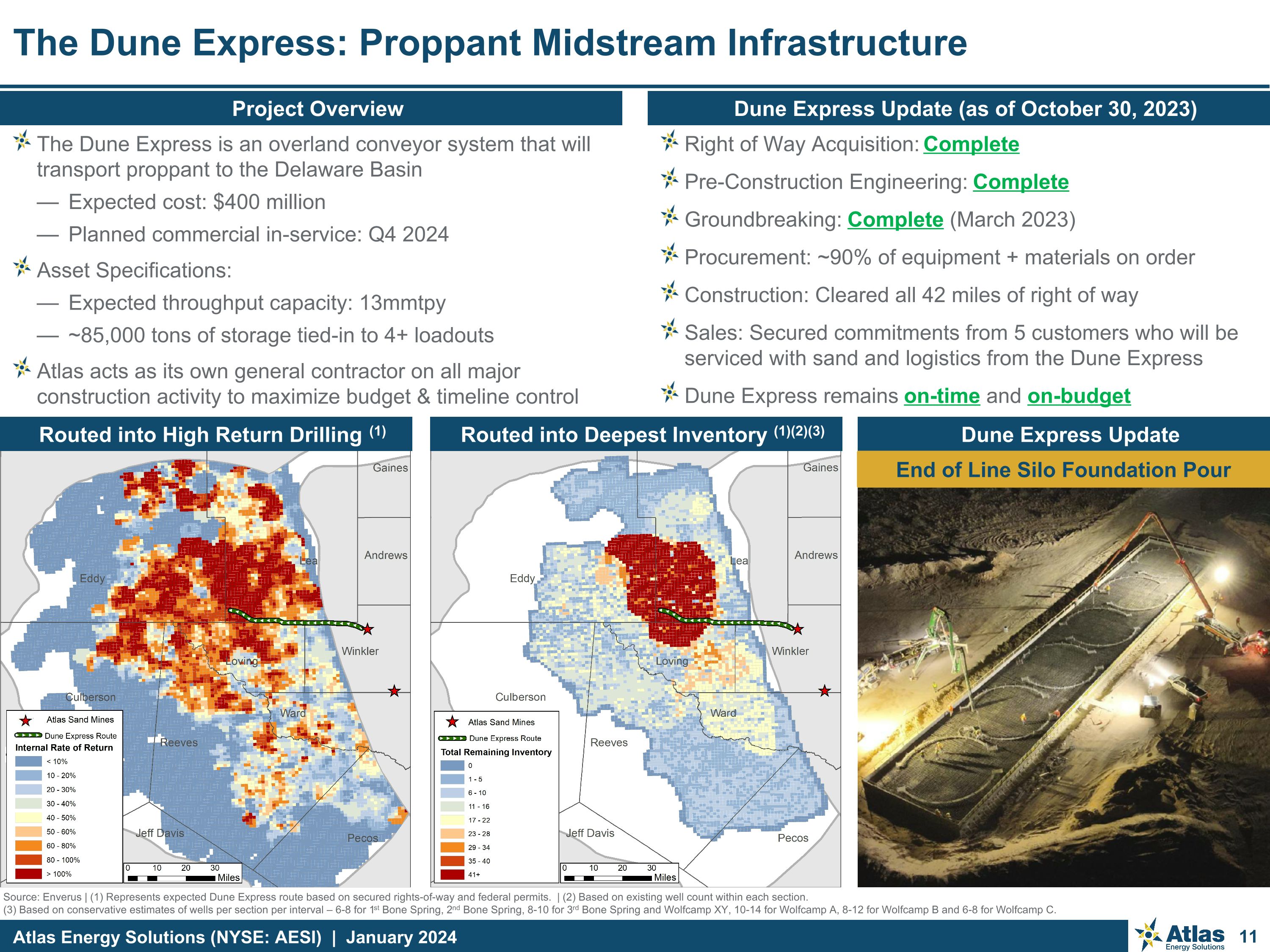

Source: Enverus | (1) Represents expected Dune Express route based on secured rights-of-way and federal permits. | (2) Based on existing well count within each section. (3) Based on conservative estimates of wells per section per interval – 6-8 for 1st Bone Spring, 2nd Bone Spring, 8-10 for 3rd Bone Spring and Wolfcamp XY, 10-14 for Wolfcamp A, 8-12 for Wolfcamp B and 6-8 for Wolfcamp C. The Dune Express: Proppant Midstream Infrastructure Dune Express Update (as of October 30, 2023) Project Overview Routed into High Return Drilling (1) The Dune Express is an overland conveyor system that will transport proppant to the Delaware Basin Expected cost: $400 million Planned commercial in-service: Q4 2024 Asset Specifications: Expected throughput capacity: 13mmtpy ~85,000 tons of storage tied-in to 4+ loadouts Atlas acts as its own general contractor on all major construction activity to maximize budget & timeline control Right of Way Acquisition: Complete Pre-Construction Engineering: Complete Groundbreaking: Complete (March 2023) Procurement: ~90% of equipment + materials on order Construction: Cleared all 42 miles of right of way Sales: Secured commitments from 5 customers who will be serviced with sand and logistics from the Dune Express Dune Express remains on-time and on-budget Routed into Deepest Inventory (1)(2)(3) Dune Express Update End of Line Silo Foundation Pour

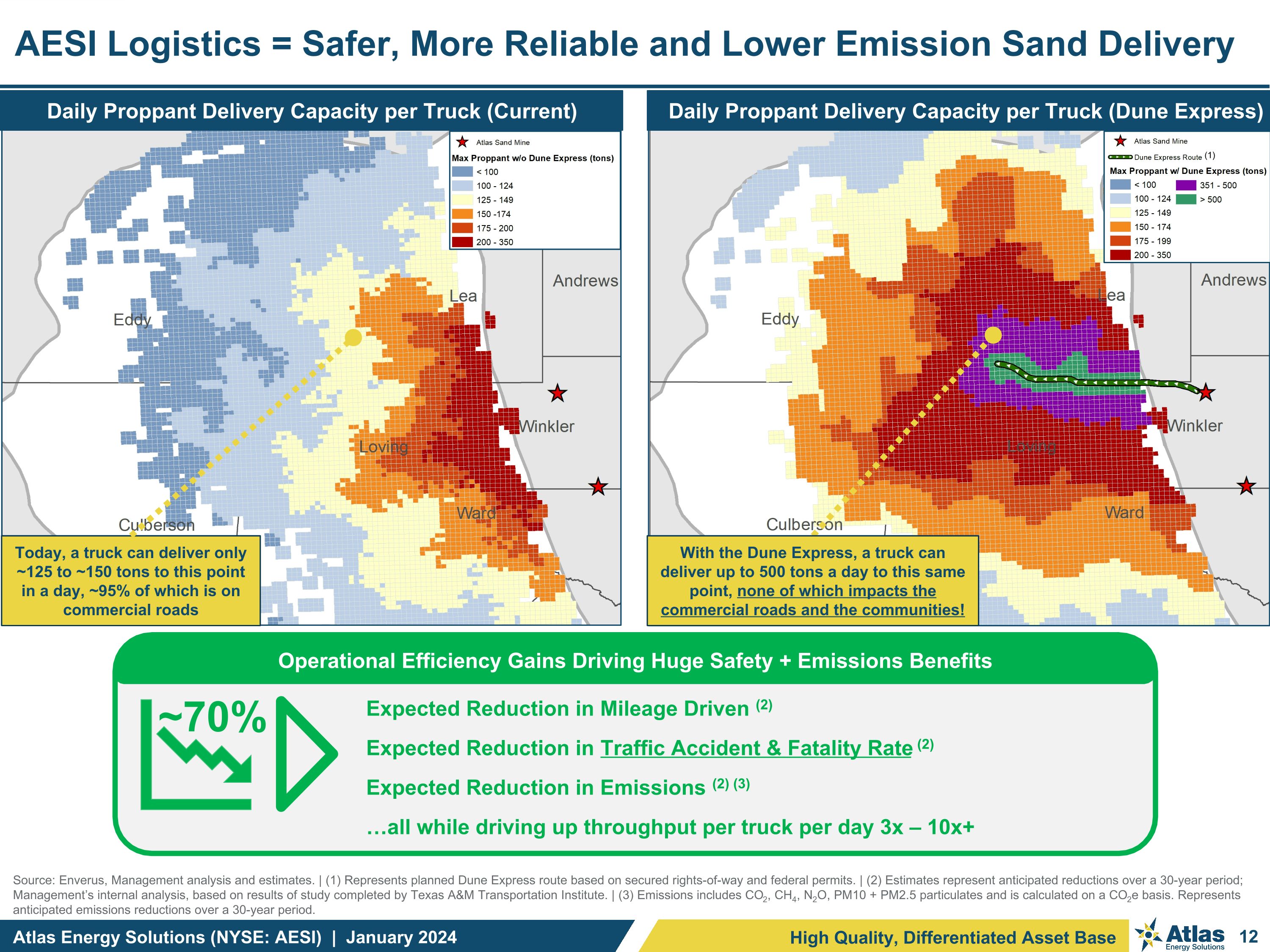

Daily Proppant Delivery Capacity per Truck (Dune Express) AESI Logistics = Safer, More Reliable and Lower Emission Sand Delivery Daily Proppant Delivery Capacity per Truck (Current) Source: Enverus, Management analysis and estimates. | (1) Represents planned Dune Express route based on secured rights-of-way and federal permits. | (2) Estimates represent anticipated reductions over a 30-year period; Management’s internal analysis, based on results of study completed by Texas A&M Transportation Institute. | (3) Emissions includes CO2, CH4, N2O, PM10 + PM2.5 particulates and is calculated on a CO2e basis. Represents anticipated emissions reductions over a 30-year period. High Quality, Differentiated Asset Base Today, a truck can deliver only ~125 to ~150 tons to this point in a day, ~95% of which is on commercial roads With the Dune Express, a truck can deliver up to 500 tons a day to this same point, none of which impacts the commercial roads and the communities! (1) Expected Reduction in Mileage Driven (2) Expected Reduction in Traffic Accident & Fatality Rate (2) Expected Reduction in Emissions (2) (3) …all while driving up throughput per truck per day 3x – 10x+ ~70% Operational Efficiency Gains Driving Huge Safety + Emissions Benefits

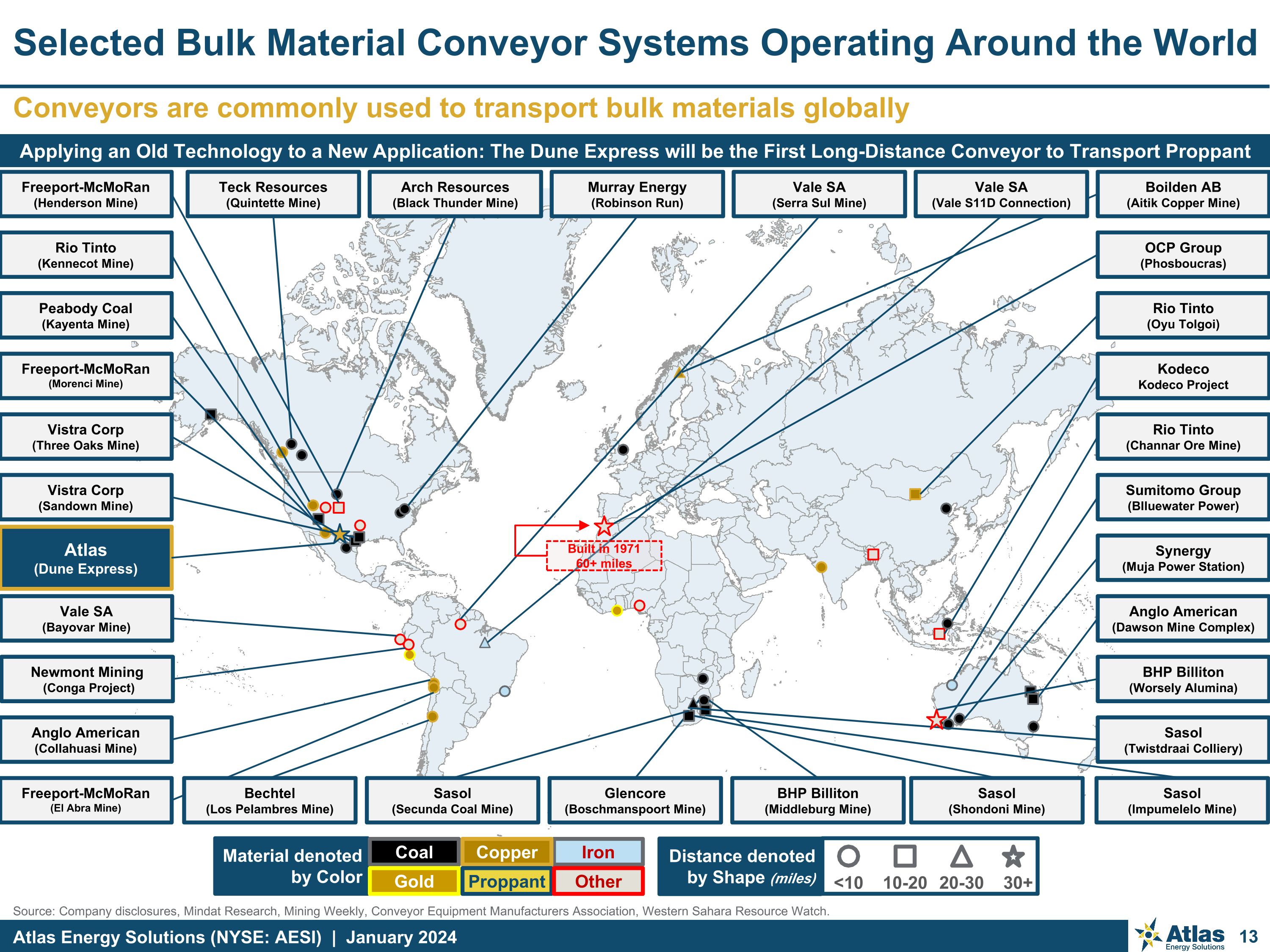

Source: Company disclosures, Mindat Research, Mining Weekly, Conveyor Equipment Manufacturers Association, Western Sahara Resource Watch. Conveyors are commonly used to transport bulk materials globally Selected Bulk Material Conveyor Systems Operating Around the World OCP Group (Phosboucras) <10 10-20 20-30 30+ Distance denoted by Shape (miles) Material denoted by Color Coal Gold Iron Copper Proppant Other Applying an Old Technology to a New Application: The Dune Express will be the First Long-Distance Conveyor to Transport Proppant Anglo American (Collahuasi Mine) BHP Billiton (Worsely Alumina) Freeport-McMoRan (Morenci Mine) Kodeco Kodeco Project Vistra Corp (Three Oaks Mine) Vistra Corp (Sandown Mine) Freeport-McMoRan (Henderson Mine) Boilden AB (Aitik Copper Mine) Sumitomo Group (Blluewater Power) Rio Tinto (Oyu Tolgoi) Rio Tinto (Channar Ore Mine) Rio Tinto (Kennecot Mine) Peabody Coal (Kayenta Mine) Freeport-McMoRan (El Abra Mine) Sasol (Shondoni Mine) Sasol (Secunda Coal Mine) Sasol (Impumelelo Mine) Sasol (Twistdraai Colliery) Vale SA (Bayovar Mine) Vale SA (Serra Sul Mine) BHP Billiton (Middleburg Mine) Arch Resources (Black Thunder Mine) Glencore (Boschmanspoort Mine) Atlas (Dune Express) Newmont Mining (Conga Project) Murray Energy (Robinson Run) Teck Resources (Quintette Mine) Synergy (Muja Power Station) Anglo American (Dawson Mine Complex) Bechtel (Los Pelambres Mine) Vale SA (Vale S11D Connection) Built in 1971 60+ miles

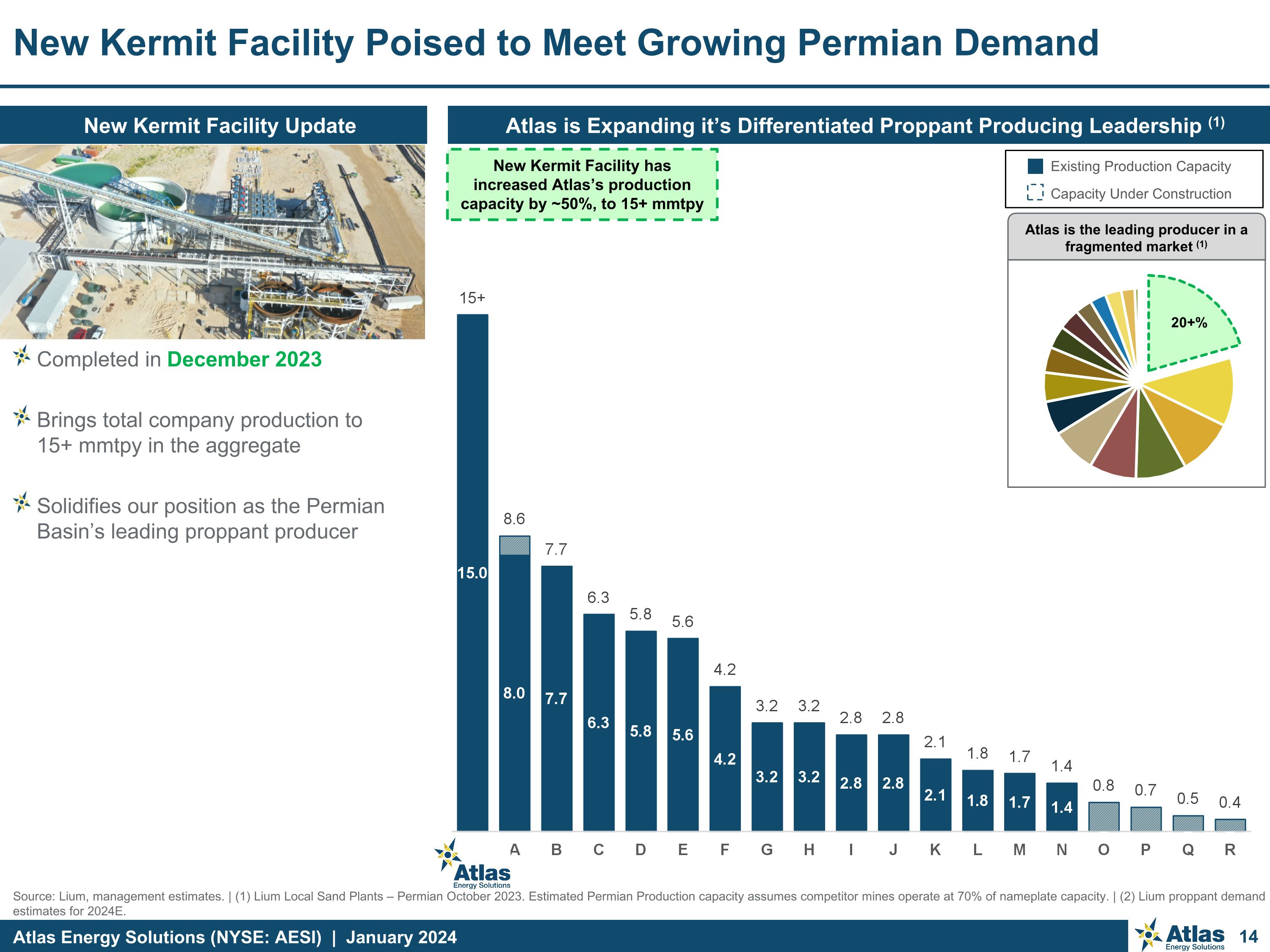

Source: Lium, management estimates. | (1) Lium Local Sand Plants – Permian October 2023. Estimated Permian Production capacity assumes competitor mines operate at 70% of nameplate capacity. | (2) Lium proppant demand estimates for 2024E. New Kermit Facility Poised to Meet Growing Permian Demand New Kermit Facility Update Completed in December 2023 Brings total company production to 15+ mmtpy in the aggregate Solidifies our position as the Permian Basin’s leading proppant producer Atlas is Expanding it’s Differentiated Proppant Producing Leadership (1) New Kermit Facility has increased Atlas’s production capacity by ~50%, to 15+ mmtpy Existing Production Capacity Capacity Under Construction Atlas is the leading producer in a fragmented market (1)

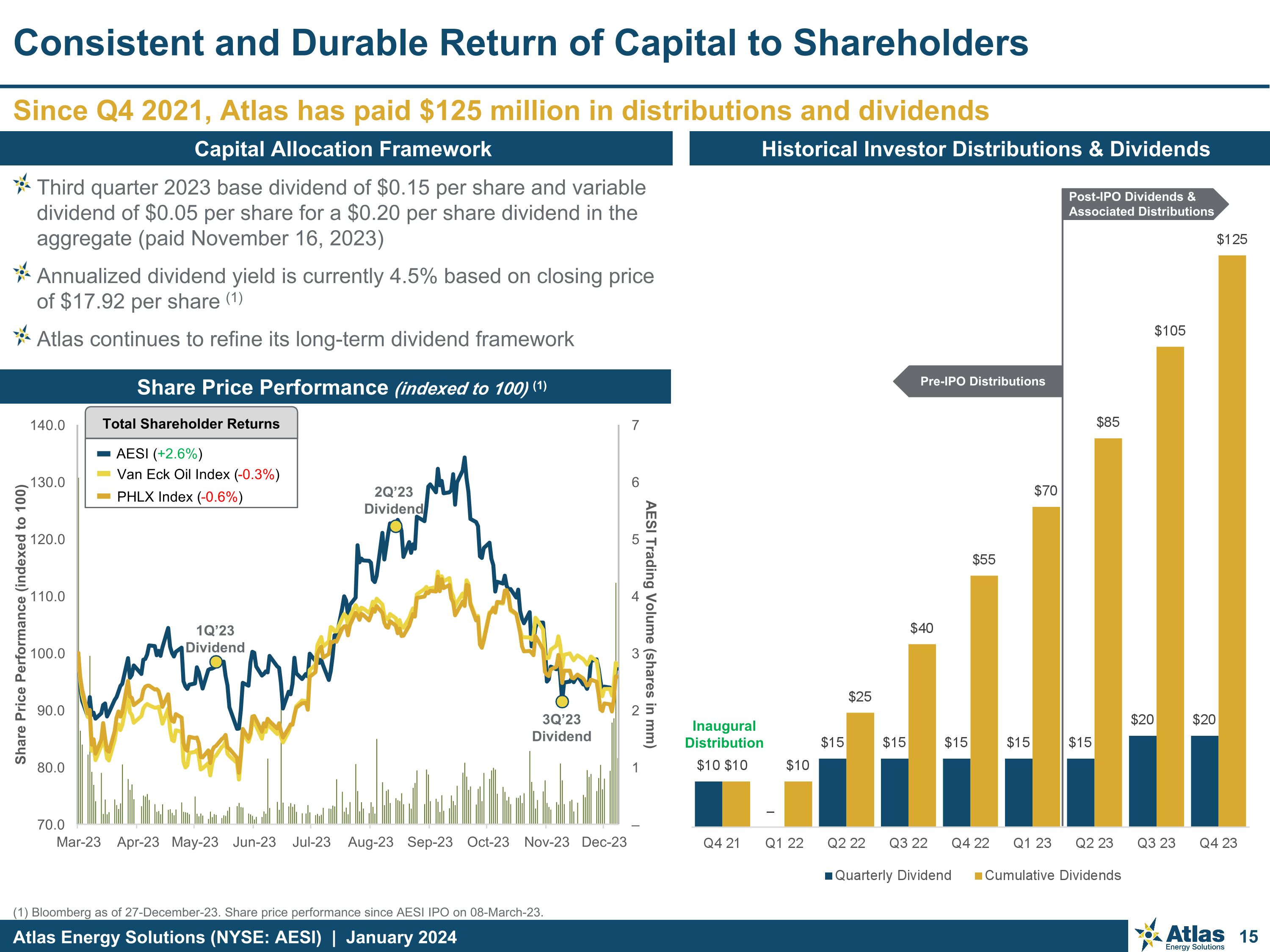

(1) Bloomberg as of 27-December-23. Share price performance since AESI IPO on 08-March-23. Since Q4 2021, Atlas has paid $125 million in distributions and dividends Consistent and Durable Return of Capital to Shareholders Historical Investor Distributions & Dividends Capital Allocation Framework Third quarter 2023 base dividend of $0.15 per share and variable dividend of $0.05 per share for a $0.20 per share dividend in the aggregate (paid November 16, 2023) Annualized dividend yield is currently 4.5% based on closing price of $17.92 per share (1) Atlas continues to refine its long-term dividend framework Inaugural Distribution Share Price Performance (indexed to 100) (1) 1Q’23 Dividend AESI (+2.6%) Van Eck Oil Index (-0.3%) Total Shareholder Returns PHLX Index (-0.6%) Post-IPO Dividends & Associated Distributions Pre-IPO Distributions 2Q’23 Dividend 3Q’23 Dividend

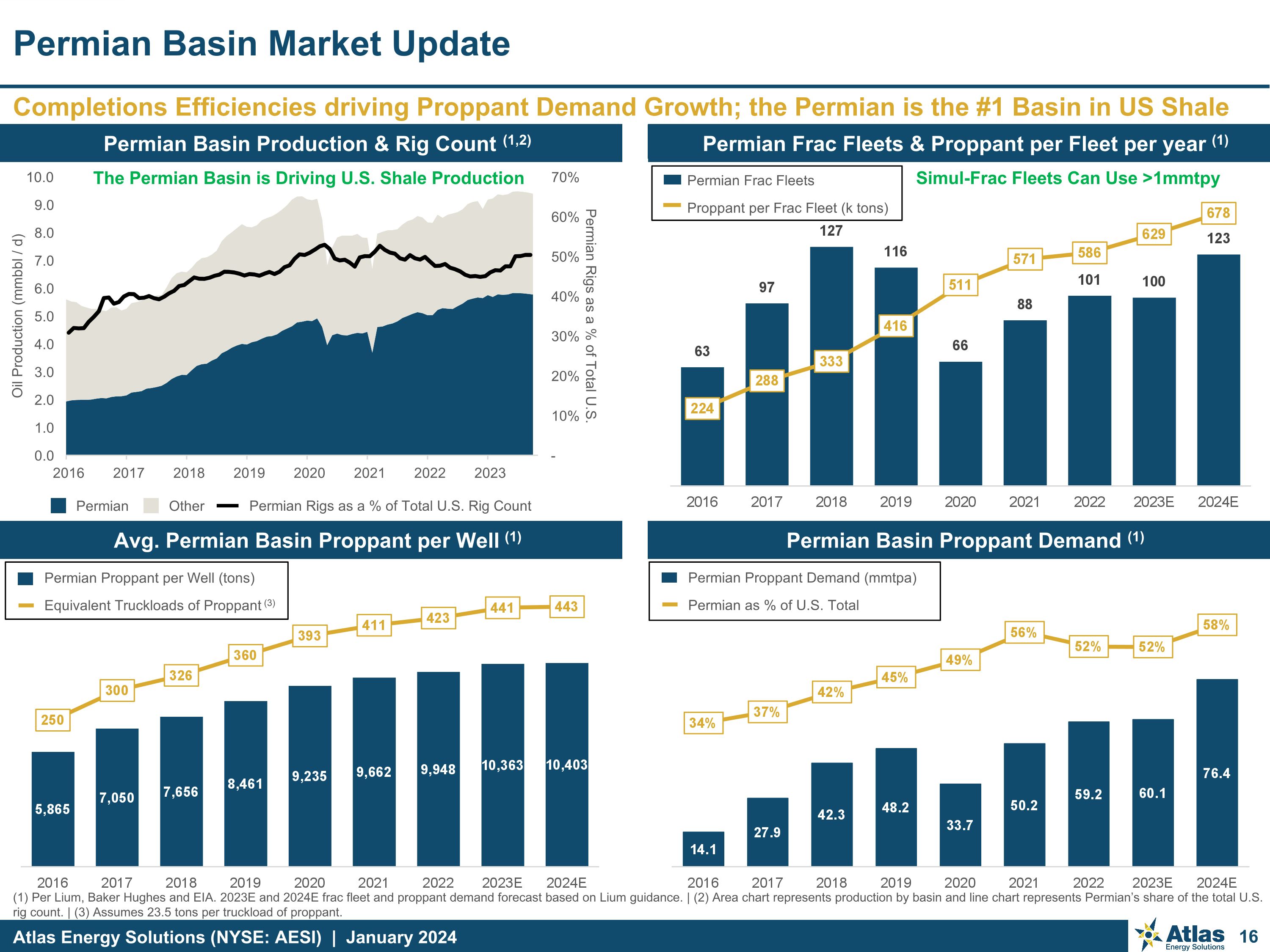

Permian Other Completions Efficiencies driving Proppant Demand Growth; the Permian is the #1 Basin in US Shale Permian Basin Market Update (1) Per Lium, Baker Hughes and EIA. 2023E and 2024E frac fleet and proppant demand forecast based on Lium guidance. | (2) Area chart represents production by basin and line chart represents Permian’s share of the total U.S. rig count. | (3) Assumes 23.5 tons per truckload of proppant. Permian Frac Fleets & Proppant per Fleet per year (1) Avg. Permian Basin Proppant per Well (1) Permian Basin Proppant Demand (1) Permian Proppant Demand (mmtpa) Permian as % of U.S. Total Permian Proppant per Well (tons) Equivalent Truckloads of Proppant (3) Permian Basin Production & Rig Count (1,2) The Permian Basin is Driving U.S. Shale Production Simul-Frac Fleets Can Use >1mmtpy Permian Frac Fleets Proppant per Frac Fleet (k tons) Permian Rigs as a % of Total U.S. Rig Count

High Quality, Differentiated Asset Base Proven Team, Compelling Track Record, E&P Experience Robust Cash Flow Generation + Strong Financial Position Compelling Valuation and Growth Profile Atlas Energy Solutions (NYSE: AESI) Investment Highlights Illustrative Dune Express Highway Overpass Atlas Wellsite Delivery Assets Atlas Conveyor Fed Silos at Kermit Facility

Appendix

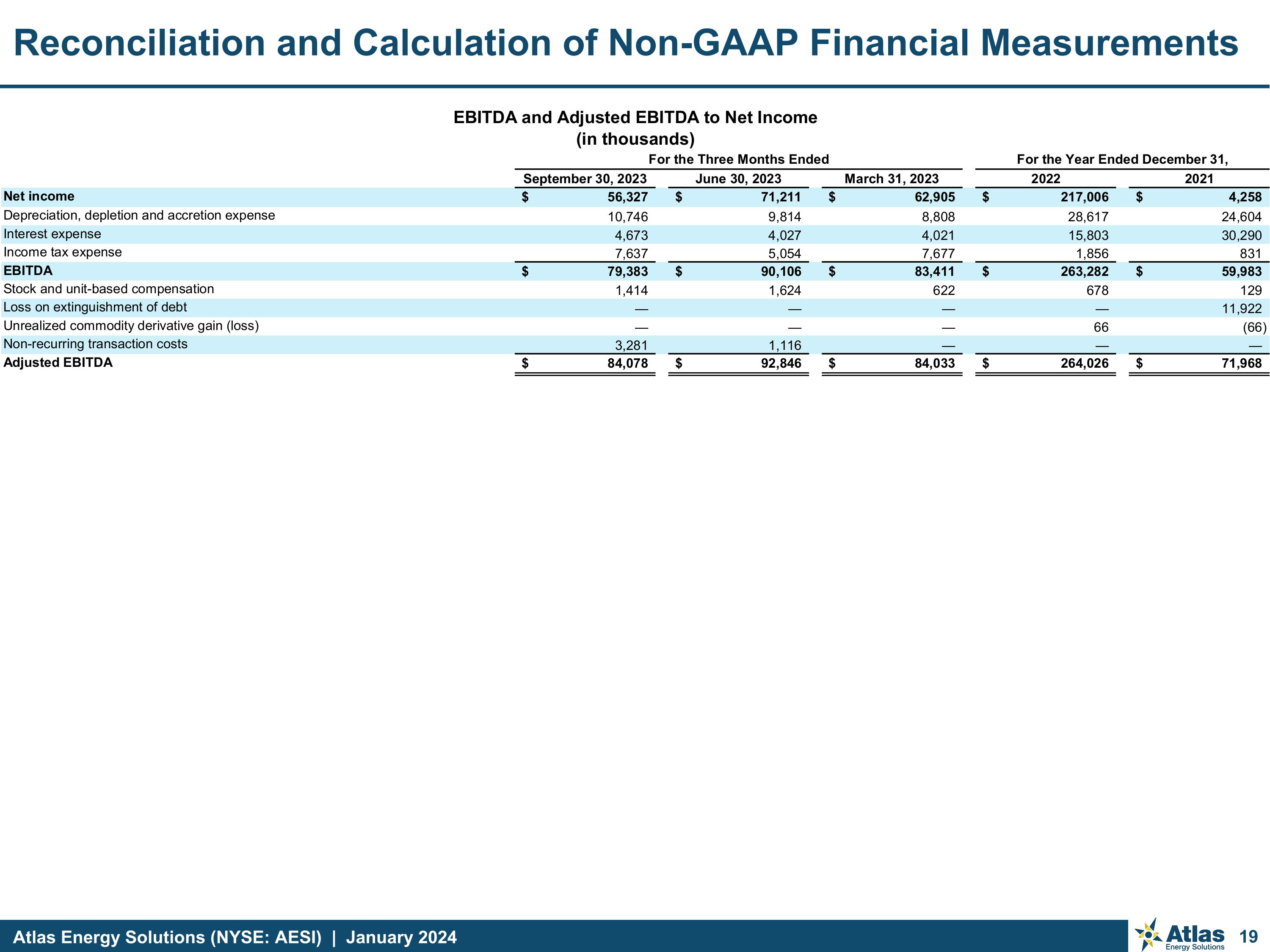

Reconciliation and Calculation of Non-GAAP Financial Measurements

Non-GAAP Financial Measure Definitions Non-GAAP Financial Measures Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Free Cash Flow, Adjusted Free Cash Flow Margin, Adjusted Free Cash Flow Conversion and Maintenance Capital Expenditures are non-GAAP supplemental financial measures used by our management and by external users of our financial statements such as investors, research analysts and others, in the case of Adjusted EBITDA, to assess our operating performance on a consistent basis across periods by removing the effects of development activities, provide views on capital resources available to organically fund growth projects and, in the case of Adjusted Free Cash Flow, assess the financial performance of our assets and their ability to sustain dividends or reinvest to organically fund growth projects over the long term without regard to financing methods, capital structure, or historical cost basis. These measures do not represent and should not be considered alternatives to, or more meaningful than, net income, income from operations, net cash provided by operating activities, or any other measure of financial performance presented in accordance with GAAP as measures of our financial performance. Adjusted EBITDA and Adjusted Free Cash Flow have important limitations as analytical tools because they exclude some but not all items that affect net income, the most directly comparable GAAP financial measure. Our computation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Free Cash Flow, Adjusted Free Cash Flow Margin, Adjusted Free Cash Flow Conversion and Maintenance Capital Expenditures may differ from computations of similarly titled measures of other companies. Non-GAAP Measure Definitions: We define Adjusted EBITDA as net income before depreciation, depletion and accretion, interest expense, income tax expense, stock and unit-based compensation, loss on extinguishment of debt, unrealized commodity derivative gain (loss), and non-recurring transaction costs. Management believes Adjusted EBITDA is useful because it allows management to more effectively evaluate the Company’s operating performance and compare the results of its operations from period to period and against our peers without regard to financing method or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by total sales. We define Adjusted Free Cash Flow as Adjusted EBITDA less Maintenance Capital Expenditures. Management believes that Adjusted Free Cash Flow is useful to investors as it provides a measure of the ability of our business to generate cash. We define Adjusted Free Cash Flow Margin as Adjusted Free Cash Flow divided by total sales. We define Adjusted Free Cash Flow Conversion as Adjusted Free Cash Flow divided by Adjusted EBITDA. We define Maintenance Capital Expenditures as capital expenditures excluding growth capital expenditures.

Investor Relations Contact For more information, please visit our website at https://atlas.energy/ IR Contact: Kyle Turlington 5918 W Courtyard Drive, Suite #500; Austin, Texas 78730 (T) 512-220-1200 IR@atlas.energy NYSE: AESI