| Atlas Energy Solutions (NYSE: AESI) | January 2025 NYSE: AESI Acquisition of Moser Energy Systems January 27, 2025 |

| Atlas Energy Solutions (NYSE: AESI) | January 2025 Disclaimer 2 Forward-Looking Statements This Presentation contains “forward-looking statements” of Atlas Energy Solutions Inc. (“Atlas,” the “Company,” “AESI,” “we,” “us” or “our”) within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are predictive or prospective in nature, that depend upon or refer to future events or conditions or that include the words “may,” “assume,” “forecast,” “position,” “strategy,” “potential,” “continue,” “could,” “will,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding Atlas’s plans to finance the acquisition of Moser Energy Services, Inc. (d/b/a Moser Energy Systems) (the “Moser Acquisition”); the anticipated financial performance of Atlas following the Moser Acquisition; expected accretion to free cash flow, cash flow per share, Adjusted EBITDA and earnings per share; expectations regarding the leverage and dividend profile of Atlas following the Moser Acquisition; the expected synergies and efficiencies to be achieved as a result of the Moser Acquisition; expansion and growth of Atlas’s business following the Moser Acquisition; the receipt of all necessary approvals to close the Moser Acquisition and the timing associated therewith; our business strategy, industry, future operations and profitability, expected capital expenditures and the impact of such expenditures on our performance, statements about our financial position, production, revenues and losses, our capital programs, expectations regarding the growth of U.S. electricity demand and the demand for distributed power generation, management changes, current and potential future long-term contracts and our future business and financial performance. Although forward-looking statements reflect our good faith beliefs at the time they are made, we caution you that these forward-looking statements are subject to a number of risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include but are not limited to: the completion of the Moser Acquisition on anticipated terms and timing or at all, including obtaining any required governmental or regulatory approval and satisfying other conditions to the completion of the Moser Acquisition; uncertainties as to whether the Moser Acquisition, if consummated, will achieve its anticipated benefits and projected synergies within the expected time period or at all; Atlas’s ability to integrate Moser’s operations in a successful manner and in the expected time period; the occurrence of any event, change, or other circumstance that could give rise to the termination of the Moser Acquisition; risks that the anticipated tax treatment of the Moser Acquisition is not obtained; unforeseen or unknown liabilities; potential litigation relating to the Moser Acquisition; the possibility that the Moser Acquisition may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the effect of the announcement, pendency or completion of the Moser Acquisition on the parties’ business relationships and business generally; risks that the Moser Acquisition disrupts current plans and operations of Atlas and its management team and potential difficulties in retaining employees as a result of the Moser Acquisition; the risks related to Atlas’s financing of the Moser Acquisition; potential negative effects of this announcement and the pendency or completion of the Moser Acquisition on the market price of Atlas’s common stock or operating results; unexpected future capital expenditures; our ability to successfully execute our stock repurchase program or implement future stock repurchase programs; commodity price volatility, including volatility stemming from the ongoing armed conflicts between Russia and Ukraine and Israel and Hamas; increasing hostilities and instability in the Middle East; adverse developments affecting the financial services industry; our ability to complete growth projects on time and on budget; the risk that stockholder litigation in connection with our recent corporate reorganization may result in significant costs of defense, indemnification and liability; changes in general economic, business and political conditions, including changes in the financial markets; transaction costs; actions of OPEC+ to set and maintain oil production levels; the level of production of crude oil, natural gas and other hydrocarbons and the resultant market prices of crude oil; inflation; environmental risks; operating risks; regulatory changes; lack of demand; market share growth; the uncertainty inherent in projecting future rates of reserves; production; cash flow; access to capital; the timing of development expenditures; the ability of our customers to meet their obligations to us; our ability to maintain effective internal controls; and other factors discussed or referenced in our filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”), including those discussed under the heading “Risk Factors” in our Annual Report on Form 10-K, filed with the SEC on February 27, 2024, and any subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Trademarks and Trade Names The Company owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with the Company, or an endorsement or sponsorship by or of the Company. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensor to these trademarks, service marks and trade names. |

| Atlas Energy Solutions (NYSE: AESI) | January 2025 Disclaimer (cont’d) 3 Industry and Market Data This Presentation has been prepared by the Company and includes market data and certain other statistical information from third-party sources, including independent industry publications, government publications, and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the third-party sources described above. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in these third-party publications. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only; there can be no assurance that such conditions will actually occur. Please also see “Forward-Looking Statements” disclaimer above. Non-GAAP Financial Measures This press release includes or references certain forward-looking financial measures not prepared in conformity with generally accepted accounting principles (“GAAP”), including free cash flow, cash flow per share, Adjusted EBITDA and earnings per share. Because Atlas provides these measures on a forward-looking basis, it cannot reliably or reasonably predict certain of the necessary components of the most directly comparable forward-looking GAAP financial measures, such as Gross Profit, Net Income, Operating Income, or any other measure derived in accordance with GAAP. Accordingly, Atlas is unable to present a quantitative reconciliation of such forward-looking, non-GAAP financial measures to the respective most directly comparable forward-looking GAAP financial measures. Atlas believes that these forward-looking, non-GAAP measures may be a useful tool for the investment community in comparing Atlas’s forecasted financial performance to the forecasted financial performance of other companies in the industry. No Offer or Solicitation This communication includes information relating to the Moser Acquisition. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, in connection with the Moser Acquisition or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. |

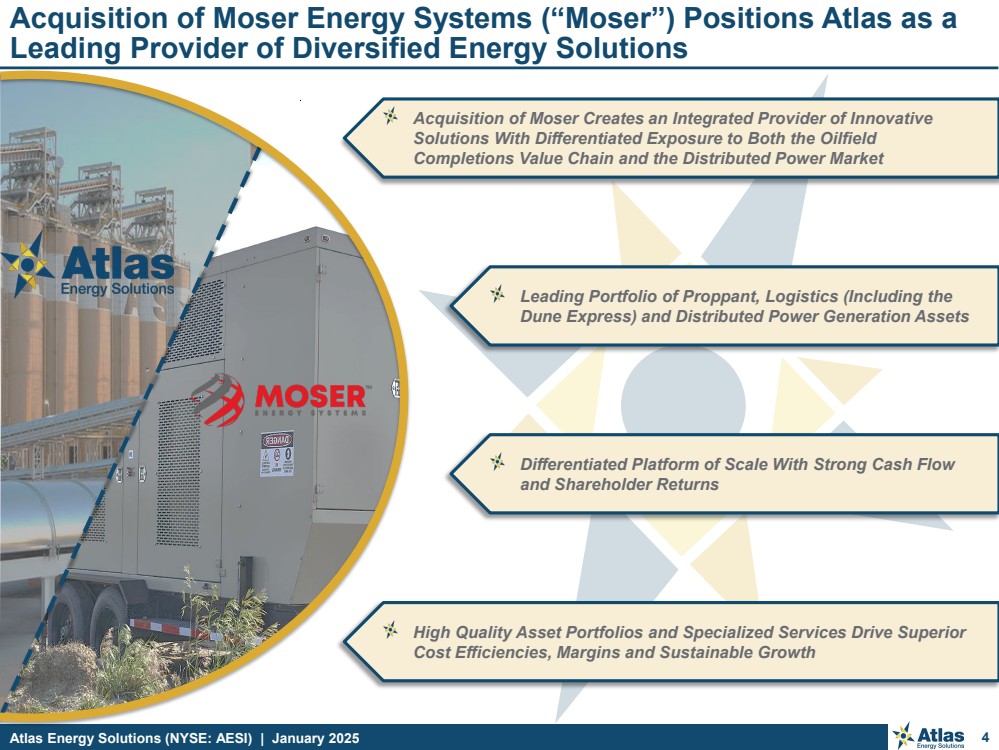

| Atlas Energy Solutions (NYSE: AESI) | January 2025 4 Acquisition of Moser Energy Systems (“Moser”) Positions Atlas as a Leading Provider of Diversified Energy Solutions Acquisition of Moser Creates an Integrated Provider of Innovative Solutions With Differentiated Exposure to Both the Oilfield Completions Value Chain and the Distributed Power Market Leading Portfolio of Proppant, Logistics (Including the Dune Express) and Distributed Power Generation Assets Differentiated Platform of Scale With Strong Cash Flow and Shareholder Returns High Quality Asset Portfolios and Specialized Services Drive Superior Cost Efficiencies, Margins and Sustainable Growth |

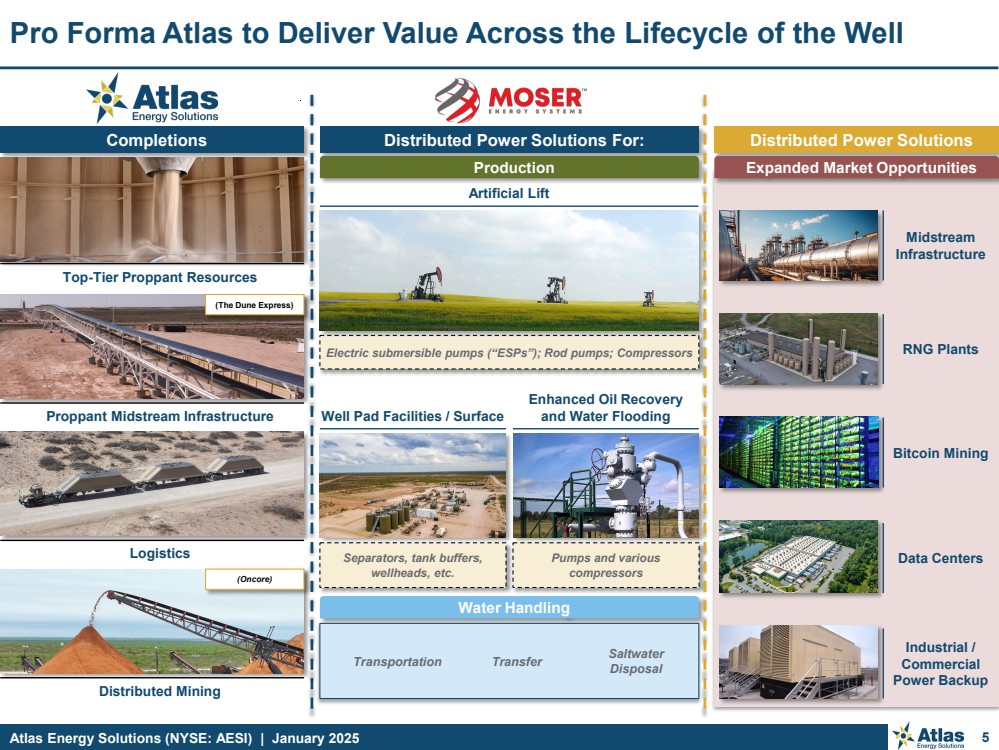

| Atlas Energy Solutions (NYSE: AESI) | January 2025 5 Pro Forma Atlas to Deliver Value Across the Lifecycle of the Well Completions Distributed Power Solutions For: Production Proppant Midstream Infrastructure (The Dune Express) Artificial Lift Enhanced Oil Recovery Well Pad Facilities / Surface and Water Flooding Pumps and various compressors Separators, tank buffers, wellheads, etc. Electric submersible pumps (“ESPs”); Rod pumps; Compressors (Oncore) Water Handling Midstream Infrastructure Logistics Distributed Mining Saltwater Disposal Transportation Transfer Distributed Power Solutions Expanded Market Opportunities Top-Tier Proppant Resources RNG Plants Bitcoin Mining Data Centers Industrial / Commercial Power Backup |

| Atlas Energy Solutions (NYSE: AESI) | January 2025 Acquisition expands on Atlas’s initial thesis to build an organization with strong competitive differentiation that enables the company to deliver superior through-cycle returns to shareholders 6 Atlas and Moser are a Compelling Strategic Fit + Creates a Diversified Energy Solutions Provider of Scale With Strong Growth Opportunities In Core Markets Establishes strong foothold in the distributed power market via the acquired low-emission, grid interactive ~212MW fleet supporting production / artificial lift operations Increases Atlas’s customer reach with a critical power service offering in Atlas’s core geography while providing geographic diversity (operating locations in the Bakken, DJ, Uinta, and Eagle Ford basins) 1 Dynamic Power Generation Portfolio Provides Entry Into Adjacent End Markets Provides a platform of scale, >900-unit natural gas-powered generator fleet, enabling Atlas to mitigate existing grid constraints, a key factor driving the demand growth for distributed power assets, both in and out of energy markets Expanded opportunities are immediately available in markets where Moser has a developing and growing presence (e.g., midstream infrastructure, RNG plants, bitcoin mining, data centers and industrial / commercial backup power) Provides increased exposure to production-end of Oil & Gas value chain, which we expect to lower volatility of future cash flows 2 Differentiated Assets and Capabilities Drive Strong Margins and Lower Through-Cycle Maintenance / Replacement Costs Strong EBITDA(1) margin profile of 50%+ expected to enhance pro forma free cash flow(1) In-house R&D and manufacturing capabilities, coupled with critical in-field service, provide quality control and standardization across the fleet ensuring market-leading uptime for customers in demanding applications Moser’s commitment to innovation has led to continuous in-house product advancements, including designing the engines to utilize field gas as a fuel source, enabling operators to mitigate flaring In-house remanufacturing competencies enable Moser to provide exceptional runtimes with remanufactured assets while reducing the cost relative to a new build by ~50%+ 3 Critical Nature of Power Service Offering Provides Sticky Customer Retention With Solid Utilization and Cash Flow Visibility Robust backlog of MSAs with top oil and gas producers and Moser’s reliable performance provide increased visibility into future cash flows 4 Acquisition Expected to Be Accretive to Free Cash Flow and Shareholder Returns Compelling transaction value of ~4.3x Adjusted EBITDA(1) Expected to enhance free cash flow, accelerating shareholder returns 5 (1) This is a non-GAAP metric. Please see the Appendix at the back of this presentation for definitions of non-GAAP measures. |

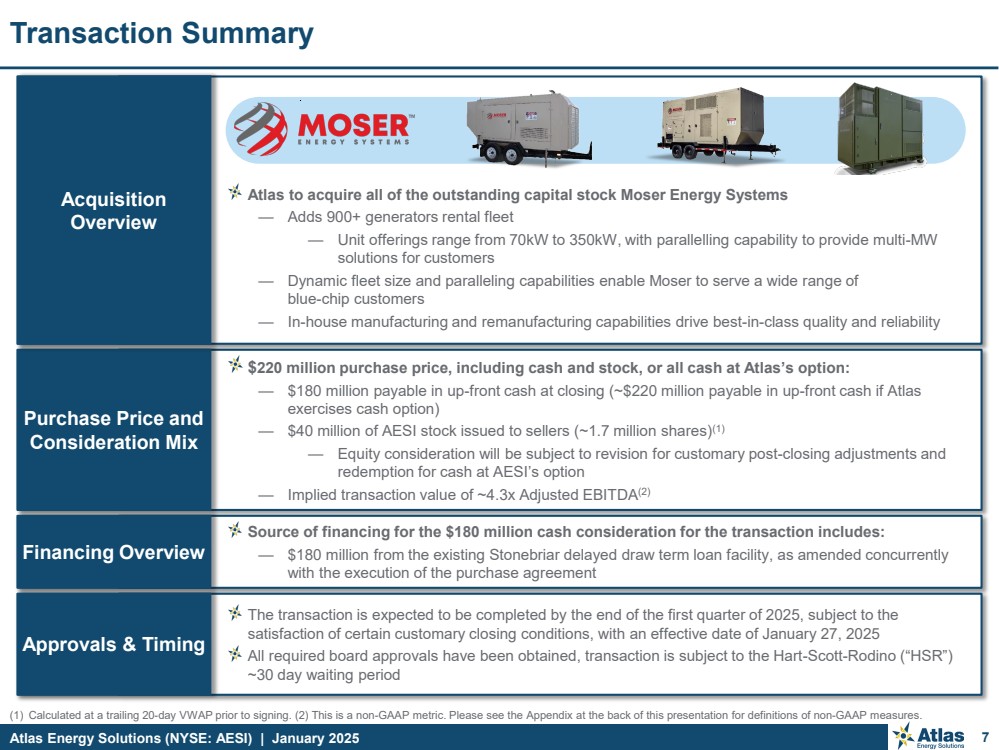

| Atlas Energy Solutions (NYSE: AESI) | January 2025 $220 million purchase price, including cash and stock, or all cash at Atlas’s option: — $180 million payable in up-front cash at closing (~$220 million payable in up-front cash if Atlas exercises cash option) — $40 million of AESI stock issued to sellers (~1.7 million shares)(1) — Equity consideration will be subject to revision for customary post-closing adjustments and redemption for cash at AESI’s option — Implied transaction value of ~4.3x Adjusted EBITDA(2) Purchase Price and Consideration Mix Source of financing for the $180 million cash consideration for the transaction includes: — $180 million from the existing Stonebriar delayed draw term loan facility, as amended concurrently with the execution of the purchase agreement Financing Overview The transaction is expected to be completed by the end of the first quarter of 2025, subject to the satisfaction of certain customary closing conditions, with an effective date of January 27, 2025 All required board approvals have been obtained, transaction is subject to the Hart-Scott-Rodino (“HSR”) ~30 day waiting period Approvals & Timing (1) Calculated at a trailing 20-day VWAP prior to signing. (2) This is a non-GAAP metric. Please see the Appendix at the back of this presentation for definitions of non-GAAP measures. 7 Transaction Summary Atlas to acquire all of the outstanding capital stock Moser Energy Systems — Adds 900+ generators rental fleet — Unit offerings range from 70kW to 350kW, with parallelling capability to provide multi-MW solutions for customers — Dynamic fleet size and paralleling capabilities enable Moser to serve a wide range of blue-chip customers — In-house manufacturing and remanufacturing capabilities drive best-in-class quality and reliability Acquisition Overview |

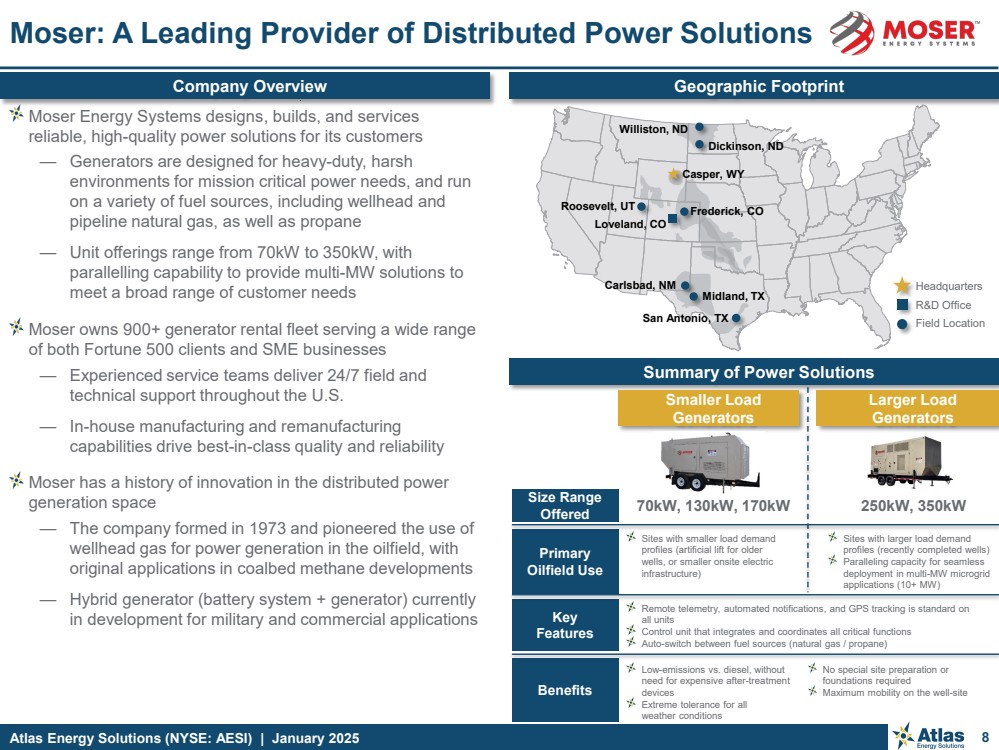

| Atlas Energy Solutions (NYSE: AESI) | January 2025 8 Moser: A Leading Provider of Distributed Power Solutions Geographic Footprint Moser Energy Systems designs, builds, and services reliable, high-quality power solutions for its customers — Generators are designed for heavy-duty, harsh environments for mission critical power needs, and run on a variety of fuel sources, including wellhead and pipeline natural gas, as well as propane — Unit offerings range from 70kW to 350kW, with parallelling capability to provide multi-MW solutions to meet a broad range of customer needs Moser owns 900+ generator rental fleet serving a wide range of both Fortune 500 clients and SME businesses — Experienced service teams deliver 24/7 field and technical support throughout the U.S. — In-house manufacturing and remanufacturing capabilities drive best-in-class quality and reliability Moser has a history of innovation in the distributed power generation space — The company formed in 1973 and pioneered the use of wellhead gas for power generation in the oilfield, with original applications in coalbed methane developments — Hybrid generator (battery system + generator) currently in development for military and commercial applications Summary of Power Solutions Larger Load Generators Smaller Load Generators Size Range Offered Primary Oilfield Use Benefits Key Features 70kW, 130kW, 170kW 250kW, 350kW Sites with smaller load demand profiles (artificial lift for older wells, or smaller onsite electric infrastructure) Sites with larger load demand profiles (recently completed wells) Paralleling capacity for seamless deployment in multi-MW microgrid applications (10+ MW) Low-emissions vs. diesel, without need for expensive after-treatment devices Extreme tolerance for all weather conditions No special site preparation or foundations required Maximum mobility on the well-site Remote telemetry, automated notifications, and GPS tracking is standard on all units Control unit that integrates and coordinates all critical functions Auto-switch between fuel sources (natural gas / propane) Headquarters R&D Office Field Location Williston, ND Dickinson, ND Casper, WY Roosevelt, UT Frederick, CO Loveland, CO Carlsbad, NM Midland, TX San Antonio, TX Company Overview |

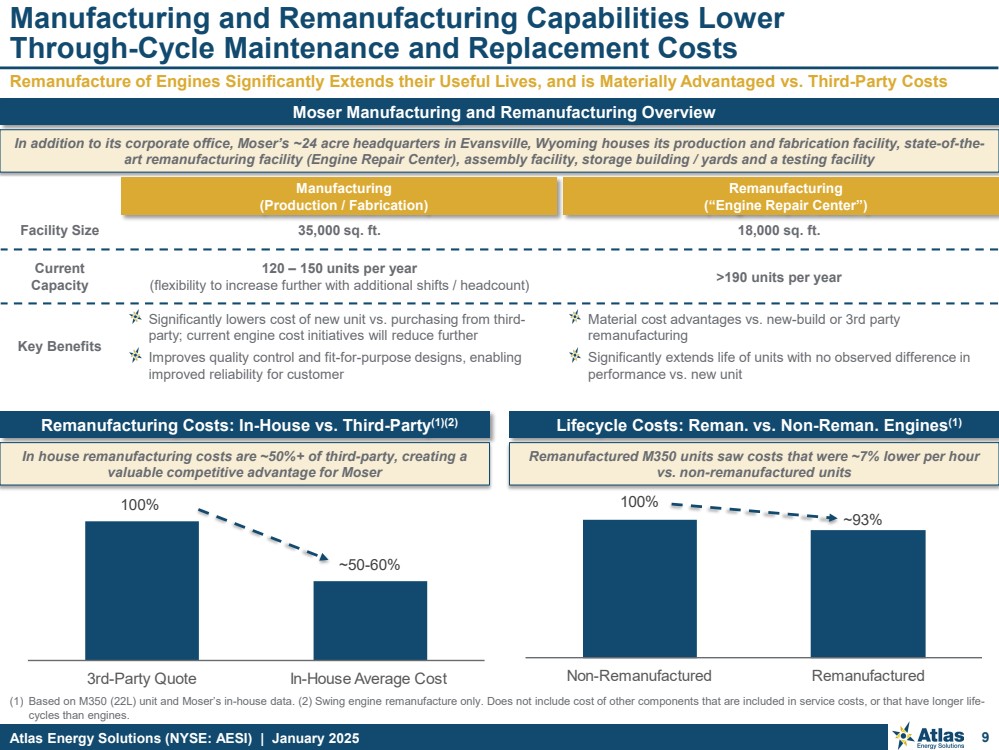

| Atlas Energy Solutions (NYSE: AESI) | January 2025 Moser Manufacturing and Remanufacturing Overview Remanufacturing Costs: In-House vs. Third-Party(1)(2) Lifecycle Costs: Reman. vs. Non-Reman. Engines(1) (1) Based on M350 (22L) unit and Moser’s in-house data. (2) Swing engine remanufacture only. Does not include cost of other components that are included in service costs, or that have longer life-cycles than engines. 9 Remanufacture of Engines Significantly Extends their Useful Lives, and is Materially Advantaged vs. Third-Party Costs Manufacturing and Remanufacturing Capabilities Lower Through-Cycle Maintenance and Replacement Costs In addition to its corporate office, Moser’s ~24 acre headquarters in Evansville, Wyoming houses its production and fabrication facility, state-of-the-art remanufacturing facility (Engine Repair Center), assembly facility, storage building / yards and a testing facility Facility Size 35,000 sq. ft. 18,000 sq. ft. Current Capacity 120 – 150 units per year (flexibility to increase further with additional shifts / headcount) >190 units per year Key Benefits Significantly lowers cost of new unit vs. purchasing from third-party; current engine cost initiatives will reduce further Improves quality control and fit-for-purpose designs, enabling improved reliability for customer Material cost advantages vs. new-build or 3rd party remanufacturing Significantly extends life of units with no observed difference in performance vs. new unit Remanufactured M350 units saw costs that were ~7% lower per hour vs. non-remanufactured units In house remanufacturing costs are ~50%+ of third-party, creating a valuable competitive advantage for Moser 100% 3rd-Party Quote In-House Average Cost Non-Remanufactured Remanufactured 100% ~50-60% Remanufacturing (“Engine Repair Center”) Manufacturing (Production / Fabrication) ~93% |

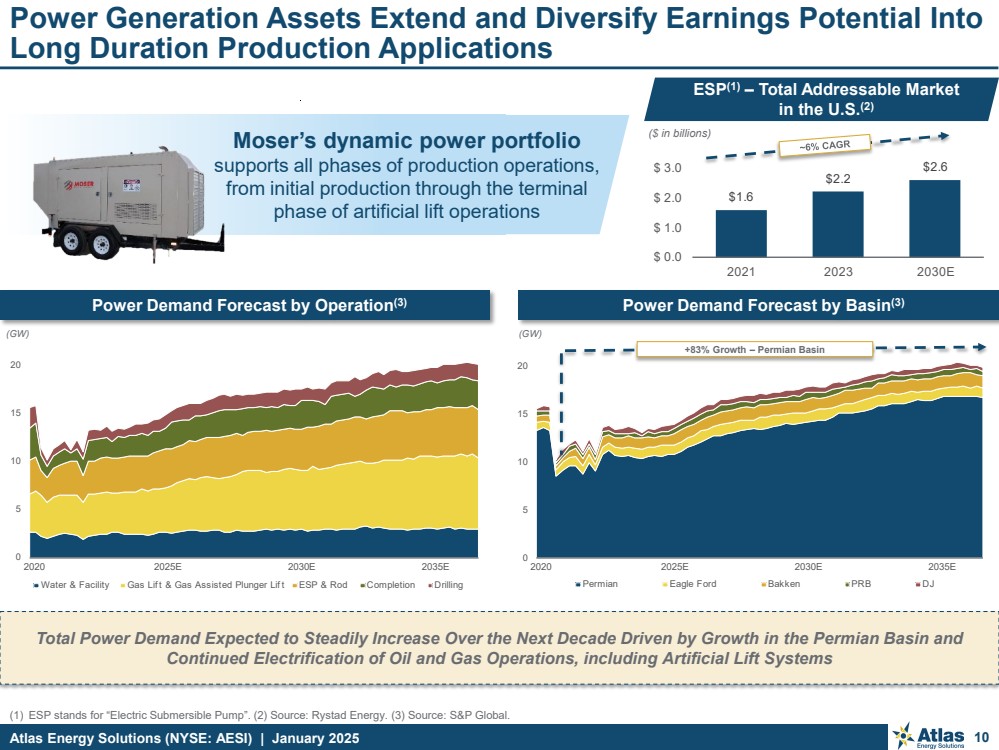

| Atlas Energy Solutions (NYSE: AESI) | January 2025 Moser’s dynamic power portfolio supports all phases of production operations, from initial production through the terminal phase of artificial lift operations (1) ESP stands for “Electric Submersible Pump”. (2) Source: Rystad Energy. (3) Source: S&P Global. 10 Power Generation Assets Extend and Diversify Earnings Potential Into Long Duration Production Applications $1.6 $2.2 $2.6 $ 0.0 $ 1.0 $ 2.0 $ 3.0 2021 2023 2030E ESP(1) – Total Addressable Market in the U.S.(2) Power Demand Forecast by Operation(3) Power Demand Forecast by Basin(3) (GW) 0 5 10 15 20 Water & Facility Gas Lif t & Gas Assisted Plunger Lif t ESP & Rod Completion Drilling 0 5 10 15 20 Permian Eagle Ford Bakken PRB DJ 2020 2025E 2030E 2035E 2020 2025E 2030E 2035E (GW) Total Power Demand Expected to Steadily Increase Over the Next Decade Driven by Growth in the Permian Basin and Continued Electrification of Oil and Gas Operations, including Artificial Lift Systems ($ in billions) +83% Growth – Permian Basin |

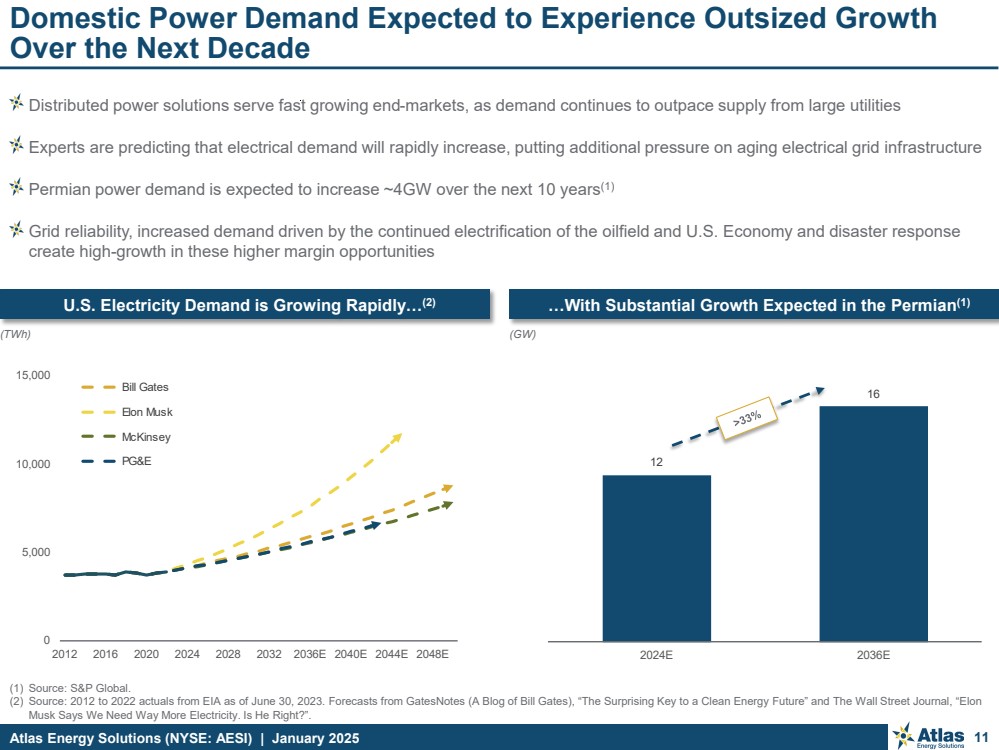

| Atlas Energy Solutions (NYSE: AESI) | January 2025 (1) Source: S&P Global. (2) Source: 2012 to 2022 actuals from EIA as of June 30, 2023. Forecasts from GatesNotes (A Blog of Bill Gates), “The Surprising Key to a Clean Energy Future” and The Wall Street Journal, “Elon Musk Says We Need Way More Electricity. Is He Right?”. 11 Domestic Power Demand Expected to Experience Outsized Growth Over the Next Decade U.S. Electricity Demand is Growing Rapidly…(2) …With Substantial Growth Expected in the Permian(1) Distributed power solutions serve fast growing end-markets, as demand continues to outpace supply from large utilities Experts are predicting that electrical demand will rapidly increase, putting additional pressure on aging electrical grid infrastructure Permian power demand is expected to increase ~4GW over the next 10 years(1) Grid reliability, increased demand driven by the continued electrification of the oilfield and U.S. Economy and disaster response create high-growth in these higher margin opportunities 12 16 2024E 2036E (TWh) 0 5,000 10,000 15,000 2012 2016 2020 2024 2028 2032 2036E 2040E 2044E 2048E Bill Gates Elon Musk McKinsey PG&E (GW) |

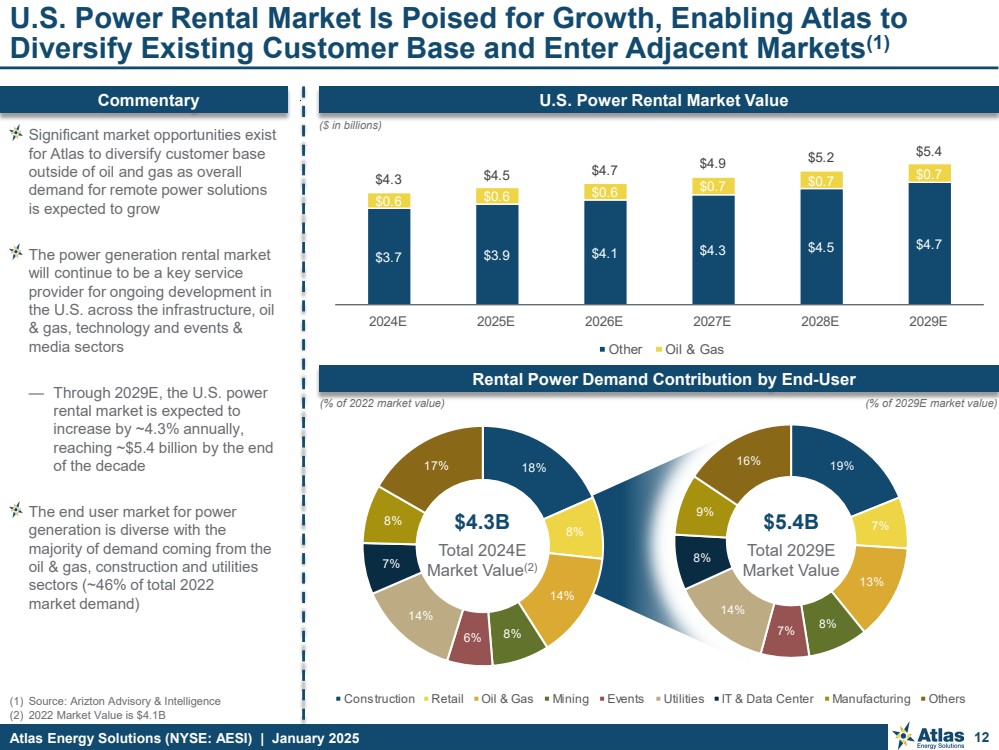

| Atlas Energy Solutions (NYSE: AESI) | January 2025 (1) Source: Arizton Advisory & Intelligence (2) 2022 Market Value is $4.1B 12 U.S. Power Rental Market Is Poised for Growth, Enabling Atlas to Diversify Existing Customer Base and Enter Adjacent Markets(1) U.S. Power Rental Market Value Significant market opportunities exist for Atlas to diversify customer base outside of oil and gas as overall demand for remote power solutions is expected to grow The power generation rental market will continue to be a key service provider for ongoing development in the U.S. across the infrastructure, oil & gas, technology and events & media sectors — Through 2029E, the U.S. power rental market is expected to increase by ~4.3% annually, reaching ~$5.4 billion by the end of the decade The end user market for power generation is diverse with the majority of demand coming from the oil & gas, construction and utilities sectors (~46% of total 2022 market demand) (% of 2022 market value) Commentary Rental Power Demand Contribution by End-User ($ in billions) $3.7 $3.9 $4.1 $4.3 $4.5 $4.7 $0.6 $0.6 $0.6 $0.7 $0.7 $0.7 $4.3 $4.5 $4.7 $4.9 $5.2 $5.4 2024E 2025E 2026E 2027E 2028E 2029E Other Oil & Gas $4.3B Total 2024E Market Value(2) $5.4B Total 2029E Market Value 18% 8% 14% 8% 6% 14% 7% 8% 17% Construction Retail Oil & Gas Mining Events Utilities IT & Data Center Manufacturing Others 19% 7% 13% 8% 7% 14% 8% 9% 16% (% of 2029E market value) |

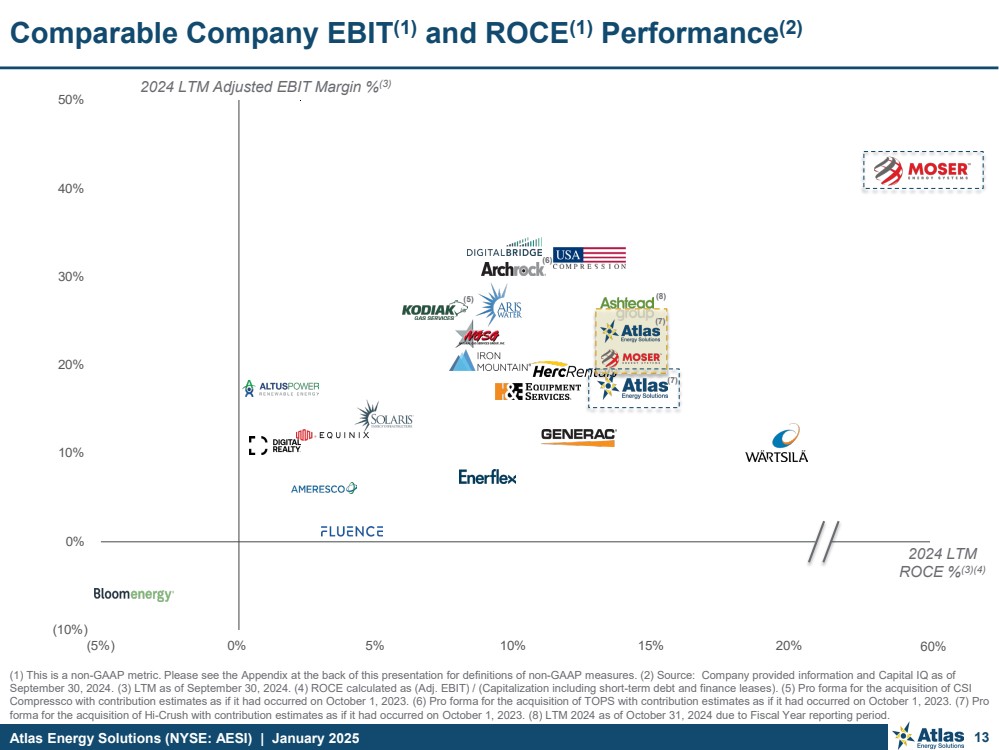

| Atlas Energy Solutions (NYSE: AESI) | January 2025 (10%) 0% 10% 20% 30% 40% 50% (5%) 0% 5% 10% 15% 20% 25% Comparable Company EBIT(1) and ROCE(1) Performance(2) 2024 LTM Adjusted EBIT Margin %(3) 2024 LTM ROCE %(3)(4) (1) This is a non-GAAP metric. Please see the Appendix at the back of this presentation for definitions of non-GAAP measures. (2) Source: Company provided information and Capital IQ as of September 30, 2024. (3) LTM as of September 30, 2024. (4) ROCE calculated as (Adj. EBIT) / (Capitalization including short-term debt and finance leases). (5) Pro forma for the acquisition of CSI Compressco with contribution estimates as if it had occurred on October 1, 2023. (6) Pro forma for the acquisition of TOPS with contribution estimates as if it had occurred on October 1, 2023. (7) Pro forma for the acquisition of Hi-Crush with contribution estimates as if it had occurred on October 1, 2023. (8) LTM 2024 as of October 31, 2024 due to Fiscal Year reporting period. 13 (5) (6) (7) (7) (8) 60% |

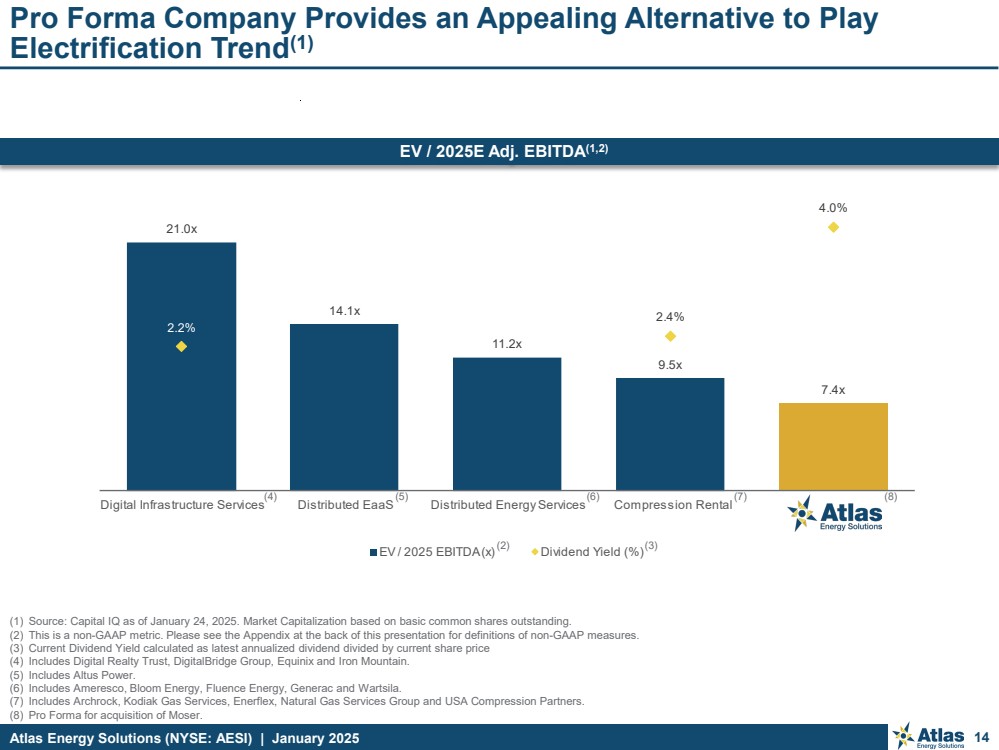

| Atlas Energy Solutions (NYSE: AESI) | January 2025 (1) Source: Capital IQ as of January 24, 2025. Market Capitalization based on basic common shares outstanding. (2) This is a non-GAAP metric. Please see the Appendix at the back of this presentation for definitions of non-GAAP measures. (3) Current Dividend Yield calculated as latest annualized dividend divided by current share price (4) Includes Digital Realty Trust, DigitalBridge Group, Equinix and Iron Mountain. (5) Includes Altus Power. (6) Includes Ameresco, Bloom Energy, Fluence Energy, Generac and Wartsila. (7) Includes Archrock, Kodiak Gas Services, Enerflex, Natural Gas Services Group and USA Compression Partners. (8) Pro Forma for acquisition of Moser. 14 21.0x 14.1x 11.2x 9.5x 7.4x 2.2% 2.4% 4.0% 0.0x 5.0x 10.0x 15.0x 20.0x 25.0x Digital Infrastructure Services Distributed EaaS Distributed Energy Services Compression Rental EV / 2025 EBITDA (x) Dividend Yield (%) Pro Forma Company Provides an Appealing Alternative to Play Electrification Trend(1) (3) (4) (5) (6) (7) (8) EV / 2025E Adj. EBITDA(1,2) (2) |

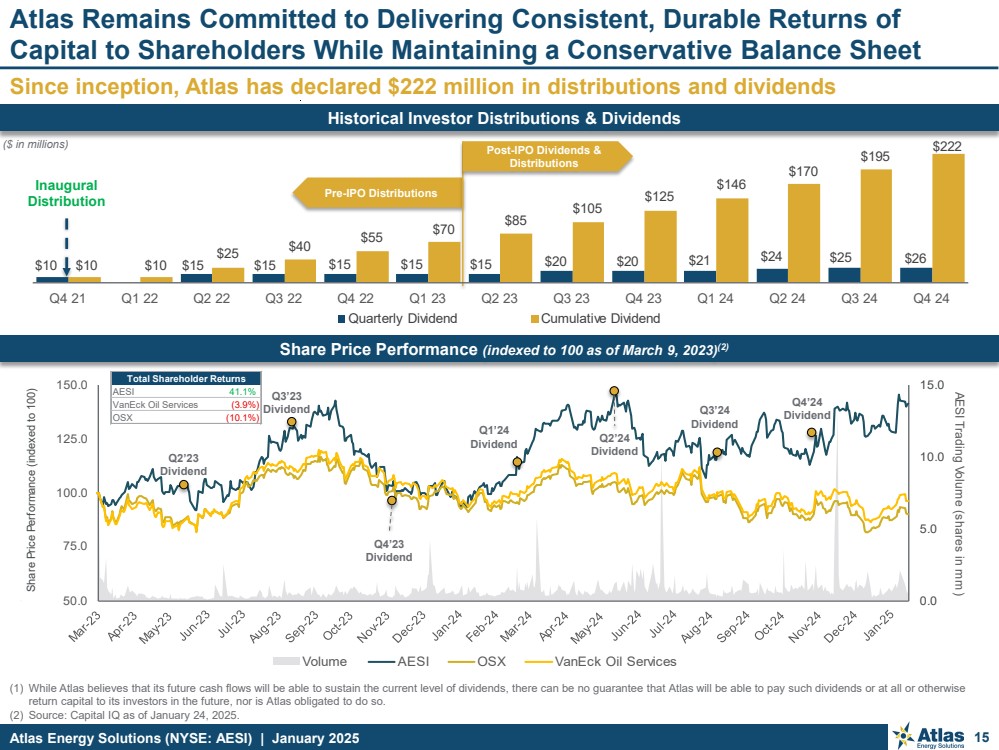

| Atlas Energy Solutions (NYSE: AESI) | January 2025 (1) While Atlas believes that its future cash flows will be able to sustain the current level of dividends, there can be no guarantee that Atlas will be able to pay such dividends or at all or otherwise return capital to its investors in the future, nor is Atlas obligated to do so. (2) Source: Capital IQ as of January 24, 2025. 15 Since inception, Atlas has declared $222 million in distributions and dividends Atlas Remains Committed to Delivering Consistent, Durable Returns of Capital to Shareholders While Maintaining a Conservative Balance Sheet Historical Investor Distributions & Dividends Share Price Performance (indexed to 100 as of March 9, 2023)(2) 0.0 5.0 10.0 15.0 50.0 75.0 100.0 125.0 150.0 AESI Trading Volume (shares in mm Share Price Performance ) (indexed to 100) Volume AESI OSX VanEck Oil Services Total Shareholder Returns AESI 41.1% VanEck Oil Services (3.9%) OSX (10.1%) Q2’23 Dividend Q3’23 Dividend Q4’23 Dividend Q1’24 Dividend Q3’24 Dividend Q4’24 Dividend Inaugural Distribution ($ in millions) Pre-IPO Distributions Post-IPO Dividends & Distributions Q2’24 Dividend $10 $15 $15 $15 $15 $15 $20 $20 $21 $24 $25 $26 $10 $10 $25 $40 $55 $70 $85 $105 $125 $146 $170 $195 $222 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Quarterly Dividend Cumulative Dividend |

| Atlas Energy Solutions (NYSE: AESI) | January 2025 16 Transaction Enhances Atlas Energy Solutions Investment Profile Enhances Sustainable Environmental and Social Progress (“SESP”) Leadership Highly Contracted Cash Flow, Conservative Financial Profile Diverse Service Offerings With Exposure to Attractive High-Growth End Markets in Both Production and Distributed Power Scale and Asset Quality Drive Exceptional Cost Structure, Margins and Growth Profile Leading Portfolio of Proppant, Logistics (Including the Dune Express) and Distributed Power Solutions Acquisition Expected to Be Accretive to Cash Flow and Shareholder Returns Innovative and Diversified Energy Solutions Platform |

| Atlas Energy Solutions (NYSE: AESI) | January 2025 17 Non-GAAP Financial Measure Definitions Non-GAAP Financial Measures Adjusted EBITDA, Adjusted Free Cash Flow, EBITDA, EBIT, ROCE and Maintenance Capital Expenditures are non-GAAP supplemental financial measures used by our management and by external users of our financial statements such as investors, research analysts and others, in the case of Adjusted EBITDA, to assess our operating performance on a consistent basis across periods by removing the effects of development activities, provide views on capital resources available to organically fund growth projects and, in the case of Adjusted Free Cash Flow, assess the financial performance of our assets and their ability to sustain dividends or reinvest to organically fund growth projects over the long term without regard to financing methods, capital structure, or historical cost basis. These measures do not represent and should not be considered alternatives to, or more meaningful than, net income, income from operations, net cash provided by operating activities, or any other measure of financial performance presented in accordance with GAAP as measures of our financial performance. Adjusted EBITDA, EBITDA, EBIT, ROCE and Adjusted Free Cash Flow have important limitations as analytical tools because they exclude some but not all items that affect net income, the most directly comparable GAAP financial measure. Our computation of Adjusted EBITDA, Adjusted Free Cash Flow, EBITDA, EBIT, ROCE and Maintenance Capital Expenditures may differ from computations of similarly titled measures of other companies. Non-GAAP Measure Definitions: We define Adjusted EBITDA as net income before depreciation, depletion and accretion, amortization expense of acquired intangible assets, interest expense, income tax expense, stock and unit-based compensation, loss on extinguishment of debt, loss on disposal of assets, insurance recovery (gain), unrealized commodity derivative gain (loss), other acquisition related costs, and other non-recurring costs. Management believes Adjusted EBITDA is useful because it allows management to more effectively evaluate the Company’s operating performance and compare the results of its operations from period to period and against our peers without regard to financing method or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. We define Adjusted Free Cash Flow as Adjusted EBITDA less Maintenance Capital Expenditures. Management believes that Adjusted Free Cash Flow is useful to investors as it provides a measure of the ability of our business to generate cash. We define Maintenance Capital Expenditures as capital expenditures excluding growth capital expenditures. We define EBITDA as net income before depreciation, depletion and accretion expense, interest expense, and income tax expense. We define EBIT as net income before interest expense and income tax expense. We define ROCE as Adjusted EBITDA less depreciation, depletion, and accretion expense. |

| Atlas Energy Solutions (NYSE: AESI) | January 2025 Investor Relations Contact For more information, please visit our website at https://atlas.energy/ IR Contact: Kyle Turlington 5918 W Courtyard Drive, Suite #500; Austin, Texas 78730 (T) 512-220-1200 IR@atlas.energy NYSE: AESI |