Investor Presentation March 2024 Exhibit 99.1

Forward-Looking Statements This Presentation contains “forward-looking statements” of Atlas Energy Solutions Inc. (“Atlas,” the “Company,” “AESI,” “we,” “us” or “our”) within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are predictive or prospective in nature, that depend upon or refer to future events or conditions or that include the words “may,” “assume,” “forecast,” “position,” “strategy,” “potential,” “continue,” “could,” “will,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include: statements about the anticipated financial performance of Atlas following the transaction; the expected synergies and efficiencies to be achieved as a result of the transaction; expected accretion to earnings per share; expectations regarding the leverage and dividend profile of Atlas following the transaction; expansion and growth of Atlas’s business; Atlas’s plans to finance the transaction; the receipt of all necessary approvals to close the transaction and the timing associated therewith; our business strategy, industry, future operations and profitability; expected capital expenditures and the impact of such expenditures on our performance; our recent corporate reorganization transaction (the "Up-C Simplification"); our financial position, production, revenues and losses; our capital programs; management changes; current and potential future long-term contracts; and our future business and financial performance. Although forward-looking statements reflect our good faith beliefs at the time they are made, we caution you that these forward-looking statements are subject to a number of risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to: the completion of the transaction on anticipated terms and timing or at all, including obtaining any required governmental or regulatory approval and satisfying other conditions to the completion of the transaction; uncertainties as to whether the transaction, if consummated, will achieve its anticipated benefits and projected synergies within the expected time period or at all; Atlas’s ability to integrate Hi-Crush’s operations in a successful manner and in the expected time period; the occurrence of any event, change, or other circumstance that could give rise to the termination of the transaction; risks that the anticipated tax treatment of the transaction is not obtained; unforeseen or unknown liabilities; unexpected future capital expenditures; potential litigation relating to the transaction; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the effect of the announcement, pendency, or completion of the transaction on the parties’ business relationships and business generally; risks that the transaction disrupts current plans and operations of Atlas or Hi-Crush and their respective management teams and potential difficulties in retaining employees as a result of the transaction; the risks related to Atlas’s financing of the transaction; potential negative effects of this announcement and the pendency or completion of the transaction on the market price of Atlas’s common stock or operating results; commodity price volatility, including volatility stemming from geopolitical conflicts and events the ongoing armed conflicts between Russia and Ukraine and Israel and Hamas; increasing hostilities and instability in the Middle East; adverse developments affecting the financial services industry; our ability to complete growth projects, including the Dune Express, on time and on budget; the risk that stockholder litigation in connection with our recent corporate reorganization the Up-C Simplification may result in significant costs of defense, indemnification and liability; changes in general economic, business and political conditions, including changes in the financial markets; transaction costs; actions of OPEC+ to set and maintain oil production levels; the level of production of crude oil, natural gas and other hydrocarbons and the resultant market prices of crude oil; inflation; environmental risks; operating risks; regulatory changes; lack of demand; market share growth; the uncertainty inherent in projecting future rates of reserves; production; cash flow; access to capital; the timing of development expenditures; the ability of our customers to meet their obligations to us; our ability to maintain effective internal controls; and other factors discussed or referenced in our filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”), including those discussed in our prospectus, dated September 11, 2023, filed with the SEC pursuant to Rule 424(b) under the Securities Act of 1933, as amended on September 12, 2023 in connection with our Up-C Simplification, and any subsequently filed Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this Presentation. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty and do not intend to update any forward-looking statements to reflect events or circumstances after the date of this Presentation. Reserves This Presentation includes frac sand reserve and resource estimates based on engineering, economic and geological data assembled and analyzed by our mining engineers, which are reviewed periodically by outside firms. However, frac sand reserve estimates are by nature imprecise and depend to some extent on statistical inferences drawn from available drilling data, which may prove unreliable. There are numerous uncertainties inherent in estimating quantities and qualities of frac sand reserves and non-reserve frac sand deposits and costs to mine recoverable reserves, many of which are beyond our control and any of which could cause actual results to differ materially from our expectations. These uncertainties include: geological and mining conditions that may not be fully identified by available data or that may differ from experience; assumptions regarding the effectiveness of our mining, quality control and training programs; assumptions concerning future prices of frac sand, operating costs, mining technology improvements, development costs and reclamation costs; and assumptions concerning future effects of regulation, including the issuance of required permits and taxes by governmental agencies. Disclaimer

Trademarks and Trade Names The Company owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with the Company, or an endorsement or sponsorship by or of the Company. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensor to these trademarks, service marks and trade names. Industry and Market Data This Presentation has been prepared by the Company and includes market data and certain other statistical information from third-party sources, including independent industry publications, government publications, and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the third-party sources described above. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in these third-party publications. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only; there can be no assurance that such conditions will actually occur. Please also see “Forward-Looking Statements” disclaimer above. Non-GAAP Financial Measures Adjusted EBITDA, Adjusted EBITDA Margin, Net Debt, and Net Leverage are non-GAAP supplemental financial measures used by our management and by external users of our financial statements such as investors, research analysts and others, in the case of Adjusted EBITDA, to assess our operating performance on a consistent basis across periods by removing the effects of development activities, provide views on capital resources available to organically fund growth projects. These measures do not represent and should not be considered alternatives to, or more meaningful than, net income, income from operations, net cash provided by operating activities, or any other measure of financial performance presented in accordance with GAAP as measures of our financial performance. Adjusted EBITDA has important limitations as an analytical tool because it exclude some but not all items that affect net income, the most directly comparable GAAP financial measure. Our computation of Adjusted EBITDA and Adjusted EBITDA Margin may differ from computations of similarly titled measures of other companies. Non-GAAP Measure Definitions: We define Adjusted EBITDA as net income before depreciation, depletion and accretion, interest expense, income tax expense, stock and unit-based compensation, loss on extinguishment of debt, unrealized commodity derivative gain (loss), and non-recurring transaction costs. Management believes Adjusted EBITDA is useful because it allows management to more effectively evaluate the Company’s operating performance and compare the results of its operations from period to period and against our peers without regard to financing method or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by total sales. We define Net Debt as total debt, net of discount and deferred financing costs, plus right-of-use lease liabilities, less cash and cash equivalents. We define Net Leverage as Net Debt divided by Adjusted EBITDA. Because Atlas provides these Non-GAAP measures on a forward-looking basis, it cannot reliably or reasonably predict certain of the necessary components of the most directly comparable forward-looking GAAP financial measures. Accordingly, Atlas is unable to present a quantitative reconciliation of such forward-looking, non-GAAP financial measures to the respective most directly comparable forward-looking GAAP financial measures. No Offer or Solicitation This communication includes information relating to the Acquisition. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, in connection with the Acquisition or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Disclaimer (cont’d)

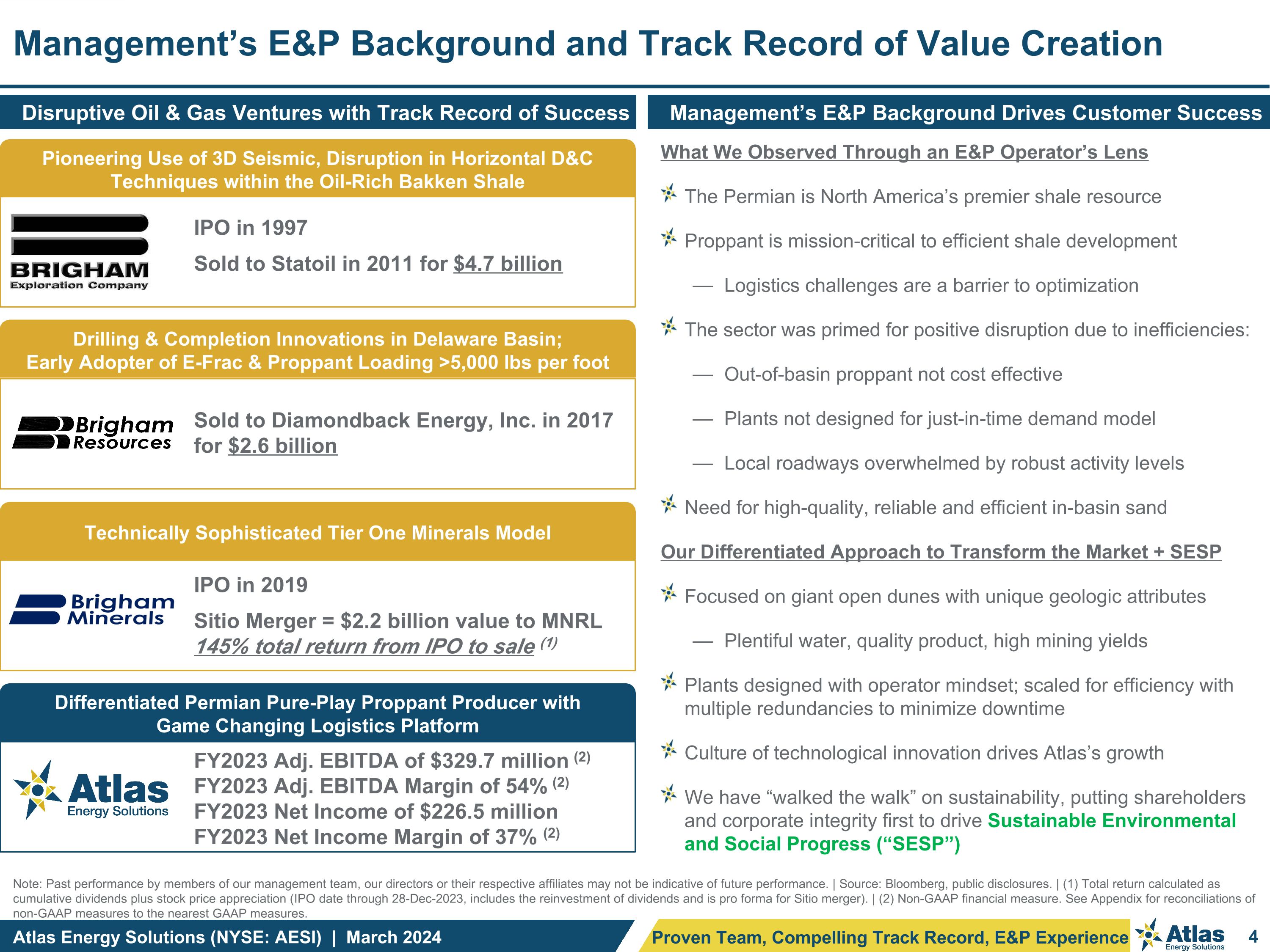

Note: Past performance by members of our management team, our directors or their respective affiliates may not be indicative of future performance. | Source: Bloomberg, public disclosures. | (1) Total return calculated as cumulative dividends plus stock price appreciation (IPO date through 28-Dec-2023, includes the reinvestment of dividends and is pro forma for Sitio merger). | (2) Non-GAAP financial measure. See Appendix for reconciliations of non-GAAP measures to the nearest GAAP measures. Management’s E&P Background and Track Record of Value Creation Disruptive Oil & Gas Ventures with Track Record of Success What We Observed Through an E&P Operator’s Lens The Permian is North America’s premier shale resource Proppant is mission-critical to efficient shale development Logistics challenges are a barrier to optimization The sector was primed for positive disruption due to inefficiencies: Out-of-basin proppant not cost effective Plants not designed for just-in-time demand model Local roadways overwhelmed by robust activity levels Need for high-quality, reliable and efficient in-basin sand Our Differentiated Approach to Transform the Market + SESP Focused on giant open dunes with unique geologic attributes Plentiful water, quality product, high mining yields Plants designed with operator mindset; scaled for efficiency with multiple redundancies to minimize downtime Culture of technological innovation drives Atlas’s growth We have “walked the walk” on sustainability, putting shareholders and corporate integrity first to drive Sustainable Environmental and Social Progress (“SESP”) Management’s E&P Background Drives Customer Success Pioneering Use of 3D Seismic, Disruption in Horizontal D&C Techniques within the Oil-Rich Bakken Shale IPO in 1997 Sold to Statoil in 2011 for $4.7 billion Drilling & Completion Innovations in Delaware Basin; Early Adopter of E-Frac & Proppant Loading >5,000 lbs per foot Sold to Diamondback Energy, Inc. in 2017 for $2.6 billion Technically Sophisticated Tier One Minerals Model IPO in 2019 Sitio Merger = $2.2 billion value to MNRL 145% total return from IPO to sale (1) Differentiated Permian Pure-Play Proppant Producer with Game Changing Logistics Platform FY2023 Adj. EBITDA of $329.7 million (2) FY2023 Adj. EBITDA Margin of 54% (2) FY2023 Net Income of $226.5 million FY2023 Net Income Margin of 37% (2) Proven Team, Compelling Track Record, E&P Experience

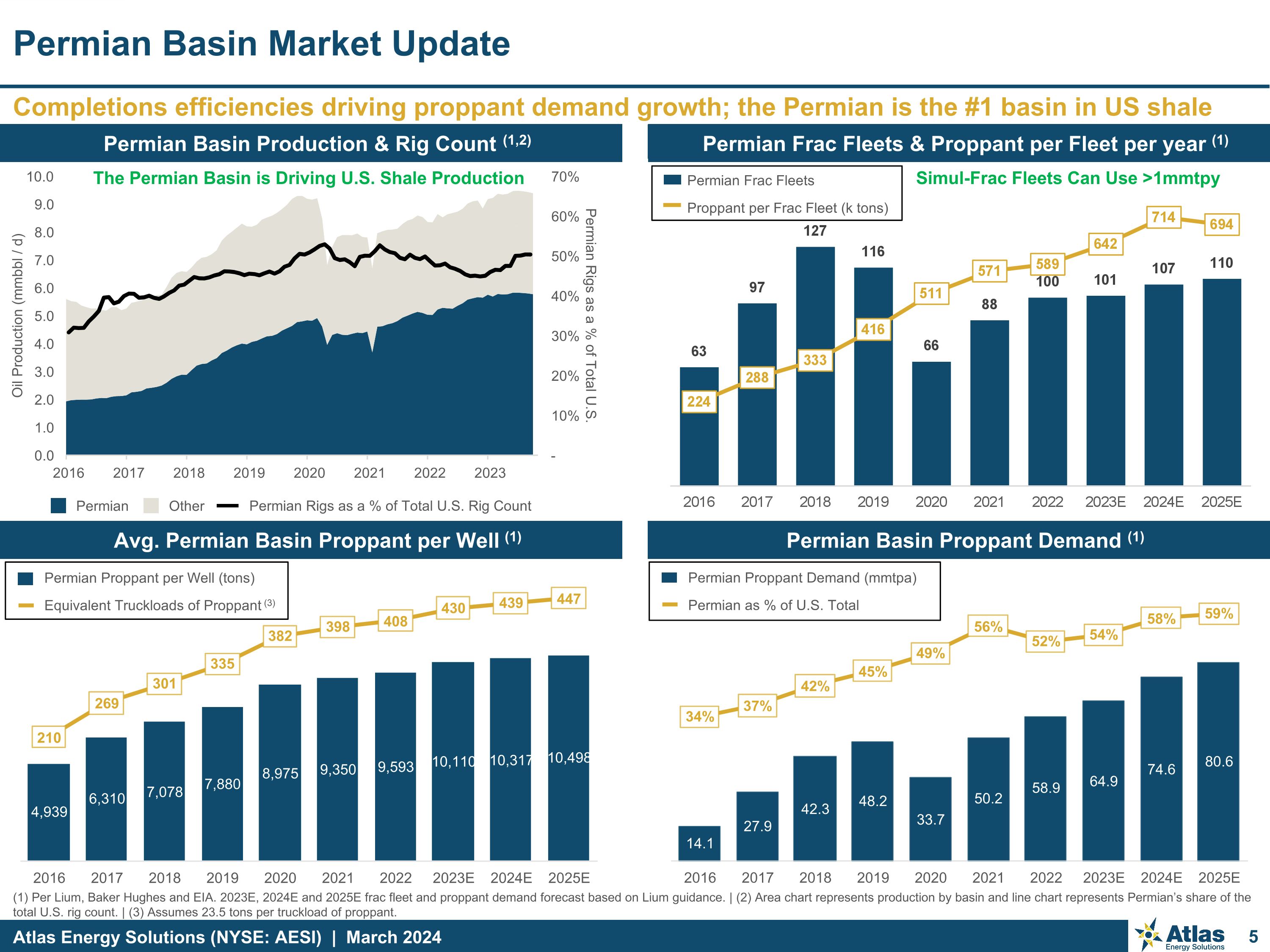

Completions efficiencies driving proppant demand growth; the Permian is the #1 basin in US shale Permian Basin Market Update Permian Other (1) Per Lium, Baker Hughes and EIA. 2023E, 2024E and 2025E frac fleet and proppant demand forecast based on Lium guidance. | (2) Area chart represents production by basin and line chart represents Permian’s share of the total U.S. rig count. | (3) Assumes 23.5 tons per truckload of proppant. Permian Frac Fleets & Proppant per Fleet per year (1) Avg. Permian Basin Proppant per Well (1) Permian Basin Proppant Demand (1) Permian Proppant Demand (mmtpa) Permian as % of U.S. Total Permian Proppant per Well (tons) Equivalent Truckloads of Proppant (3) Permian Basin Production & Rig Count (1,2) The Permian Basin is Driving U.S. Shale Production Simul-Frac Fleets Can Use >1mmtpy Permian Frac Fleets Proppant per Frac Fleet (k tons) Permian Rigs as a % of Total U.S. Rig Count

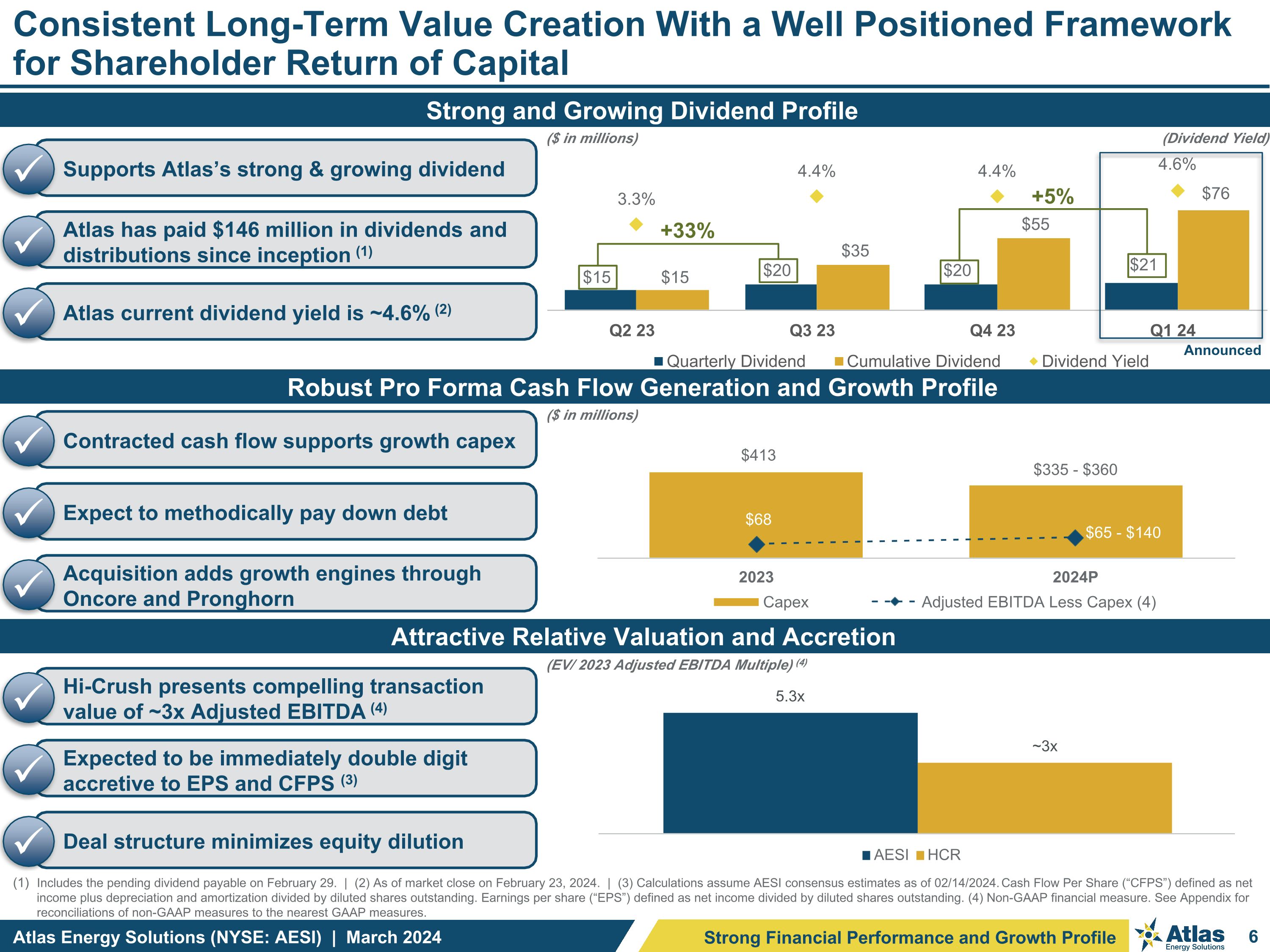

Includes the pending dividend payable on February 29. | (2) As of market close on February 23, 2024. | (3) Calculations assume AESI consensus estimates as of 02/14/2024. Cash Flow Per Share (“CFPS”) defined as net income plus depreciation and amortization divided by diluted shares outstanding. Earnings per share (“EPS”) defined as net income divided by diluted shares outstanding. (4) Non-GAAP financial measure. See Appendix for reconciliations of non-GAAP measures to the nearest GAAP measures. Consistent Long-Term Value Creation With a Well Positioned Framework for Shareholder Return of Capital Robust Pro Forma Cash Flow Generation and Growth Profile Strong and Growing Dividend Profile ($ in millions) Attractive Relative Valuation and Accretion (EV/ 2023 Adjusted EBITDA Multiple) (4) Announced ($ in millions) +33% +5% (Dividend Yield) Supports Atlas’s strong & growing dividend ü Atlas has paid $146 million in dividends and distributions since inception (1) ü Atlas current dividend yield is ~4.6% (2) ü Contracted cash flow supports growth capex ü Expect to methodically pay down debt ü Acquisition adds growth engines through Oncore and Pronghorn ü Hi-Crush presents compelling transaction value of ~3x Adjusted EBITDA (4) ü Expected to be immediately double digit accretive to EPS and CFPS (3) ü Deal structure minimizes equity dilution ü Strong Financial Performance and Growth Profile

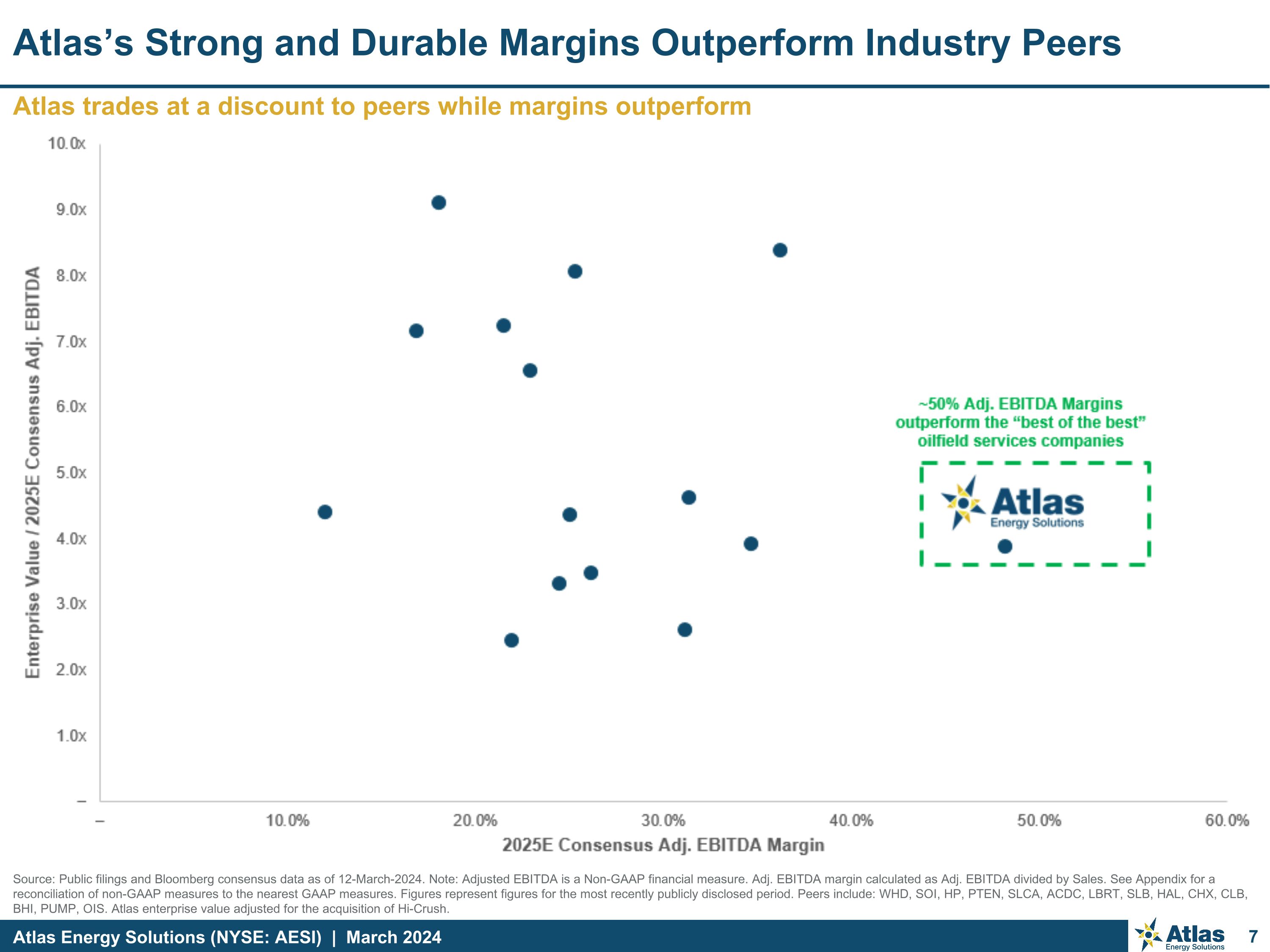

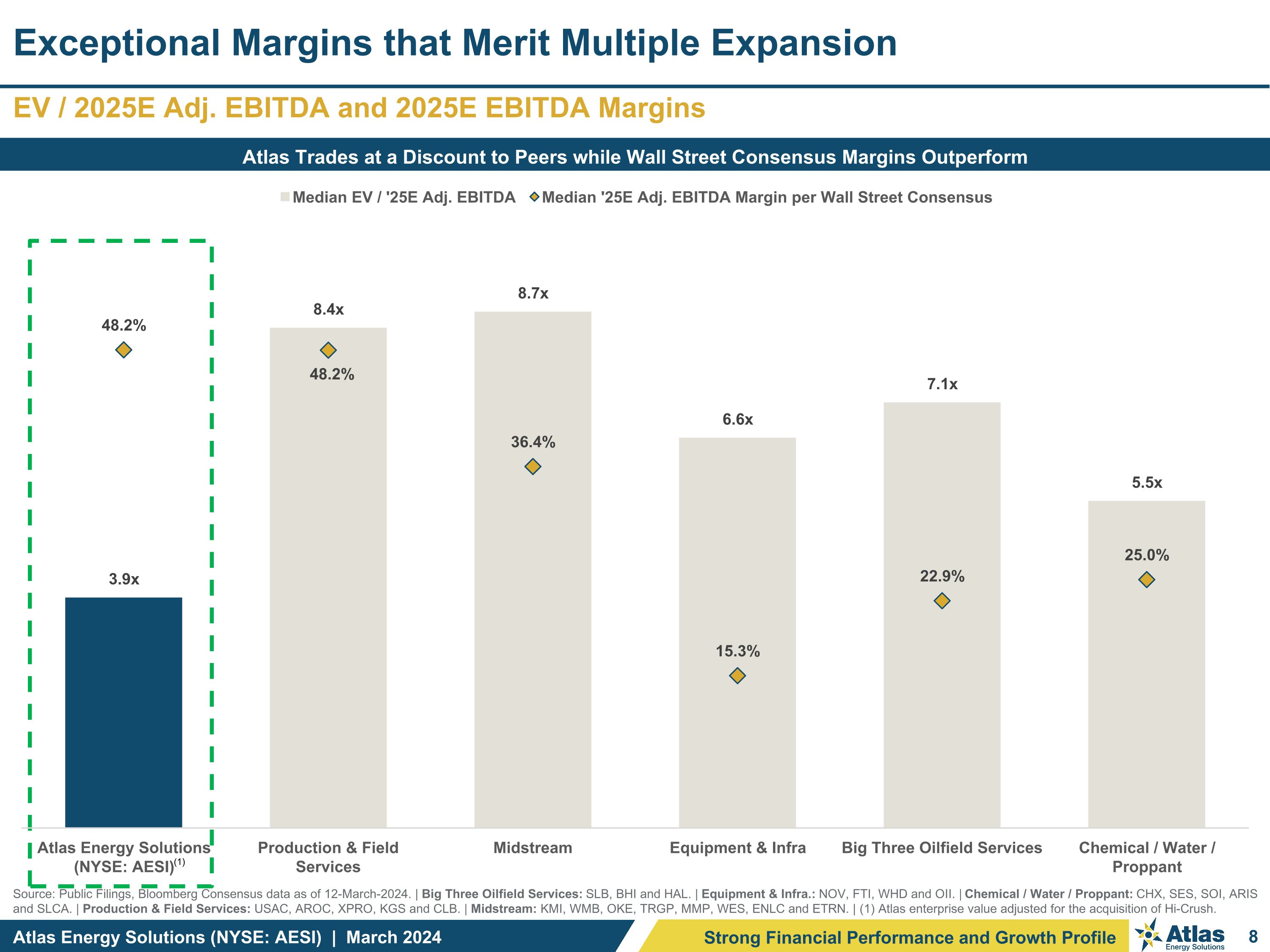

Source: Public filings and Bloomberg consensus data as of 12-March-2024. Note: Adjusted EBITDA is a Non-GAAP financial measure. Adj. EBITDA margin calculated as Adj. EBITDA divided by Sales. See Appendix for a reconciliation of non-GAAP measures to the nearest GAAP measures. Figures represent figures for the most recently publicly disclosed period. Peers include: WHD, SOI, HP, PTEN, SLCA, ACDC, LBRT, SLB, HAL, CHX, CLB, BHI, PUMP, OIS. Atlas enterprise value adjusted for the acquisition of Hi-Crush. Atlas trades at a discount to peers while margins outperform Atlas’s Strong and Durable Margins Outperform Industry Peers Enterprise Value / 2025E Consensus Adj. EBITDA ~50% Adj. EBITDA Margins outperform the “best of the best” oilfield services companies 2025E Consensus Adj. EBITDA Margin 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 10.0x 9.0x 8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x Atlas Energy Solutions

Source: Public Filings, Bloomberg Consensus data as of 12-March-2024. | Big Three Oilfield Services: SLB, BHI and HAL. | Equipment & Infra.: NOV, FTI, WHD and OII. | Chemical / Water / Proppant: CHX, SES, SOI, ARIS and SLCA. | Production & Field Services: USAC, AROC, XPRO, KGS and CLB. | Midstream: KMI, WMB, OKE, TRGP, MMP, WES, ENLC and ETRN. | (1) Atlas enterprise value adjusted for the acquisition of Hi-Crush. EV / 2025E Adj. EBITDA and 2025E EBITDA Margins Exceptional Margins that Merit Multiple Expansion Strong Financial Performance and Growth Profile Atlas Trades at a Discount to Peers while Wall Street Consensus Margins Outperform (1)

Acquisition of Hi-Crush

Transaction excludes midwestern mining assets and NE terminal assets. Atlas’s Acquisition of Hi-Crush Creates a Leading Proppant Logistics Provider and the Largest Proppant Producer in North America Accelerating Free Cash Flow and Shareholder Returns Combines Two of the Proppant Industry’s Primary Innovators Scale and Asset Quality Drive Exceptional Cost Structure, Margins and Growth Profile Acquisition includes Hi-Crush’s Permian Basin proppant production assets & Pronghorn Logistics platform (1) Unparalleled Portfolio of Proppant & Logistics Assets

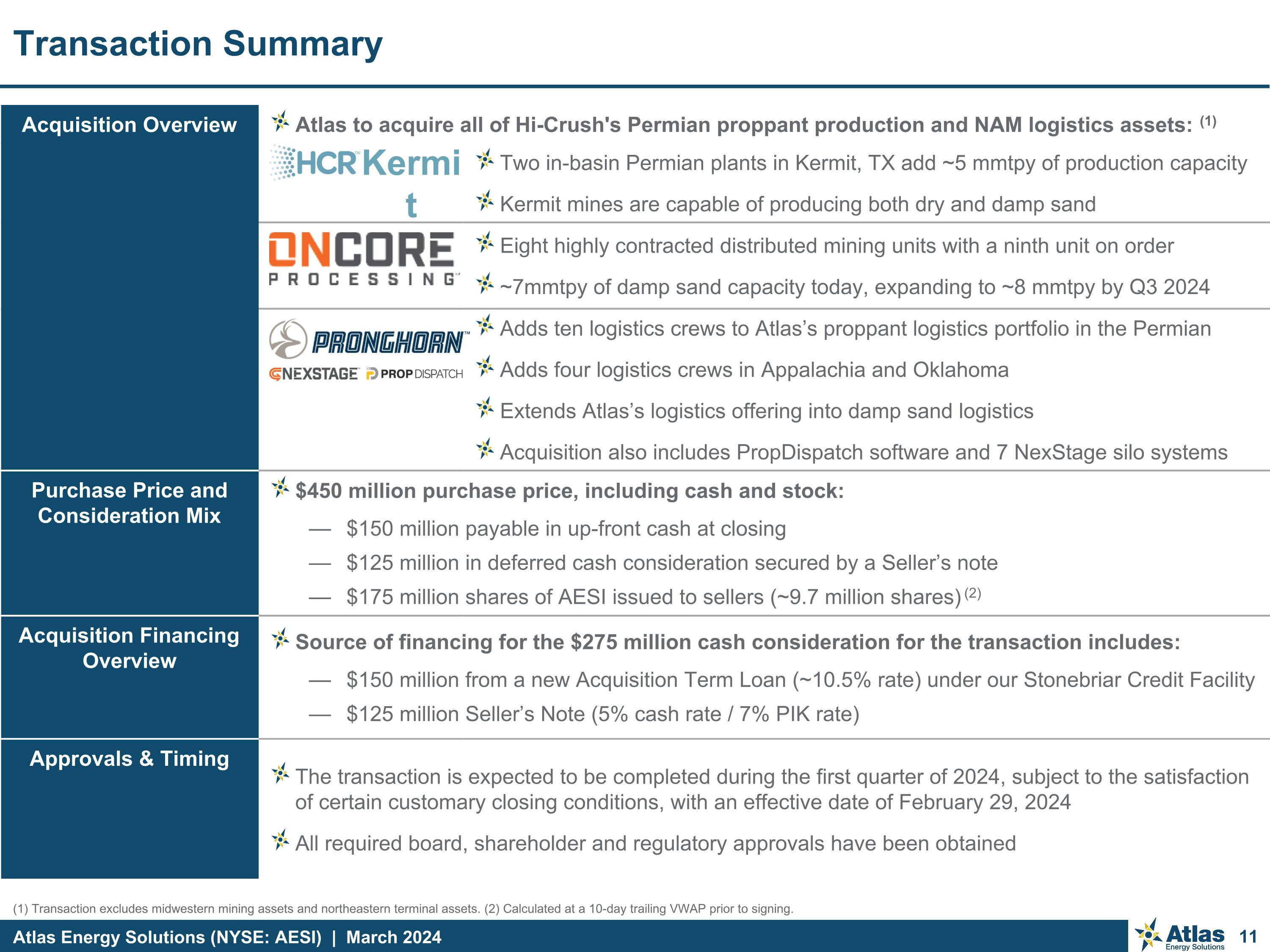

Transaction Summary Acquisition Overview Atlas to acquire all of Hi-Crush's Permian proppant production and NAM logistics assets: (1) Two in-basin Permian plants in Kermit, TX add ~5 mmtpy of production capacity Kermit mines are capable of producing both dry and damp sand Eight highly contracted distributed mining units with a ninth unit on order ~7mmtpy of damp sand capacity today, expanding to ~8 mmtpy by Q3 2024 Adds ten logistics crews to Atlas’s proppant logistics portfolio in the Permian Adds four logistics crews in Appalachia and Oklahoma Extends Atlas’s logistics offering into damp sand logistics Acquisition also includes PropDispatch software and 7 NexStage silo systems Purchase Price and Consideration Mix $450 million purchase price, including cash and stock: $150 million payable in up-front cash at closing $125 million in deferred cash consideration secured by a Seller’s note $175 million shares of AESI issued to sellers (~9.7 million shares) (2) Acquisition Financing Overview Source of financing for the $275 million cash consideration for the transaction includes: $150 million from a new Acquisition Term Loan (~10.5% rate) under our Stonebriar Credit Facility $125 million Seller’s Note (5% cash rate / 7% PIK rate) Approvals & Timing The transaction is expected to be completed during the first quarter of 2024, subject to the satisfaction of certain customary closing conditions, with an effective date of February 29, 2024 All required board, shareholder and regulatory approvals have been obtained Kermit (1) Transaction excludes midwestern mining assets and northeastern terminal assets. (2) Calculated at a 10-day trailing VWAP prior to signing.

Acquisition advances Atlas’s goal of logistically advantaging our proppant to every Permian wellhead (1) Atlas and Hi-Crush are a Compelling Strategic Fit Creates a premier portfolio of Permian proppant production assets with unmatched scale Significant opportunity for operational synergies through consolidation of giant open dune reserves (~21 mmtpy of capacity) Expands Atlas’s leading Permian proppant acreage position to ~45,365 acres Increases Atlas’s control of available Permian tier-one giant-open dune sand resources to ~85% OnCore adds ~7mmtpy of distributed mining assets producing damp sand to Atlas’s leading dry sand portfolio Expands total production to capacity 28 mmtpy (2), creating the largest proppant producer in North America Substantially improved geographic profile; increases the % of Permian rigs within 50-miles of an Atlas facility from 60% to 89% Highly contracted cash flow, conservative financial profile ~80% (4) contracted for 2024 on a pro forma production capacity of ~28 mmtpy (2), with an expanded high-quality customer base Initial Net Leverage of ~0.5x (3); debt expected to be methodically reduced to less than $300 million of total debt by YE2026 Pro forma liquidity of ~$434 million more than sufficient to fund ongoing growth, increased dividends, and debt paydown Scale and asset quality drive exceptional cost structure, margins and growth profile Maintains Atlas’s strong Adj. EBITDA margins, 40%+ Adj. EBITDA Margins (3) expected after the Dune Express comes online Hi-Crush Kermit mines can be tied into the Dune Express to meet or exceed the throughput capacity of the conveyor system OnCore provides an additional avenue for growth through the ongoing expansion of its distributed mining network Pronghorn brings Atlas its first geographic expansion outside the Permian Basin Accretive acquisition that accelerates free cash flow and shareholder returns Compelling transaction value of ~3x Adjusted EBITDA (3) Immediately expected to be double-digit accretive to CFPS and EPS (5) Accelerates free cash flow and expands capacity for shareholder returns + Combines the proppant industry’s primary innovators, creating a clear leader in proppant logistics Dune Express drives efficiencies by reducing mileage driven to deliver proppant via truck in the Delaware Basin OnCore distributed mining assets drive efficiencies, primarily in the Midland Basin, through efficient geographic footprint Drop depot / expanded payload model reduces total mileage driven by increasing payload per delivery Combination of Dune Express, Oncore and Pronghorn establish a highly developed proppant logistics network in the Permian Addition of Pronghorn approximately doubles Atlas’s active crew count and logistics revenue base 1 2 3 4 5 (1) Transaction excludes midwestern mining assets and northeastern terminal assets. (2) Based on annualized pro forma production capacity assuming full contribution from OnCore 8. (3) Non-GAAP financial measure. See disclaimer for definition of non-GAAP measures. (4) Based on realized effective (a) economic contribution & (b) production capacity in 2024. (5) Cash Flow Per Share (“CFPS”) defined as (net income plus depreciation and amortization) divided by diluted shares outstanding. Earnings per share (“EPS”) defined as net income divided by diluted shares outstanding.

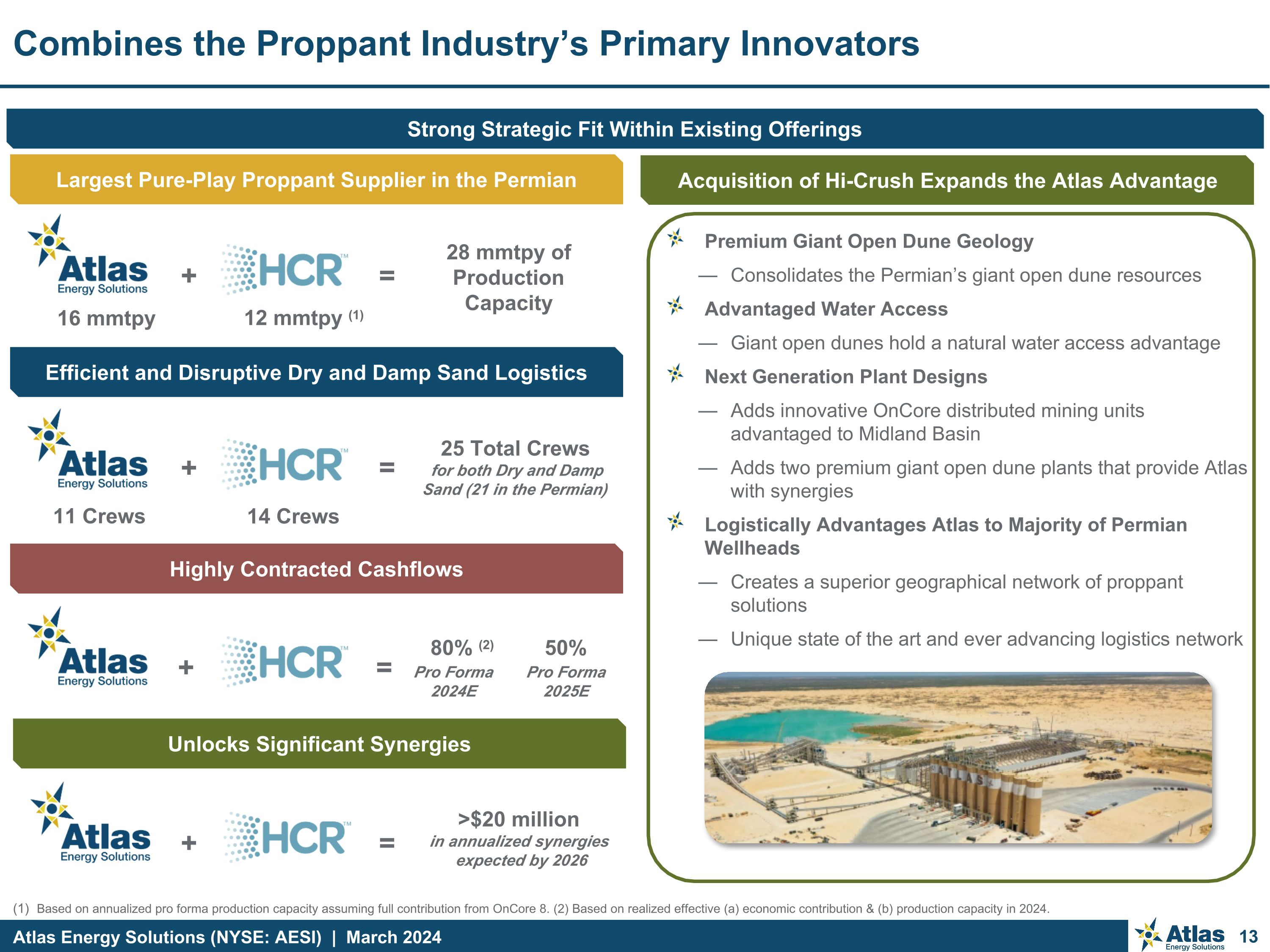

Based on annualized pro forma production capacity assuming full contribution from OnCore 8. (2) Based on realized effective (a) economic contribution & (b) production capacity in 2024. Combines the Proppant Industry’s Primary Innovators Strong Strategic Fit Within Existing Offerings Premium Giant Open Dune Geology Consolidates the Permian’s giant open dune resources Advantaged Water Access Giant open dunes hold a natural water access advantage Next Generation Plant Designs Adds innovative OnCore distributed mining units advantaged to Midland Basin Adds two premium giant open dune plants that provide Atlas with synergies Logistically Advantages Atlas to Majority of Permian Wellheads Creates a superior geographical network of proppant solutions Unique state of the art and ever advancing logistics network Acquisition of Hi-Crush Expands the Atlas Advantage Largest Pure-Play Proppant Supplier in the Permian Efficient and Disruptive Dry and Damp Sand Logistics Unlocks Significant Synergies + = 16 mmtpy 12 mmtpy (1) 28 mmtpy of Production Capacity + = 11 Crews 14 Crews 25 Total Crews for both Dry and Damp Sand (21 in the Permian) + = >$20 million in annualized synergies expected by 2026 Highly Contracted Cashflows + = 80% (2) Pro Forma 2024E 50% Pro Forma 2025E

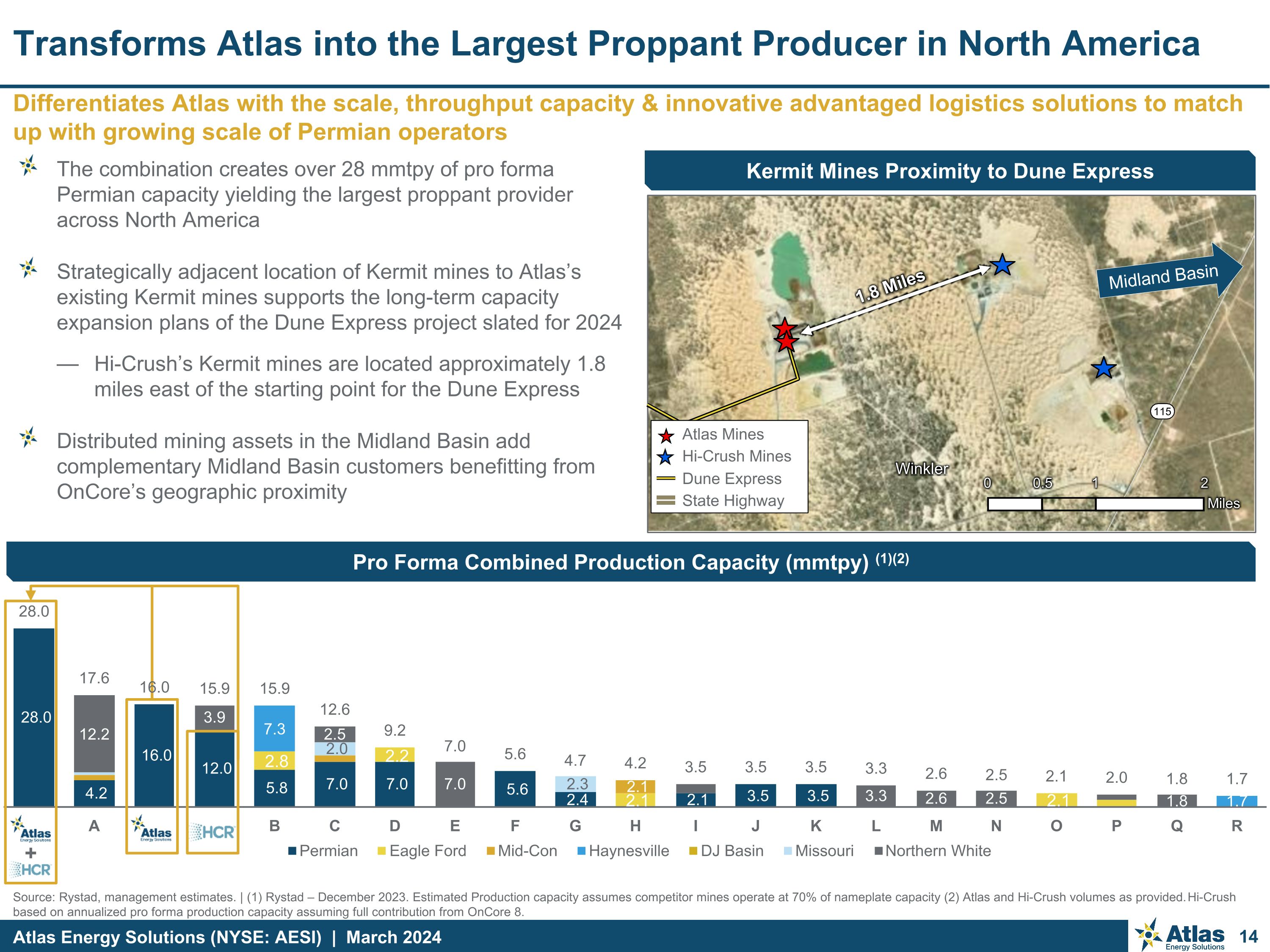

Transforms Atlas into the Largest Proppant Producer in North America The combination creates over 28 mmtpy of pro forma Permian capacity yielding the largest proppant provider across North America Strategically adjacent location of Kermit mines to Atlas’s existing Kermit mines supports the long-term capacity expansion plans of the Dune Express project slated for 2024 Hi-Crush’s Kermit mines are located approximately 1.8 miles east of the starting point for the Dune Express Distributed mining assets in the Midland Basin add complementary Midland Basin customers benefitting from OnCore’s geographic proximity Kermit Mines Proximity to Dune Express Source: Rystad, management estimates. | (1) Rystad – December 2023. Estimated Production capacity assumes competitor mines operate at 70% of nameplate capacity (2) Atlas and Hi-Crush volumes as provided. Hi-Crush based on annualized pro forma production capacity assuming full contribution from OnCore 8. Pro Forma Combined Production Capacity (mmtpy) (1)(2) + Differentiates Atlas with the scale, throughput capacity & innovative advantaged logistics solutions to match up with growing scale of Permian operators 115 1.8 Miles Midland Basin Hi-Crush Mines Atlas Mines Dune Express State Highway 0 1 2 0.5 Miles Winkler

Dune Express Proppant Logistics Infrastructure Historically ~60-70% of logistics costs are labor, impacting opex and reliability. The Dune Express (midstream asset), high-capacity trucking with drop depots and OnCore all drive labor intensity and opex down, along with emissions, while enhancing reliability and safety Innovative Logistics Platform – Constructive Disruption to Drive Growth High-Efficiency, Expanded Payload Wellsite Delivery Assets Acquisition of Hi-Crush’s adjacent giant open dune Kermit plants supplements Atlas existing Kermit production to fully supply the Dune Express deliveries into the Delaware Basin High-capacity trailers & multi-trailer configurations enable Atlas to leapfrog industry standard payloads by 3x – 4x Superior in-field customer service from Atlas’s remote command center delivers the industry’s fastest response times Consolidated & integrated logistics platform provide end-to-end services from the mine to the wellsite with dry or damp sand Synergies and cross application of best practices should compound Atlas’s performance to the benefit of customers and shareholders Enhances optionality and redundancy by providing additional storage options during transport and at the wellsite +

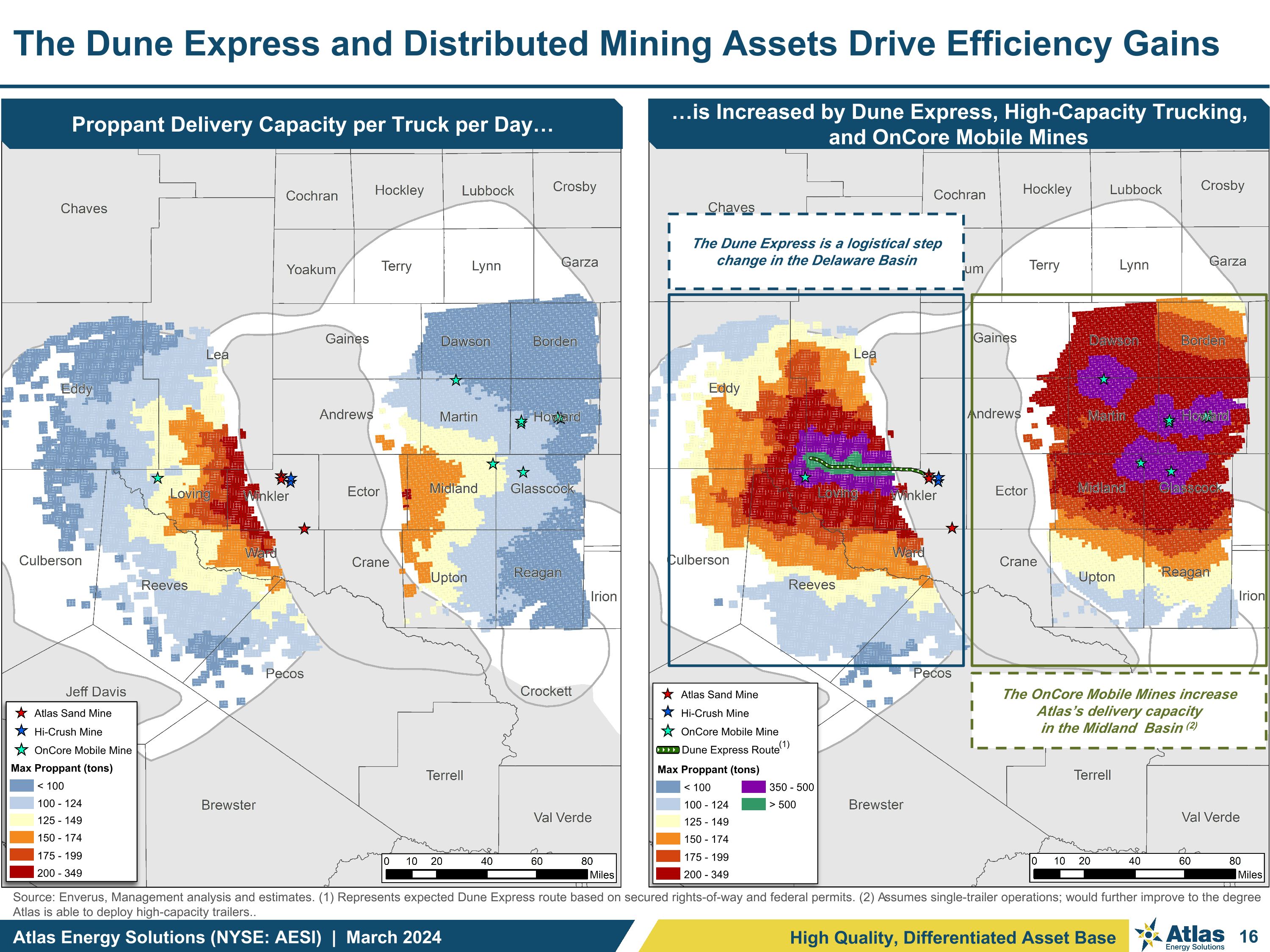

200 - 349 < 100 100 - 124 125 - 149 150 - 174 175 - 199 Max Proppant (tons) The Dune Express and Distributed Mining Assets Drive Efficiency Gains Source: Enverus, Management analysis and estimates. (1) Represents expected Dune Express route based on secured rights-of-way and federal permits. (2) Assumes single-trailer operations; would further improve to the degree Atlas is able to deploy high-capacity trailers.. 200 - 349 < 100 100 - 124 125 - 149 150 - 174 175 - 199 Max Proppant (tons) Crockett The Dune Express is a logistical step change in the Delaware Basin The OnCore Mobile Mines increase Atlas’s delivery capacity in the Midland Basin (2) OnCore Mobile Mine Atlas Sand Mine Hi-Crush Mine Proppant Delivery Capacity per Truck per Day… …is Increased by Dune Express, High-Capacity Trucking, and OnCore Mobile Mines High Quality, Differentiated Asset Base 200 - 349 (1) < 100 100 - 124 125 - 149 150 - 174 175 - 199 OnCore Mobile Mine Atlas Sand Mine 350 - 500 > 500 Dune Express Route Max Proppant (tons) Hi-Crush Mine

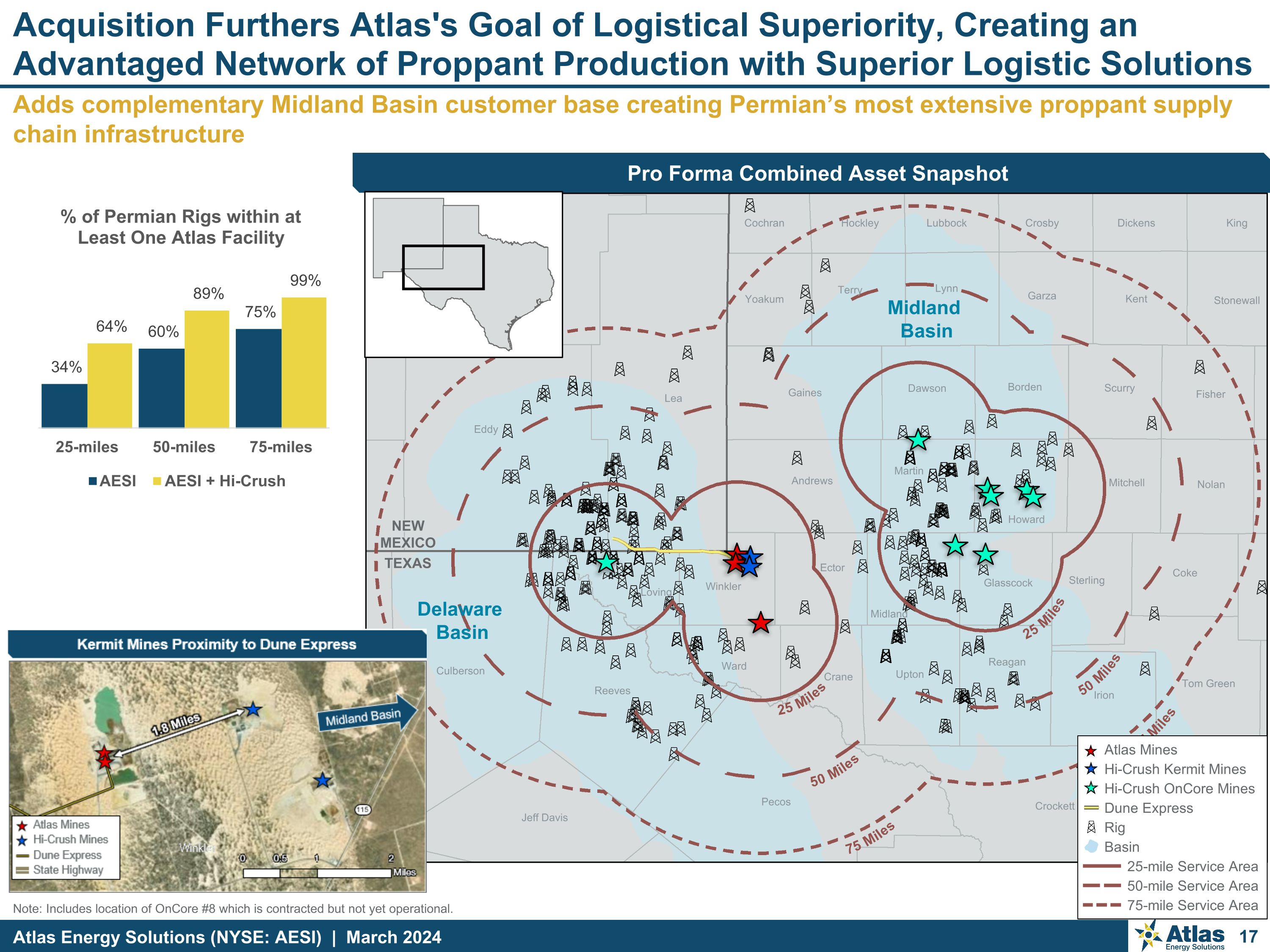

Note: Includes location of OnCore #8 which is contracted but not yet operational. Adds complementary Midland Basin customer base creating Permian’s most extensive proppant supply chain infrastructure Acquisition Furthers Atlas's Goal of Logistical Superiority, Creating an Advantaged Network of Proppant Production with Superior Logistic Solutions Pro Forma Combined Asset Snapshot Pro Forma Combined Asset Snapshot Haskell Concho Menard Knox 75 Miles 50 Miles 25 Miles 75 Miles 50 Miles 25 Miles Delaware Basin Midland Basin Lea Eddy Chaves Pecos Culberson Reeves Crockett Irion Gaines Jeff Davis Upton Kent Lynn Terry Coke Andrews Ector Nolan Ward Garza Martin Reagan Fisher Scurry Tom Green Borden Crane Schleicher Mitchell Sterling Howard Midland Dawson Winkler Yoakum Loving Stonewall Glasscock Dickens Lubbock Hockley Crosby Cochran King Rig Basin Atlas Mines Hi-Crush Kermit Mines Dune Express Hi-Crush OnCore Mines 25-mile Service Area 75-mile Service Area 50-mile Service Area TEXAS NEW MEXICO

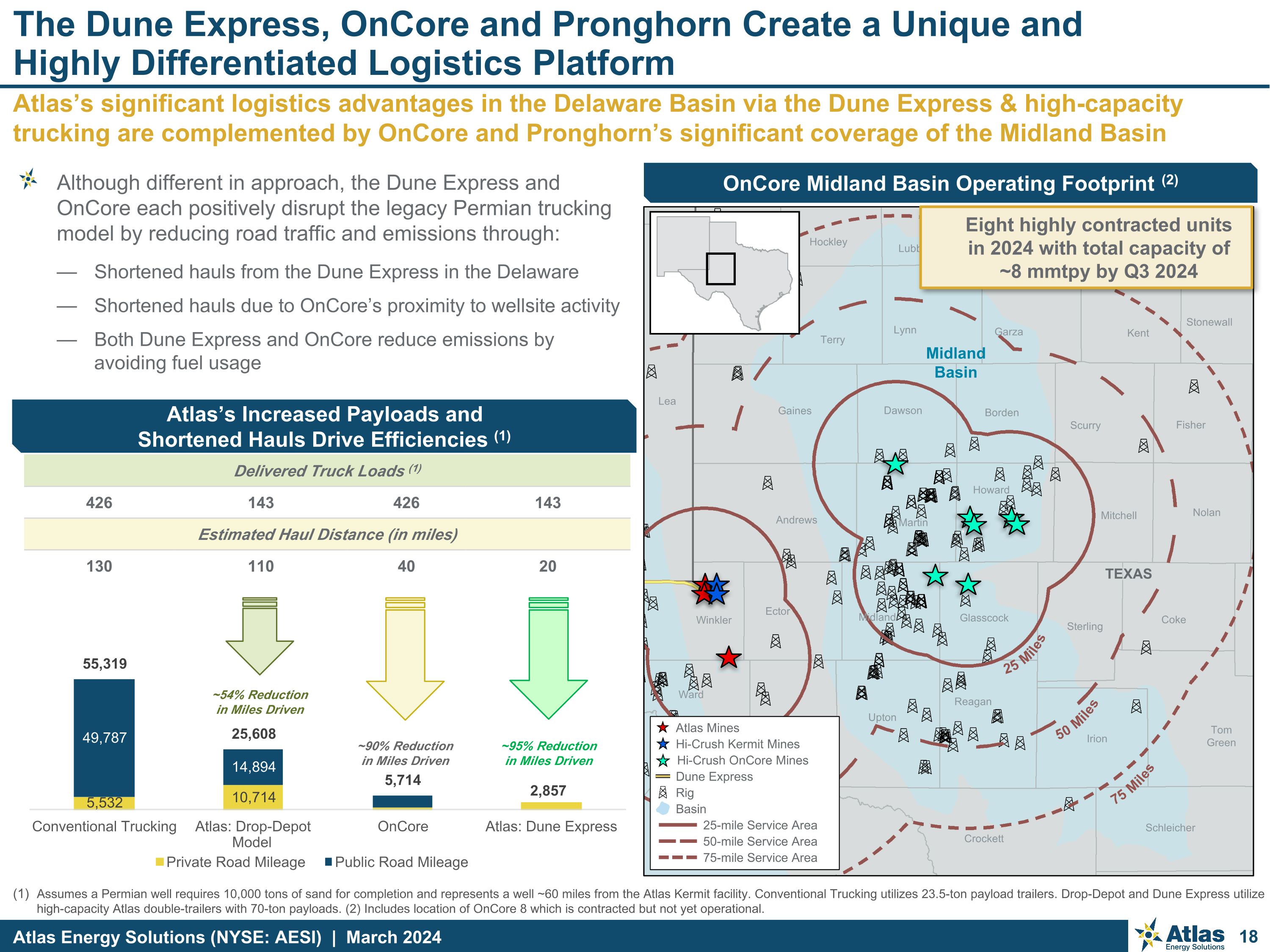

Although different in approach, the Dune Express and OnCore each positively disrupt the legacy Permian trucking model by reducing road traffic and emissions through: Shortened hauls from the Dune Express in the Delaware Shortened hauls due to OnCore’s proximity to wellsite activity Both Dune Express and OnCore reduce emissions by avoiding fuel usage Assumes a Permian well requires 10,000 tons of sand for completion and represents a well ~60 miles from the Atlas Kermit facility. Conventional Trucking utilizes 23.5-ton payload trailers. Drop-Depot and Dune Express utilize high-capacity Atlas double-trailers with 70-ton payloads. (2) Includes location of OnCore 8 which is contracted but not yet operational. Atlas’s significant logistics advantages in the Delaware Basin via the Dune Express & high-capacity trucking are complemented by OnCore and Pronghorn’s significant coverage of the Midland Basin The Dune Express, OnCore and Pronghorn Create a Unique and Highly Differentiated Logistics Platform OnCore Midland Basin Operating Footprint (2) Atlas’s Increased Payloads and Shortened Hauls Drive Efficiencies (1) Delivered Truck Loads (1) 426 143 426 143 Estimated Haul Distance (in miles) 130 110 40 20 ~54% Reduction in Miles Driven ~95% Reduction in Miles Driven ~90% Reduction in Miles Driven TEXAS 75 Miles 50 Miles 25 Miles Midland Basin Lea Pecos Irion Gaines Crockett Upton Kent Lynn Terry Coke Andrews Ector Nolan Garza Martin Reagan Fisher Scurry Tom Green Borden Crane Ward Mitchell Sterling Schleicher Howard Midland Dawson Winkler Yoakum Glasscock Stonewall King Crosby Hockley Dickens Lubbock Cochran Rig Basin Atlas Mines Hi-Crush Kermit Mines Dune Express Hi-Crush OnCore Mines 25-mile Service Area 75-mile Service Area 50-mile Service Area Eight highly contracted units in 2024 with total capacity of ~8 mmtpy by Q3 2024

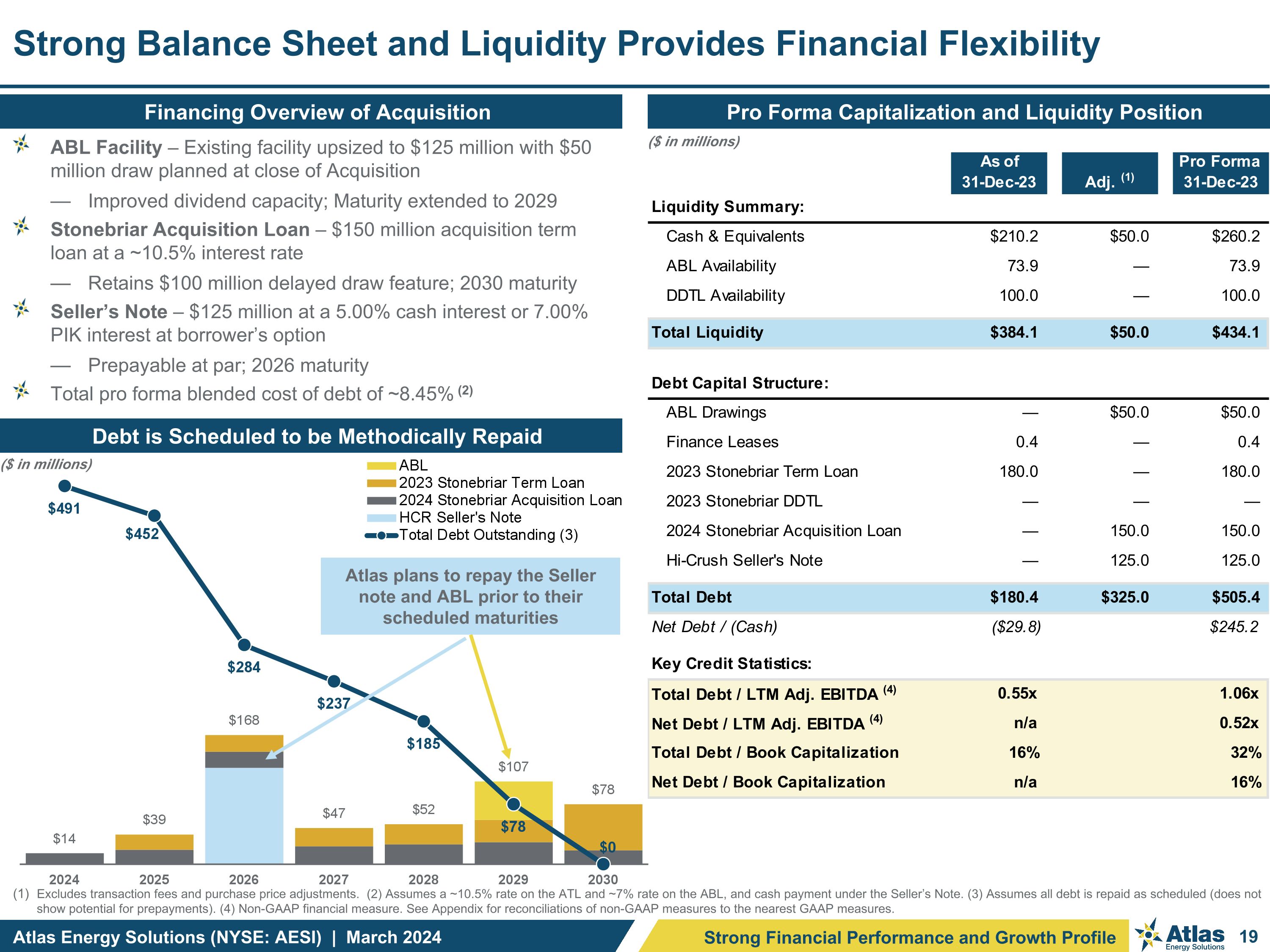

ABL Facility – Existing facility upsized to $125 million with $50 million draw planned at close of Acquisition Improved dividend capacity; Maturity extended to 2029 Stonebriar Acquisition Loan – $150 million acquisition term loan at a ~10.5% interest rate Retains $100 million delayed draw feature; 2030 maturity Seller’s Note – $125 million at a 5.00% cash interest or 7.00% PIK interest at borrower’s option Prepayable at par; 2026 maturity Total pro forma blended cost of debt of ~8.45% (2) Excludes transaction fees and purchase price adjustments. (2) Assumes a ~10.5% rate on the ATL and ~7% rate on the ABL, and cash payment under the Seller’s Note. (3) Assumes all debt is repaid as scheduled (does not show potential for prepayments). (4) Non-GAAP financial measure. See Appendix for reconciliations of non-GAAP measures to the nearest GAAP measures. Strong Balance Sheet and Liquidity Provides Financial Flexibility Pro Forma Capitalization and Liquidity Position ($ in millions) Financing Overview of Acquisition Debt is Scheduled to be Methodically Repaid ($ in millions) Atlas plans to repay the Seller note and ABL prior to their scheduled maturities Strong Financial Performance and Growth Profile

Transaction Enhances Atlas Energy Solutions Investment Profile Enhances sustainable environmental and social progress (“SESP”) leadership Highly contracted cash flow, conservative financial profile Combines the proppant industry’s primary innovators Scale and asset quality drive exceptional cost structure, margins and growth profile Unparalleled portfolio of proppant & logistics assets Accretive acquisition that accelerates free cash flow and shareholder returns Creates a clear leader in proppant logistics

Atlas Overview & Update

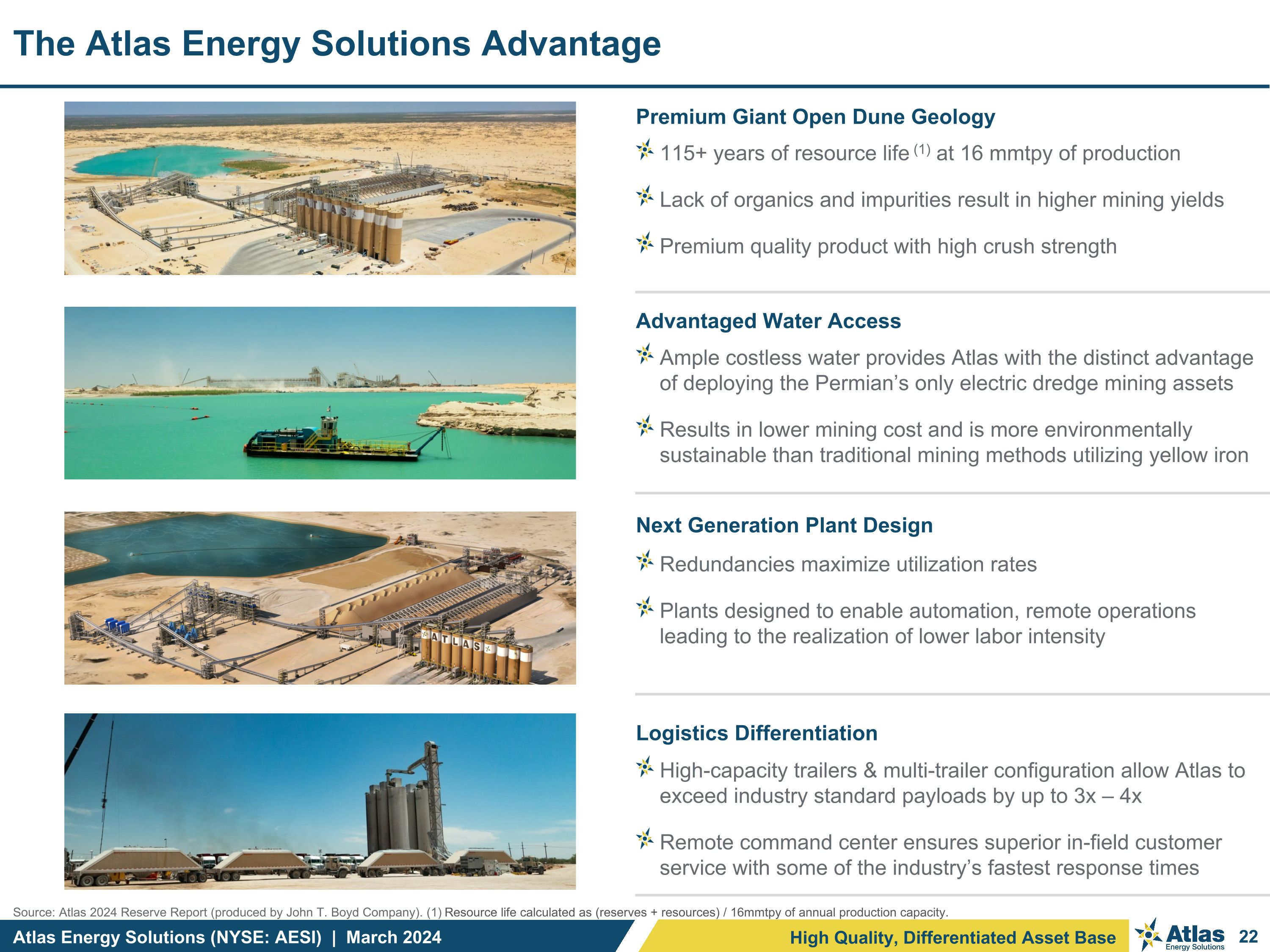

The Atlas Energy Solutions Advantage Premium Giant Open Dune Geology 115+ years of resource life (1) at 16 mmtpy of production Lack of organics and impurities result in higher mining yields Premium quality product with high crush strength Advantaged Water Access Ample costless water provides Atlas with the distinct advantage of deploying the Permian’s only electric dredge mining assets Results in lower mining cost and is more environmentally sustainable than traditional mining methods utilizing yellow iron Next Generation Plant Design Redundancies maximize utilization rates Plants designed to enable automation, remote operations leading to the realization of lower labor intensity Logistics Differentiation High-capacity trailers & multi-trailer configuration allow Atlas to exceed industry standard payloads by up to 3x – 4x Remote command center ensures superior in-field customer service with some of the industry’s fastest response times High Quality, Differentiated Asset Base Source: Atlas 2024 Reserve Report (produced by John T. Boyd Company). (1) Resource life calculated as (reserves + resources) / 16mmtpy of annual production capacity.

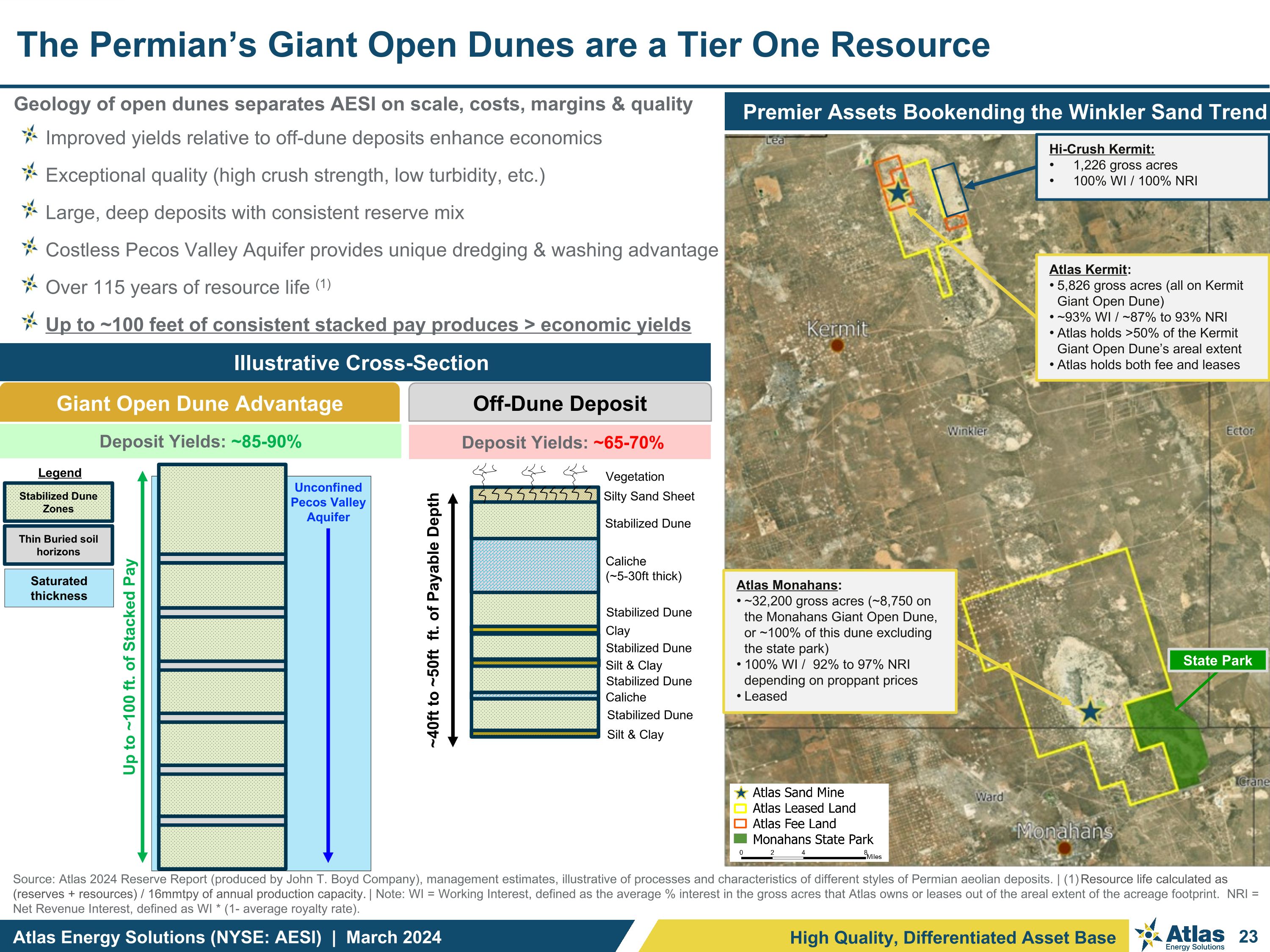

High Quality, Differentiated Asset Base Geology of open dunes separates AESI on scale, costs, margins & quality Improved yields relative to off-dune deposits enhance economics Exceptional quality (high crush strength, low turbidity, etc.) Large, deep deposits with consistent reserve mix Costless Pecos Valley Aquifer provides unique dredging & washing advantage Over 115 years of resource life (1) Up to ~100 feet of consistent stacked pay produces > economic yields The Permian’s Giant Open Dunes are a Tier One Resource Source: Atlas 2024 Reserve Report (produced by John T. Boyd Company), management estimates, illustrative of processes and characteristics of different styles of Permian aeolian deposits. | (1) Resource life calculated as (reserves + resources) / 16mmtpy of annual production capacity. | Note: WI = Working Interest, defined as the average % interest in the gross acres that Atlas owns or leases out of the areal extent of the acreage footprint. NRI = Net Revenue Interest, defined as WI * (1- average royalty rate). Premier Assets Bookending the Winkler Sand Trend Atlas Kermit: 5,826 gross acres (all on Kermit Giant Open Dune) ~93% WI / ~87% to 93% NRI Atlas holds >50% of the Kermit Giant Open Dune’s areal extent Atlas holds both fee and leases Atlas Monahans: ~32,200 gross acres (~8,750 on the Monahans Giant Open Dune, or ~100% of this dune excluding the state park) 100% WI / 92% to 97% NRI depending on proppant prices Leased State Park Illustrative Cross-Section Unconfined Pecos Valley Aquifer Up to ~100 ft. of Stacked Pay Deposit Yields: ~85-90% Deposit Yields: ~65-70% Giant Open Dune Advantage Off-Dune Deposit Legend Thin Buried soil horizons Saturated thickness Stabilized Dune Zones Caliche (~5-30ft thick) Clay Caliche Silt & Clay Silty Sand Sheet Stabilized Dune ~40ft to ~50ft ft. of Payable Depth Vegetation Silt & Clay Stabilized Dune Stabilized Dune Stabilized Dune Stabilized Dune Hi-Crush Kermit: 1,226 gross acres 100% WI / 100% NRI

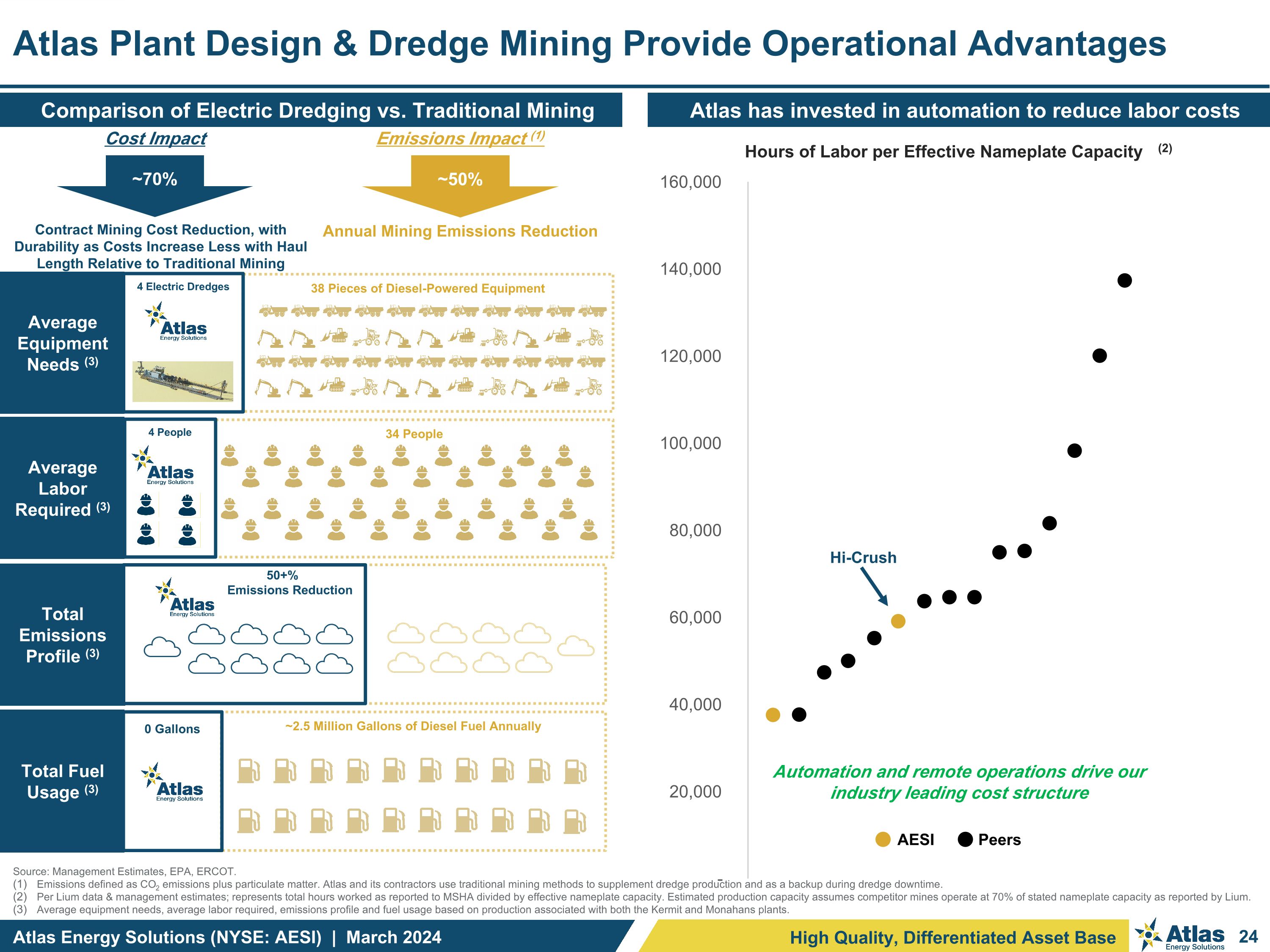

Source: Management Estimates, EPA, ERCOT. Emissions defined as CO2 emissions plus particulate matter. Atlas and its contractors use traditional mining methods to supplement dredge production and as a backup during dredge downtime. Per Lium data & management estimates; represents total hours worked as reported to MSHA divided by effective nameplate capacity. Estimated production capacity assumes competitor mines operate at 70% of stated nameplate capacity as reported by Lium. Average equipment needs, average labor required, emissions profile and fuel usage based on production associated with both the Kermit and Monahans plants. Atlas Plant Design & Dredge Mining Provide Operational Advantages High Quality, Differentiated Asset Base Atlas has invested in automation to reduce labor costs Comparison of Electric Dredging vs. Traditional Mining Cost Impact ~70% Contract Mining Cost Reduction, with Durability as Costs Increase Less with Haul Length Relative to Traditional Mining Emissions Impact (1) ~50% Annual Mining Emissions Reduction 38 Pieces of Diesel-Powered Equipment 34 People 50+% Emissions Reduction ~2.5 Million Gallons of Diesel Fuel Annually 0 Gallons AESI Peers Automation and remote operations drive our industry leading cost structure Average Equipment Needs (3) Average Labor Required (3) Total Emissions Profile (3) Total Fuel Usage (3) 4 Electric Dredges 4 People Hi-Crush

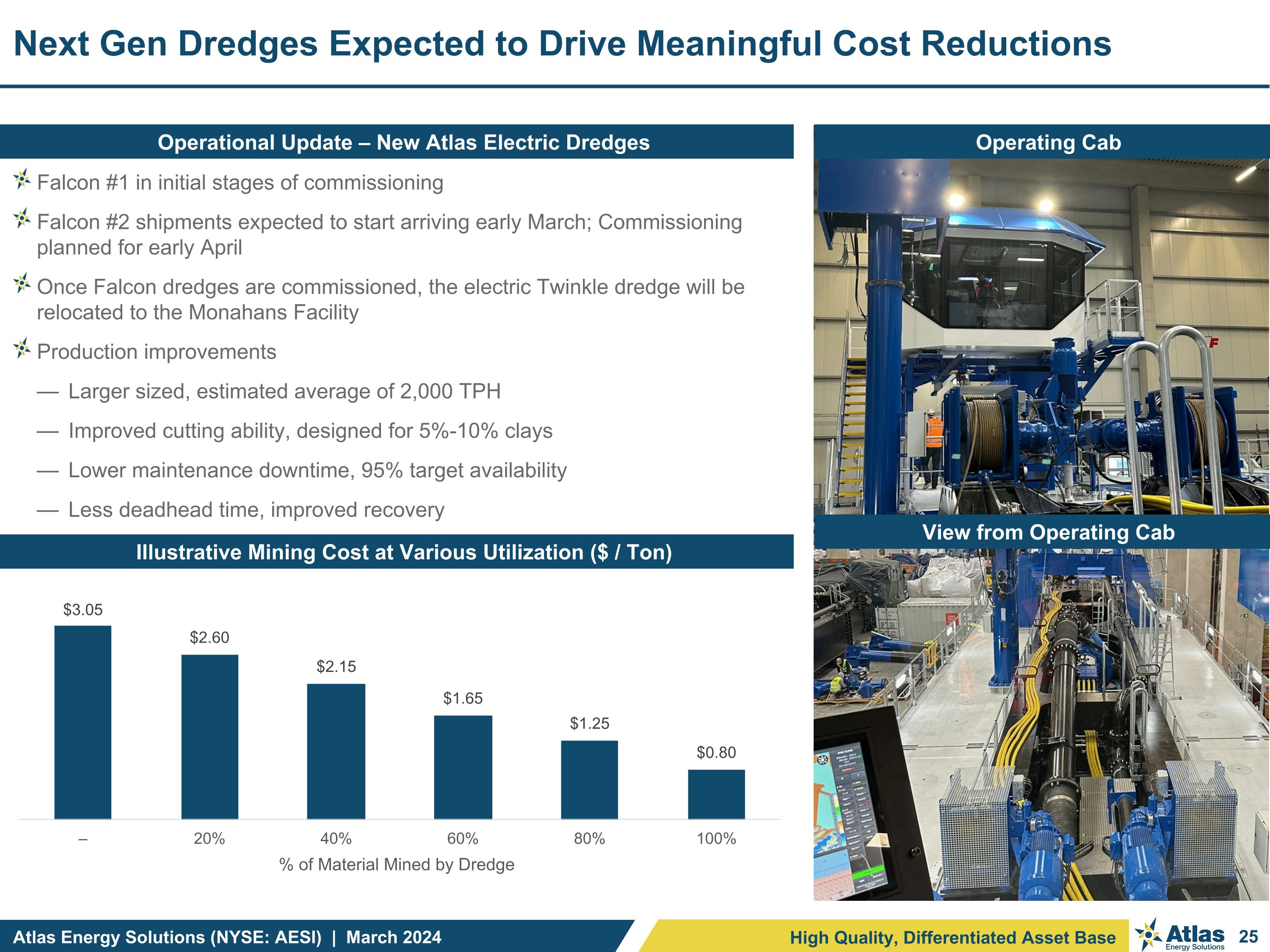

Next Gen Dredges Expected to Drive Meaningful Cost Reductions Operating Cab Operational Update – New Atlas Electric Dredges View from Operating Cab Falcon #1 in initial stages of commissioning Falcon #2 shipments expected to start arriving early March; Commissioning planned for early April Once Falcon dredges are commissioned, the electric Twinkle dredge will be relocated to the Monahans Facility Production improvements Larger sized, estimated average of 2,000 TPH Improved cutting ability, designed for 5%-10% clays Lower maintenance downtime, 95% target availability Less deadhead time, improved recovery High Quality, Differentiated Asset Base Illustrative Mining Cost at Various Utilization ($ / Ton)

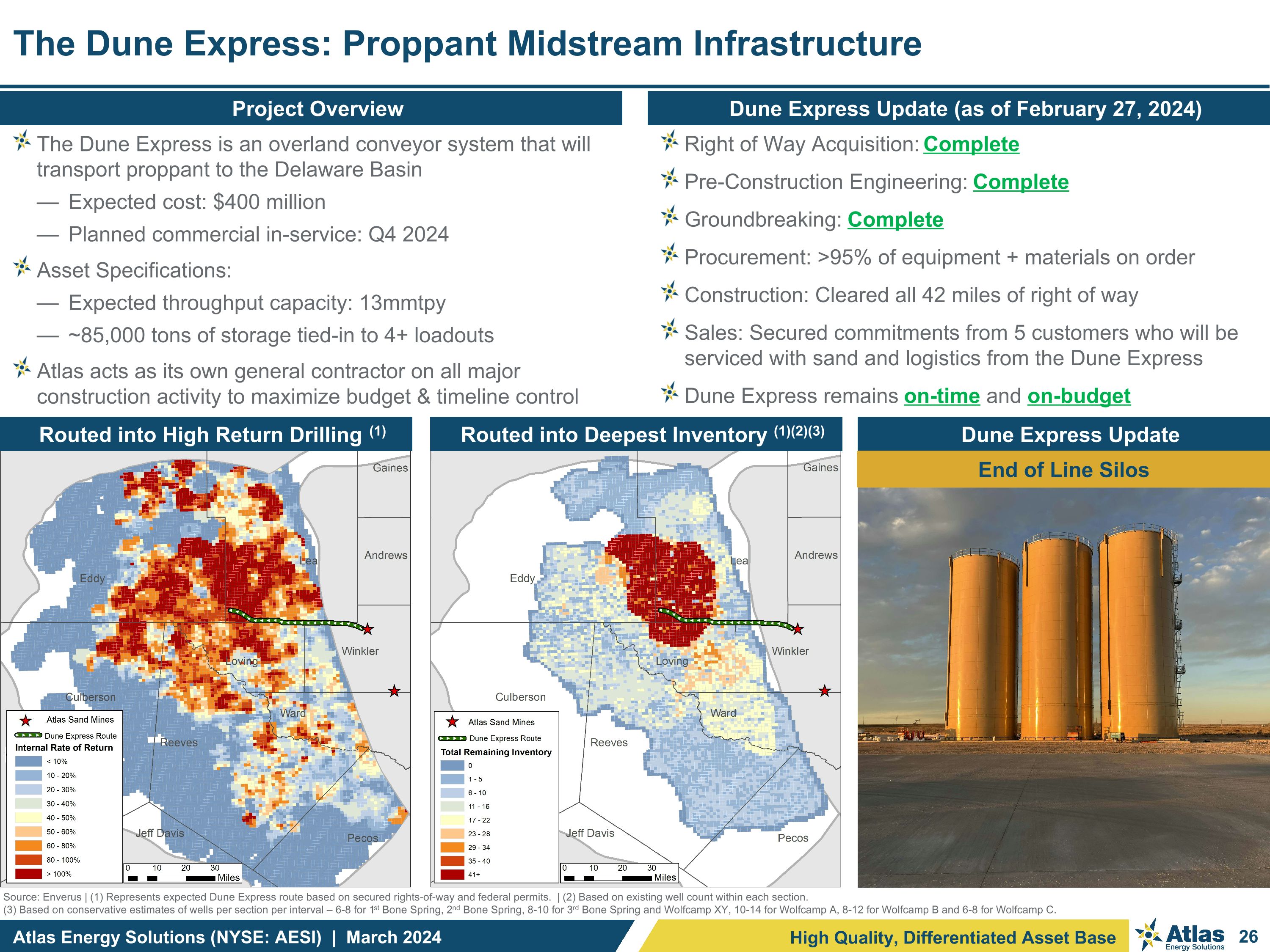

The Dune Express: Proppant Midstream Infrastructure High Quality, Differentiated Asset Base Source: Enverus | (1) Represents expected Dune Express route based on secured rights-of-way and federal permits. | (2) Based on existing well count within each section. (3) Based on conservative estimates of wells per section per interval – 6-8 for 1st Bone Spring, 2nd Bone Spring, 8-10 for 3rd Bone Spring and Wolfcamp XY, 10-14 for Wolfcamp A, 8-12 for Wolfcamp B and 6-8 for Wolfcamp C. Dune Express Update (as of February 27, 2024) Project Overview Routed into High Return Drilling (1) The Dune Express is an overland conveyor system that will transport proppant to the Delaware Basin Expected cost: $400 million Planned commercial in-service: Q4 2024 Asset Specifications: Expected throughput capacity: 13mmtpy ~85,000 tons of storage tied-in to 4+ loadouts Atlas acts as its own general contractor on all major construction activity to maximize budget & timeline control Right of Way Acquisition: Complete Pre-Construction Engineering: Complete Groundbreaking: Complete Procurement: >95% of equipment + materials on order Construction: Cleared all 42 miles of right of way Sales: Secured commitments from 5 customers who will be serviced with sand and logistics from the Dune Express Dune Express remains on-time and on-budget Routed into Deepest Inventory (1)(2)(3) Dune Express Update End of Line Silos

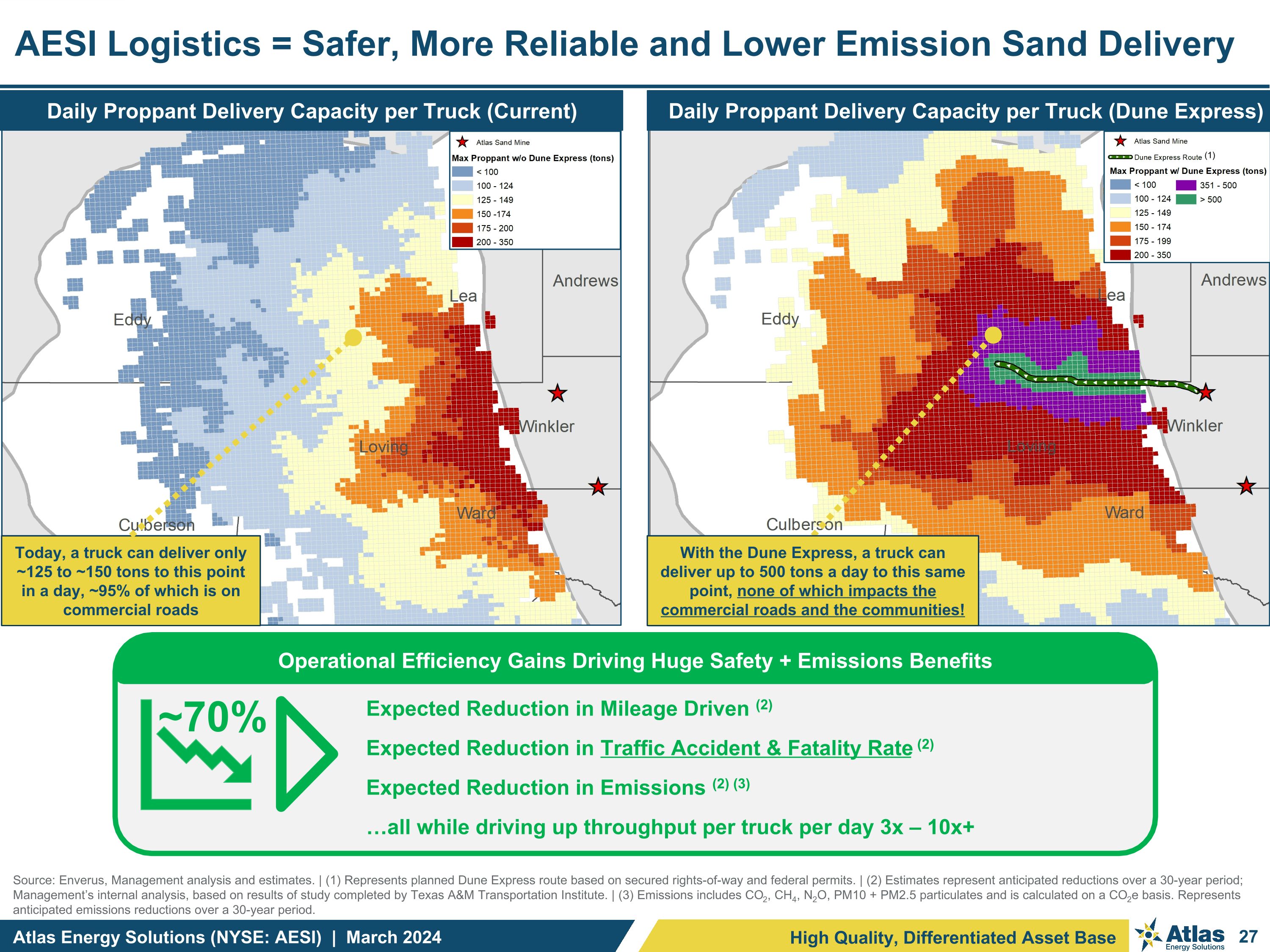

High Quality, Differentiated Asset Base Daily Proppant Delivery Capacity per Truck (Dune Express) AESI Logistics = Safer, More Reliable and Lower Emission Sand Delivery Daily Proppant Delivery Capacity per Truck (Current) Source: Enverus, Management analysis and estimates. | (1) Represents planned Dune Express route based on secured rights-of-way and federal permits. | (2) Estimates represent anticipated reductions over a 30-year period; Management’s internal analysis, based on results of study completed by Texas A&M Transportation Institute. | (3) Emissions includes CO2, CH4, N2O, PM10 + PM2.5 particulates and is calculated on a CO2e basis. Represents anticipated emissions reductions over a 30-year period. Today, a truck can deliver only ~125 to ~150 tons to this point in a day, ~95% of which is on commercial roads With the Dune Express, a truck can deliver up to 500 tons a day to this same point, none of which impacts the commercial roads and the communities! (1) Expected Reduction in Mileage Driven (2) Expected Reduction in Traffic Accident & Fatality Rate (2) Expected Reduction in Emissions (2) (3) …all while driving up throughput per truck per day 3x – 10x+ ~70% Operational Efficiency Gains Driving Huge Safety + Emissions Benefits

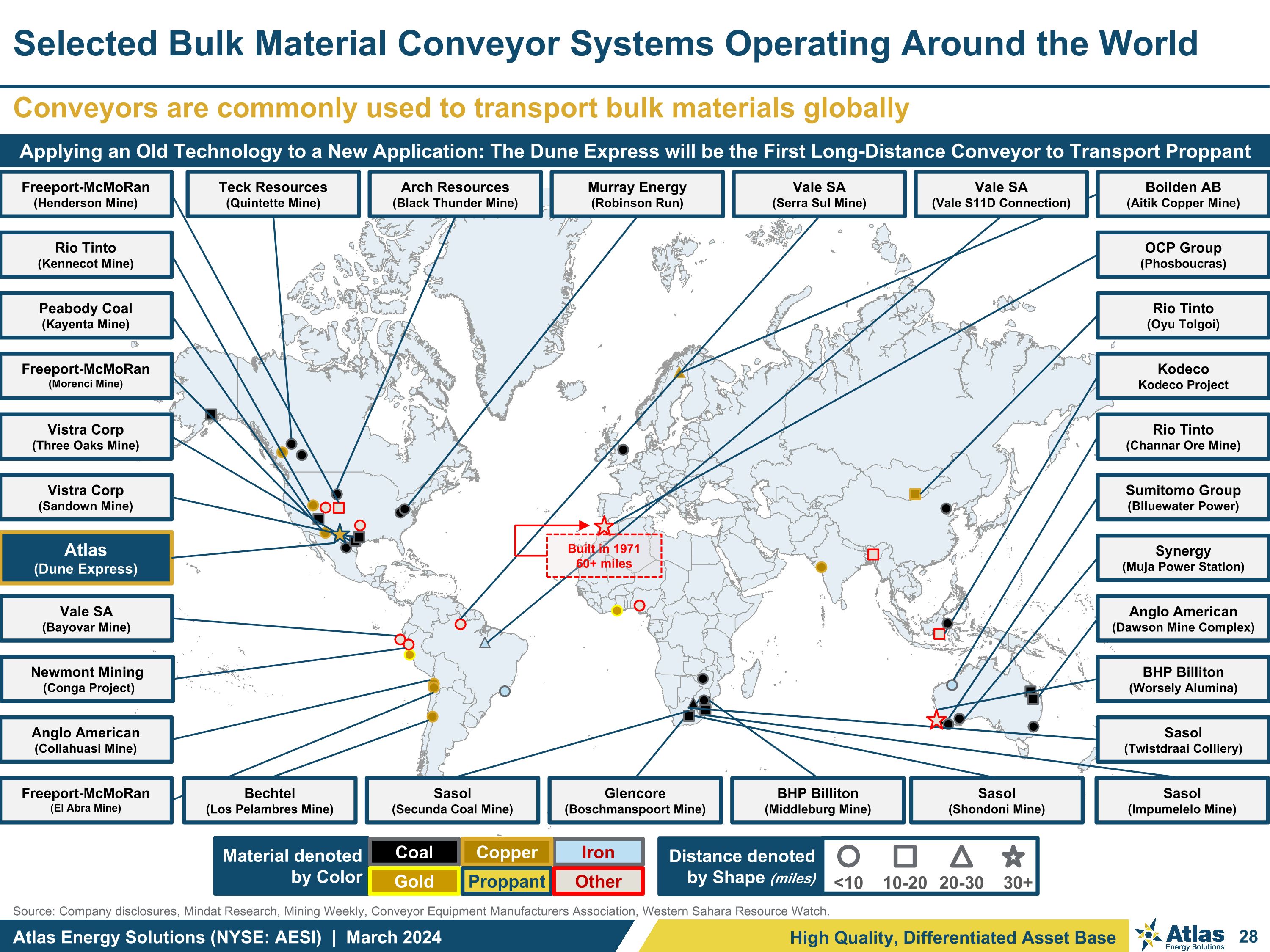

High Quality, Differentiated Asset Base Source: Company disclosures, Mindat Research, Mining Weekly, Conveyor Equipment Manufacturers Association, Western Sahara Resource Watch. Conveyors are commonly used to transport bulk materials globally Selected Bulk Material Conveyor Systems Operating Around the World OCP Group (Phosboucras) <10 10-20 20-30 30+ Distance denoted by Shape (miles) Material denoted by Color Coal Gold Iron Copper Proppant Other Applying an Old Technology to a New Application: The Dune Express will be the First Long-Distance Conveyor to Transport Proppant Anglo American (Collahuasi Mine) BHP Billiton (Worsely Alumina) Freeport-McMoRan (Morenci Mine) Kodeco Kodeco Project Vistra Corp (Three Oaks Mine) Vistra Corp (Sandown Mine) Freeport-McMoRan (Henderson Mine) Boilden AB (Aitik Copper Mine) Sumitomo Group (Blluewater Power) Rio Tinto (Oyu Tolgoi) Rio Tinto (Channar Ore Mine) Rio Tinto (Kennecot Mine) Peabody Coal (Kayenta Mine) Freeport-McMoRan (El Abra Mine) Sasol (Shondoni Mine) Sasol (Secunda Coal Mine) Sasol (Impumelelo Mine) Sasol (Twistdraai Colliery) Vale SA (Bayovar Mine) Vale SA (Serra Sul Mine) BHP Billiton (Middleburg Mine) Arch Resources (Black Thunder Mine) Glencore (Boschmanspoort Mine) Atlas (Dune Express) Newmont Mining (Conga Project) Murray Energy (Robinson Run) Teck Resources (Quintette Mine) Synergy (Muja Power Station) Anglo American (Dawson Mine Complex) Bechtel (Los Pelambres Mine) Vale SA (Vale S11D Connection) Built in 1971 60+ miles

Investor Relations Contact For more information, please visit our website at https://atlas.energy/ IR Contact: Kyle Turlington 5918 W Courtyard Drive, Suite #500; Austin, Texas 78730 (T) 512-220-1200 IR@atlas.energy NYSE: AESI

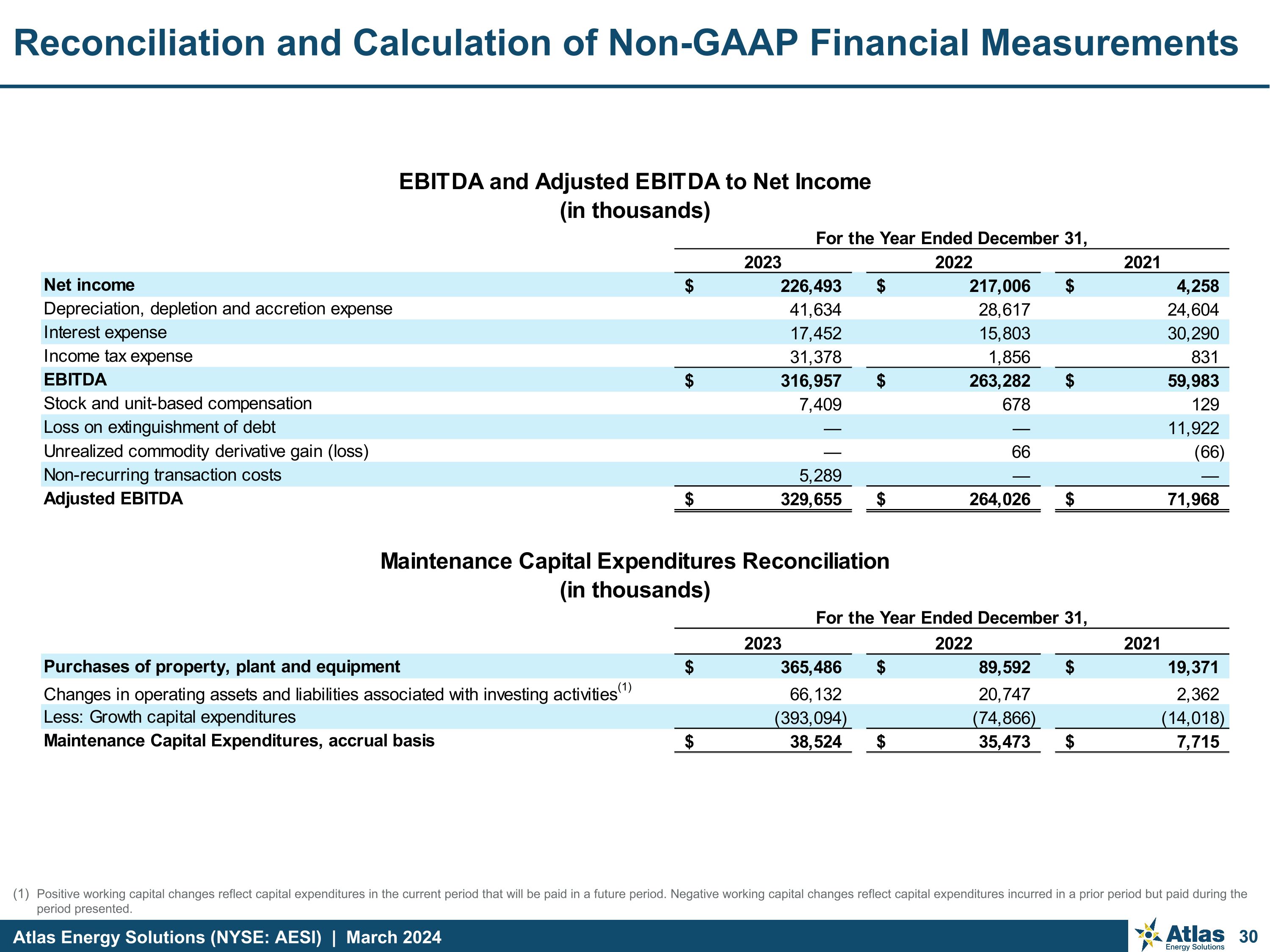

Positive working capital changes reflect capital expenditures in the current period that will be paid in a future period. Negative working capital changes reflect capital expenditures incurred in a prior period but paid during the period presented. Reconciliation and Calculation of Non-GAAP Financial Measurements

Non-GAAP Financial Measure Definitions Non-GAAP Financial Measures Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP supplemental financial measures used by our management and by external users of our financial statements such as investors, research analysts and others, in the case of Adjusted EBITDA, to assess our operating performance on a consistent basis across periods by removing the effects of development activities, provide views on capital resources available to organically fund growth projects and, in the case of Adjusted Free Cash Flow, assess the financial performance of our assets and their ability to sustain dividends or reinvest to organically fund growth projects over the long term without regard to financing methods, capital structure, or historical cost basis. These measures do not represent and should not be considered alternatives to, or more meaningful than, net income, income from operations, net cash provided by operating activities, or any other measure of financial performance presented in accordance with GAAP as measures of our financial performance. Adjusted EBITDA and Adjusted Free Cash Flow have important limitations as analytical tools because they exclude some but not all items that affect net income, the most directly comparable GAAP financial measure. Our computation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Free Cash Flow, Adjusted Free Cash Flow Margin, Adjusted Free Cash Flow Conversion and Maintenance Capital Expenditures may differ from computations of similarly titled measures of other companies. Non-GAAP Measure Definitions: We define Adjusted EBITDA as net income before depreciation, depletion and accretion, interest expense, income tax expense, stock and unit-based compensation, loss on extinguishment of debt, unrealized commodity derivative gain (loss), and non-recurring transaction costs. Management believes Adjusted EBITDA is useful because it allows management to more effectively evaluate the Company’s operating performance and compare the results of its operations from period to period and against our peers without regard to financing method or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by total sales.