The information in this information statement/prospectus is not complete and may be changed. New Atlas HoldCo Inc. may not distribute or issue the securities being registered pursuant to this registration statement until the registration statement, as filed with the Securities and Exchange Commission (of which this information statement/prospectus is a part) is effective. This information statement/prospectus is not an offer to sell nor should it be considered a solicitation of an offer to buy the securities described herein in any state where the offer or sale is not permitted.

PRELIMINARY – SUBJECT TO COMPLETION, DATED AUGUST 1, 2023

ATLAS ENERGY SOLUTIONS INC.

5918 W. Courtyard Drive, Suite 500

Austin, Texas 78730

INFORMATION STATEMENT/PROSPECTUS

NOTICE OF ACTION BY WRITTEN CONSENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE ACCOMPANYING INFORMATION STATEMENT IS FURNISHED ONLY TO INFORM STOCKHOLDERS OF THE ACTION DESCRIBED ABOVE BEFORE IT TAKES EFFECT IN ACCORDANCE WITH RULE 14c-2

, 2023

Dear Stockholder:

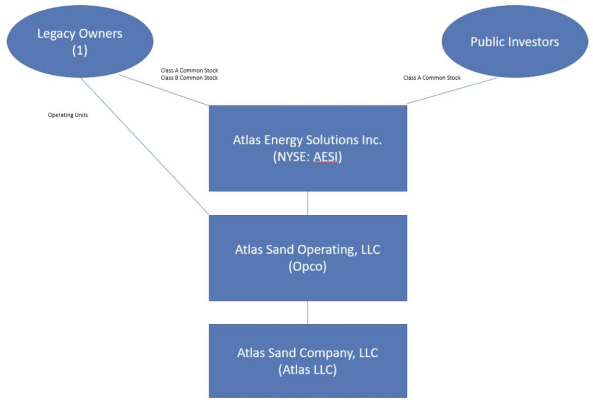

This notice of action by written consent and the accompanying information statement/prospectus (the “Information Statement/Prospectus”) is being furnished by the Board of Directors (the “Board”) of Atlas Energy Solutions Inc., a Delaware corporation (“Atlas,” the “Company,” “we,” “us” or “our”), to the holders of record at the close of business on , 2023 of the outstanding shares of our Class A common stock, par value $0.01 (“Class A Common Stock”), and Class B common stock, par value $0.01 (“Class B Common Stock” and, together with the Class A Common Stock, “Common Stock”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

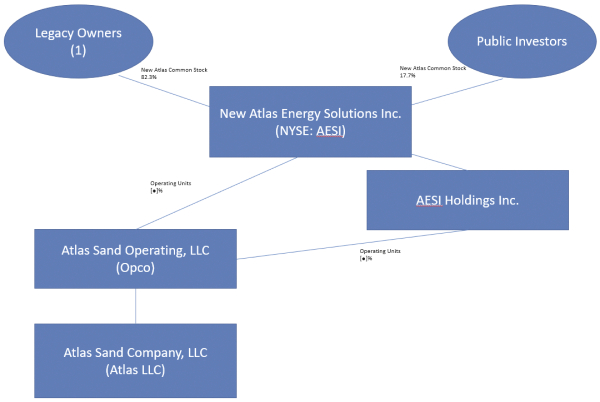

The purpose of the accompanying Information Statement/Prospectus is twofold. First, the Information Statement/Prospectus acts to inform the Company’s stockholders that on , 2023, holders of approximately % of the voting power of all outstanding shares of Common Stock acted by written consent (the “Written Consent”) in lieu of a special meeting of stockholders to approve the entry by the Company into a Master Reorganization Agreement, as amended from time to time (the “Master Reorganization Agreement”), in order to, among other things, add a new holding company above Atlas. The new holding company will initially be called New Atlas HoldCo Inc. (“New Atlas”). The creation of New Atlas will enable us to simplify our overall corporate structure and financial reporting by (i) eliminating our so-called “Up-C” structure and causing all equityholders to hold all of their equity interests in our business at the same top-level parent entity, which will be New Atlas, and (ii) transitioning to a single class of common stock held by all stockholders, as opposed to the two classes of Common Stock of Atlas that are currently authorized, issued and outstanding (the “Reorganization”). Second, the Information Statement/Prospectus acts as a prospectus of New Atlas under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the shares of common stock of New Atlas (“New Atlas Common Stock”) to be issued to existing Atlas stockholders in connection with the Reorganization.

We believe that one of the effects of this Reorganization will be to increase our market capitalization at our parent-level entity, which could enable certain investors (specifically, those with investment position limits tied to percentages of a company’s market capitalization) to own larger positions in our stock than before, and could also make shares of New Atlas Common Stock more likely to be included in or weighted more heavily by certain stock market indices than our existing Class A Common Stock. Improved weighting, in turn, could mean an increased demand for shares of New Atlas Common Stock, which could assist in our stated goal of seeking to maximize long-term stockholder value.

As part of the Reorganization:

| • | In connection with and immediately before the Opco Merger (as defined below), a newly-formed, wholly-owned subsidiary of New Atlas (which itself is a newly-formed, wholly-owned subsidiary of Atlas) will merge with and into Atlas, with Atlas surviving the merger as a wholly-owned subsidiary of New Atlas (the “Pubco Merger”). |

| • | In connection with the Pubco Merger, (i) each share of Class A Common Stock issued and outstanding immediately prior to the effective time of the Pubco Merger will be exchanged on a one-for-one basis for shares of New Atlas Common Stock, and (ii) each share of Class B Common Stock issued and outstanding immediately prior to the effective time of the Pubco Merger will be surrendered and cancelled for no consideration. By virtue of the PubCo Merger and effective as of the effective time of the PubCo Merger, each share of Class A Common Stock then held by New Atlas will be recapitalized into a single share of common stock. |

| • | In connection with and immediately after the Pubco Merger, another newly-formed, wholly-owned subsidiary of New Atlas will merge with and into Atlas Sand Operating, LLC, a Delaware limited liability company and the current operating subsidiary of Atlas (“Opco”), with Opco surviving the merger as a wholly-owned subsidiary (partially direct and partially indirect through Atlas) of New Atlas (the “Opco Merger” and, together with the Pubco Merger, the “Mergers”). |

| • | In connection with the Opco Merger, each common unit of Opco (“Operating Units”) issued and outstanding immediately prior to the effective time of the Opco Merger, other than Operating Units held by Atlas, will be exchanged on a one-for-one basis for shares of New Atlas Common Stock. Operating Units held by Atlas will continue to be held by Atlas. |

| • | As a result of the Reorganization, Atlas will become a direct, wholly-owned subsidiary of New Atlas, and New Atlas and Atlas will together own 100% of the Operating Units. |