UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

t

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code:

(

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☒ |

|

Smaller reporting company |

|

||

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO

The aggregate market value of the outstanding common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $

As of February 21, 2024, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2024 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K and will be filed within 120 days of the registrant’s fiscal year end.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

9 |

|

Item 1A. |

18 |

|

Item 1B. |

46 |

|

Item 1C. |

46 |

|

Item 2. |

48 |

|

Item 3. |

54 |

|

Item 4. |

54 |

|

|

|

|

PART II |

|

|

Item 5. |

55 |

|

Item 6. |

56 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

57 |

Item 7A. |

70 |

|

Item 8. |

F-1 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

108 |

Item 9A. |

108 |

|

Item 9B. |

108 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

108 |

|

|

|

PART III |

|

|

Item 10. |

109 |

|

Item 11. |

109 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

109 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

109 |

Item 14. |

109 |

|

|

|

|

PART IV |

|

|

Item 15. |

110 |

|

Item 16. |

112 |

i

GLOSSARY OF COMMONLY USED TERMS

Unless the context otherwise requires, all references in this Annual Report on Form 10‑K (this “Annual Report”) to:

2

3

4

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that are subject to risks and uncertainties. All statements, other than statements of historical fact included in this Annual Report, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. Additionally the information in this Annual Report includes forward-looking statements related to the recently-announced Hi-Crush Transaction (as defined in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.—Recent Developments”). When used in this Report, the words “may,” “forecast,” “continue,” “could,” “would,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described in Item 1A. “Risk Factors” included in this Annual Report. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we believe that the forward-looking statements contained in this Annual Report are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in such forward-looking statements, including but not limited to:

5

We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, the risks described in Item 1A. “Risk Factors” in this Annual Report.

You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this Annual Report. Should one or more of the risks or uncertainties described in this Annual Report occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, included in this Annual Report are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements to reflect events or circumstances after the date of this Annual Report.

6

SUMMARY OF RISK FACTORS

This summary briefly lists the principal risks and uncertainties facing our business, which are only a select portion of those risks. A more complete discussion of those risks and uncertainties is set forth in Item 1A. “Risk Factors.” Additional risks not presently known to us or that we currently deem immaterial may also affect us. If any of these risks occur, our business, financial condition or results of operations could be materially and adversely affected. Our business is subject to, among others, the following principal risks and uncertainties:

Risks Related to Our Business and Operations

Risks Related to Our Financial Condition

7

Risks Related to Our Organizational Structure and Ownership of Our Common Stock

Risks Related to Environmental, Mining and Other Regulations

Risks Related to the Hi-Crush Transaction

8

PART I

Item 1. Business.

Overview

We are a low-cost producer of high-quality, locally sourced 100 mesh and 40/70 sand used as a proppant during the well completion process. Proppant is necessary to facilitate the recovery of hydrocarbons from oil and natural gas wells. One hundred percent of our sand reserves are located in Winkler and Ward Counties, Texas, within the Permian Basin, and our operations consist of proppant production and processing facilities, including two facilities near Kermit, Texas and a third facility near Monahans, Texas. As of December 31, 2023, our Kermit and Monahans facilities have a total combined annual production capacity of 16.5 million tons.

We also operate a logistics platform that is designed to increase the efficiency, safety and sustainability of the oil and natural gas industry within the Permian Basin. This includes our fleet of fit-for-purpose trucks and trailers and will include the Dune Express, an overland conveyor infrastructure solution currently under construction.

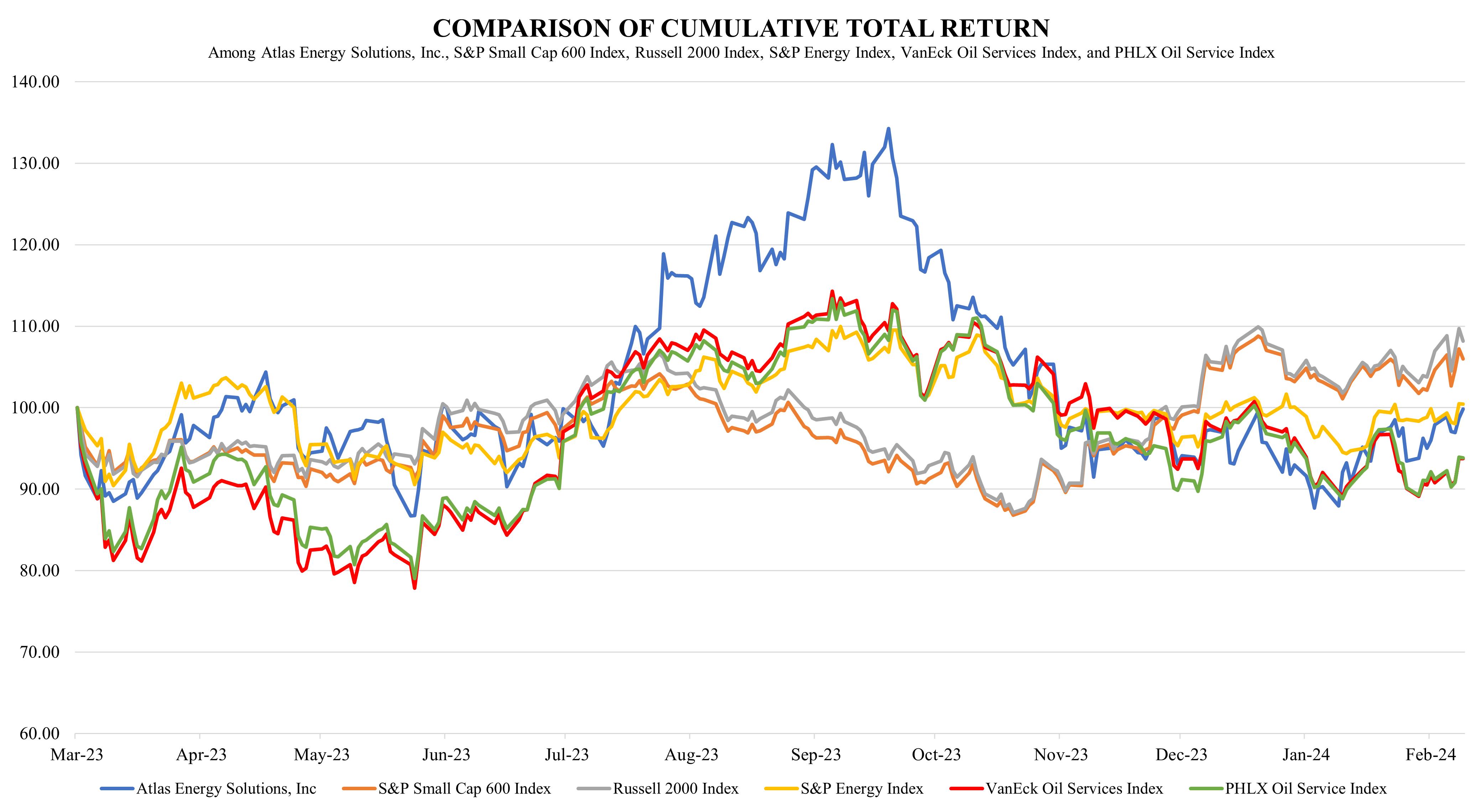

On March 13, 2023, Old Atlas completed its initial public offering of 18,000,000 shares of Old Atlas Class A Common Stock at a price of $18.00 per share. The IPO generated $324.0 million of gross proceeds and net proceeds of approximately $291.2 million, after deducting underwriter discounts and commissions and estimated offering costs. In connection with the IPO, pursuant to a master reorganization agreement dated March 8, 2023, by and among Old Atlas, ASMC, Atlas LLC, Holdings, Atlas Operating, Holdings II, ASMC II, and Atlas Sand Merger Sub, LLC, a Delaware limited liability company, Old Atlas and the parties thereto completed certain restructuring transactions. As a result of these restructuring transactions, Atlas Operating became the wholly-owned operating subsidiary of Old Atlas, Atlas LLC became a wholly-owned subsidiary of Atlas Operating, and Atlas LLC continued to own all of the Company’s operating assets.

On October 2, 2023, Old Atlas and the Company completed the Up-C Simplification as contemplated by the Master Reorganization Agreement in order to, among other things, reorganize under a new public holding company and eliminate Old Atlas’s “up-C” and dual-class stock structure. Pursuant to the Master Reorganization Agreement, (a) PubCo Merger Sub merged with and into Old Atlas, as a result of which (i) each share of Old Atlas Class A Common Stock then issued and outstanding was exchanged for one share of Common Stock of the Company, (ii) all of the shares of Old Atlas Class B Common Stock then issued and outstanding were surrendered and cancelled for no consideration and (iii) Old Atlas survived the PubCo Merger as a direct, wholly-owned subsidiary of the Company; and (b) Opco Merger Sub merged with and into Atlas Operating, as a result of which (i) each Operating Unit then issued and outstanding, other than those Operating Units held by Old Atlas, was exchanged for one share of Common Stock of the Company and (ii) Atlas Operating became a wholly-owned subsidiary of the Company.

After completion of the Up-C Simplification, the Company replaced Old Atlas as the publicly held entity and, through its subsidiaries, conducts all of the operations previously conducted by Old Atlas, and Old Atlas remains the managing member of Atlas Operating.

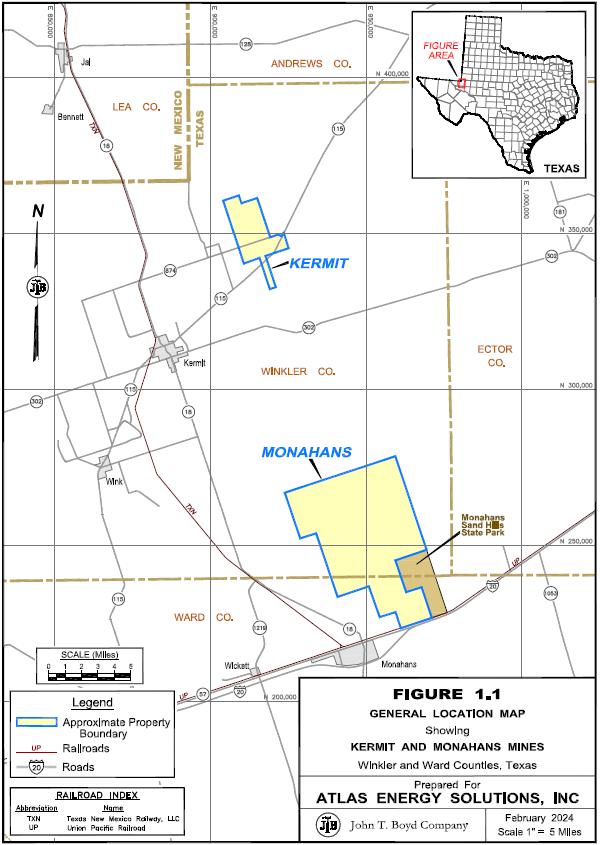

Assets and Operations

We developed our Kermit and Monahans facilities as in-basin proppant mines on approximately 38,000 surface acres that we own or lease in Winkler and Ward Counties, Texas. We control 14,575 acres of large open-dune reserves and resources, which represent more than 70% of the total giant open dune acreage in the Winkler Sand Trend available for sand mining. The Monahans Dune consists of approximately 8,750 acres of premium open-dune reserves. Additionally, we have substantial off-dune acreage at Monahans that is not included in our estimated reserves or resources but that could be mined following our removal of material, such as soil and unusable sand, that lies above the useable sand and must be removed to excavate the useable sand, which we refer to as “overburden.” The Kermit Dunes consists of approximately 5,826 acres of premium open-dune reserves.

Significant Innovation Projects

Second Kermit Facility

At the start of 2023, we had one Kermit facility and one Monahans facility, each of which was capable of producing 5.5 million tons of proppant annually. In response to the increase in market demand, and also in connection with the expansion of our logistics offering, we expanded our Kermit production capacity in 2023 by adding a new facility with 5.5 million tons of annual production capacity, for a combined total production capacity of 16.5 million tons annually as of December 31, 2023.

The Dune Express Electric Conveyor System

The Dune Express, which will originate at our Kermit facilities and stretch into the middle of the Northern Delaware Basin, will be the first long-haul proppant conveyor system in the world. Upon completion, we expect the Dune Express to be 42 miles in length, capable of transporting 13 million tons of proppant annually and to have approximately 85,000 tons of dry storage within the system. This conveyor system will be strategically located to deliver proppant to the producing region of the Delaware Basin. We expect the Dune Express to lower transportation cost and increase safety by removing trucks from public roadways, thus reducing traffic, accidents and fatalities on public roadways in the region.

9

We plan to install two permanent loadout facilities near the middle of the conveyor system close to the Texas side of the Texas-New Mexico state line and at the end of the Dune Express right-of-way on BLM land near the Lea-Eddy County line in New Mexico. The conveyor system will also utilize one or more “mobile” loadouts, which can be mobilized and relocated from time to time, to maximize delivery efficiencies particularly for operators pursuing a concentrated development plan in the area that is proximate to the conveyor system but not proximate to one of the two permanent loadouts connected to the system.

As of December 31, 2023, 90% of equipment and materials and 80% of installation services for construction of the Dune Express have been ordered and contracted. Additionally, we have cleared, graded and laid caliche on the vast majority of the right-of-way and have taken delivery of approximately 150 conveyor belt sections, equivalent to approximately 57 miles of total conveyor belt and over 100 miles of fiberoptic cable. The Dune Express is expected to be in service during the fourth quarter of 2024.

Wellsite Delivery Assets

Our existing logistics business utilizes third-party transportation contractors which we currently supplement with our own trucks and trailers. As of February 27, 2024, we added 120 trucks and 323 trailers to our fit-for-purpose trucking fleet, which we expect will improve our productivity, as measured by tons per truck that can be delivered daily, compared to the throughput performance of traditional trucking assets.

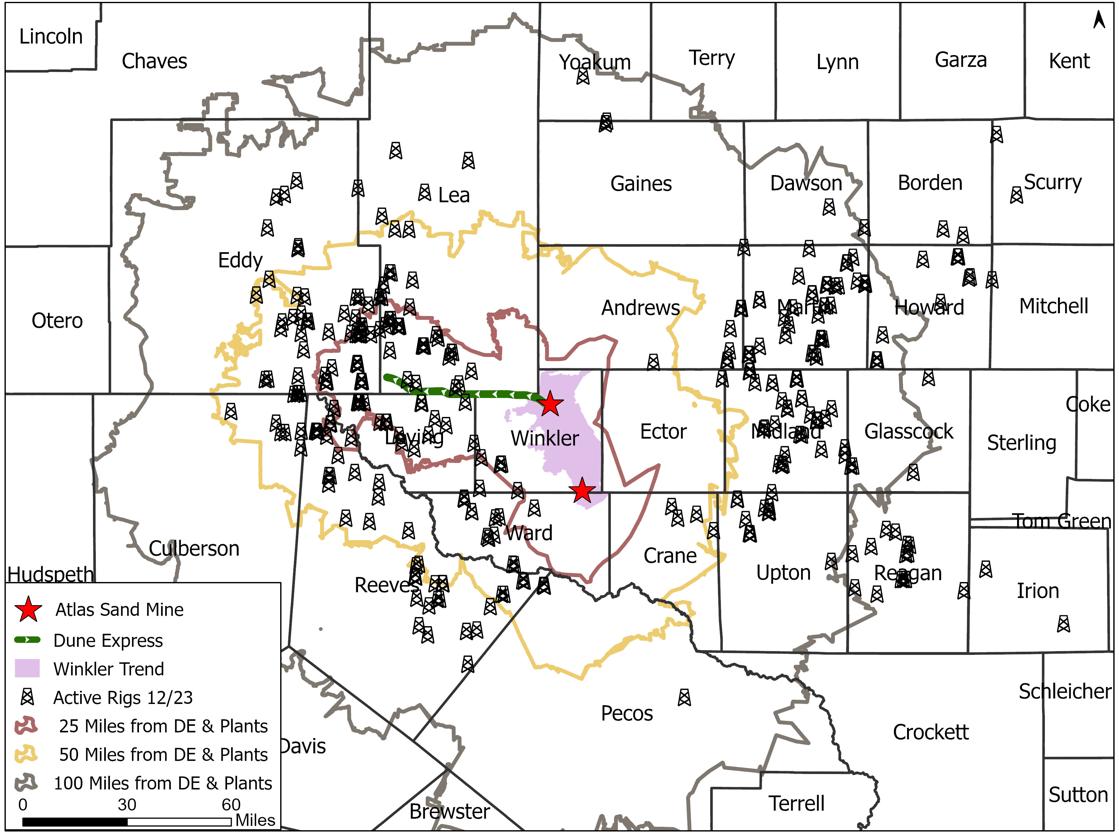

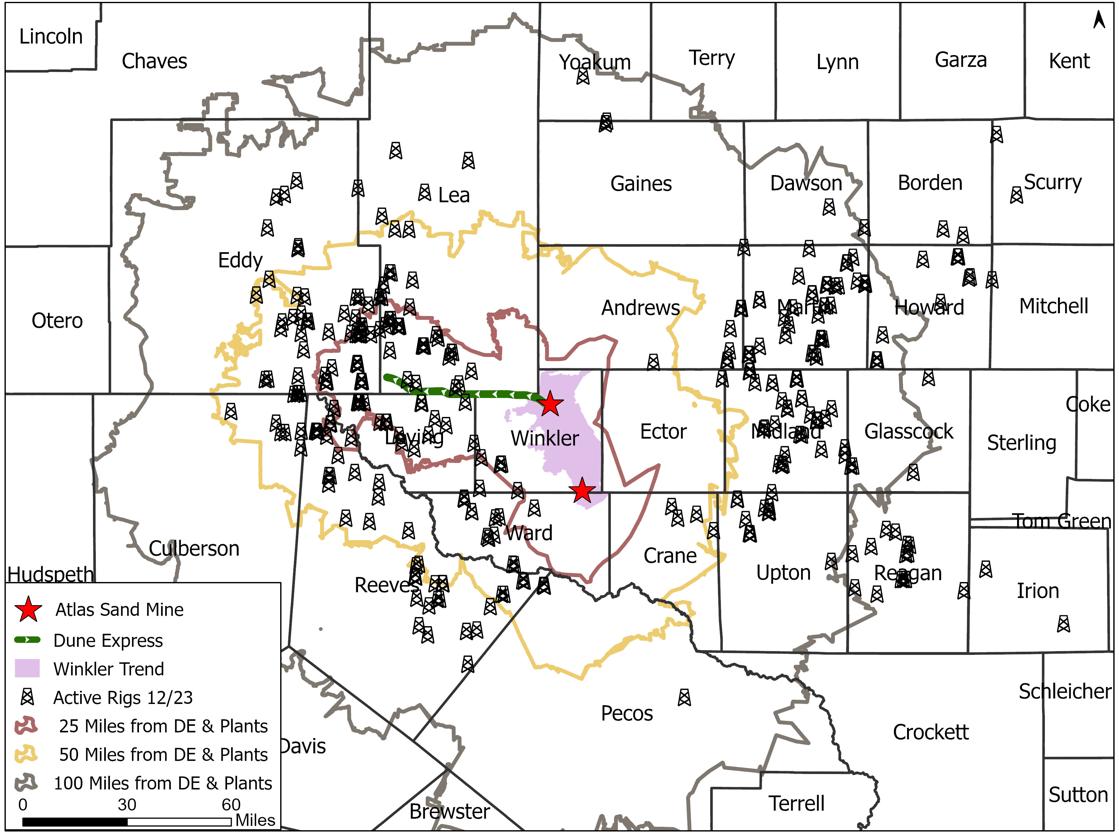

Map of Operations

The following map shows the locations of our Kermit and Monahans facilities in Winkler and Ward Counties, Texas, as well as the Dune Express route based on secured rights-of-ways and federal permits, alongside a recent snapshot of the rig count in the Permian Basin as of December 31, 2023:

Source: Enverus, Baker Hughes.

Our Kermit and Monahans facilities were built to produce high quality 40/70-mesh and 100-mesh sands, each of which is used extensively in upstream operations in the Permian Basin. Each facility was constructed with a modular design that provides us with the flexibility to expand any of the existing facilities to achieve incremental production capacity gains if such expansion were found to be necessary or desirable in light of customer demand, broader market conditions or other relevant considerations. Innovative plant design and large-scale operations facilitate low-cost operations and continuity on site. Redundancies were designed into our facilities to remove singular points of failure that could disrupt the production process, ensuring maximum reliability of proppant production and delivery. The facilities are capable of operating year-round and feature advanced safety designs, onsite water supply, power infrastructure and access to low-cost natural gas through connections to interstate natural gas lines. Collectively, our Kermit and Monahans facilities have a combined annual production capacity of 16.5 million tons, 85,000 tons of dry storage, 1,190,000 tons of wet storage and 17 loadout lanes.

10

Further, we benefit from the strategic locations of our facilities, proximal to major highways at the south and north ends of the Winkler Sand Trend. Our Kermit facilities are bisected by two state highways, while our Monahans facility its adjacent to two highways, one of which is Interstate 20, facilitating efficient transportation of our proppant to customers located at various points within the Permian Basin.

The operations of our sand facilities are managed and monitored in a highly automated manner from our command center in Austin, Texas. The remote ecosystem allows our employees to simultaneously manage processes at all facilities, resulting in personnel productivity gains.

Our Products and Services

Product

We serve the oil and gas end markets, and our sand reserves contain deposits of fine grade 40/70-mesh and 100-mesh sizes that API specifies for use in wellsite fracturing operations. We believe that this mix of finer grade sand reserves is in higher demand and meets current industry preferences. Based on the reserve report prepared by John T. Boyd Company, our independent mining engineers and geologists, as of December 31, 2023, we had 488.0 million tons of proven and probable sand reserves at our Kermit and Monahans locations, and our reserves were composed of approximately 53% 40/70-mesh and 47% 70/140-mesh substrate sand. Based on our current total annual expected production capacity of approximately 16.5 million tons as of December 31, 2023, we estimate our reserve life to be approximately 31 years for our Kermit facilities and 29 years for our Monahans facility, as may be extended or adjusted for future conversions of measured, indicated or inferred resources to proven or probable reserves or any change to our production capacity. For more information regarding our mineral reserves, see Item 2. “Property.—Our Reserves.”

Proppant from our Kermit and Monahans facilities is stored in our onsite silos before transport and delivery by truck to customers’ well sites located primarily in the Delaware and Midland Basins. Our proppant is offered to our customers at the mine or as an integrated mine-to-wellhead solution.

Services

We provide transportation, storage solutions and contract labor services to companies in the oil and gas industry. Transportation services typically consist of transporting product from the plant facilities to the wellsite. The locations of the Kermit and Monahans facilities are within close proximity to well activity and enable us to deliver proppant directly to our customers’ wellheads using traditional pneumatic assets, portable silos, boxes or portable conveyance systems, reducing handling costs and delivery lead times.

Our Permits

We have obtained numerous federal, state and local permits required for operations at our Kermit and Monahans facilities. The Kermit and Monahans operations are predominantly regulated by the TCEQ with respect to environmental compliance. The predominant permitting requirement is an active New Source Review (“NSR”) permit for air pollution control. Both of our operations have a current NSR permit which is renewable next in 2028. Other permits held by our operations include Stormwater, Above Ground Storage Tank, Aggregate Production Operation, and a septic permit. A Spill Prevention, Control, and Countermeasure plan is also active at both locations.

While resources invested in securing permits are significant, this cost has not had a material adverse effect on our results of operations or financial condition. We cannot be certain that existing environmental laws and regulations will not be reinterpreted or revised or that new environmental laws and regulations will not be adopted or become applicable to us. Revised or additional environmental requirements that result in increased compliance costs or additional operating restrictions could have a material adverse effect on our business.

Environmental and Occupational Health and Safety Regulations

We are subject to stringent and complex federal, state and local laws and regulations governing the discharge of materials into the environment or otherwise relating to protection of worker health, safety and the environment and natural resources (including threatened and endangered species). Compliance with these laws and regulations may expose us to significant costs and liabilities and cause us to incur significant capital expenditures in our operations. Any failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of remedial obligations and the issuance of injunctions delaying or prohibiting operations. Certain environmental laws may impose strict, joint and several liability for remediation costs. Private parties may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property damage. In addition, the trend in environmental regulation has been to place more restrictions on activities that may affect the environment, and thus, any changes in, or more stringent enforcement of, these laws and regulations that result in more stringent and costly pollution control equipment, the occurrence of delays in the permitting or performance of projects, or waste handling, storage, transport, disposal or remediation requirements could have an adverse effect on our operations and financial position.

11

We do not believe that compliance by us and our customers with federal, state or local environmental laws and regulations will have an adverse effect on our business, financial position or results of operations or cash flows. We cannot assure you, however, that future events, such as changes in existing laws or enforcement policies, the enactment or promulgation of new laws or regulations or the development or discovery of new facts or conditions adverse to our operations will not cause us to incur significant costs. The following is a discussion of material environmental and worker health and safety laws, as amended from time to time, that relate to our operations or those of our customers that could have an adverse effect on our business.

Worker & Community Health and Safety

We are subject to the requirements of the federal Occupational Safety and Health Administration (“OSHA”), and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and the public. Similar obligations related to community safety are codified in the Emergency Planning & Community Right to Know Act, as authorized by the Superfund Amendments and Reauthorization Act. These laws and regulations are subject to frequent changes and any failure to comply with these laws could lead to the assertion of third-party claims against us, civil or criminal fines and changes in the way we operate our facilities, which one or more events could have an adverse effect on our financial position. We have an internal program of inspection designed to monitor and enforce compliance with worker safety requirements. Historically, our worker and community health and safety compliance costs have not had an adverse effect on our results of operations.

Air Emissions

Our operations and the operations of our customers are subject to the federal Clean Air Act (“CAA”) and related state and local laws, which restrict the emission of air pollutants and impose permitting, monitoring and reporting requirements on various sources. These regulatory programs may require preconstruction permitting, best available control technology analysis, the installation of emissions abatement equipment, modification of operational practices and obtaining permits or similar authorizations for our operations. Obtaining air emissions permits has the potential to delay the development or continued performance of our operations. Over the next several years, we may be required to incur certain capital expenditures for air pollution control equipment or to address air emissions-related issues as we expand our facilities or develop new ones. Changing and increasingly stricter requirements, future non-compliance or failure to maintain necessary permits or other authorizations could require us to incur substantial costs or suspend or terminate our operations. We could be subject to administrative, civil and criminal penalties as well as injunctive relief for noncompliance with air permits or other requirements of the CAA and comparable state laws and regulations.

Climate Change

In the United States, no comprehensive climate change legislation has been implemented at the federal level. However, following the U.S. Supreme Court finding that emissions of greenhouse gases (“GHGs”) constitute a pollutant under the CAA, the EPA has adopted regulations that, among other things, establish construction and operating permit reviews for emissions from certain large stationary sources, require the monitoring and annual reporting of GHG emissions from certain petroleum and natural gas system sources in the United States, and together with the Department of Transportation (the “DOT”), implement GHG emissions limits on vehicles manufactured for operation in the United States. In recent years the U.S. Congress has also considered legislation to reduce emissions of methane and carbon dioxide, two GHGs associated with the development and use of natural gas. Additionally, energy legislation and related regulatory initiatives have been and continue to be proposed that are relevant to GHG emissions issues. For example, the Inflation Reduction Act of 2022 (“IRA”) appropriated significant federal funding for renewable energy initiatives and, for the first time ever, imposed a fee (the implementation of which is currently under development by the EPA) on GHG emissions from certain facilities. The emissions fee and funding provisions of the law could increase the operating costs of our customers and accelerate the transition away from fossil fuels, which could in turn adversely affect our business and results of operations. Additionally, several U.S. states, either individually or in regional collaboration, have adopted or are considering adopting legislation, policies, or regulatory initiatives focused on GHG emissions reductions, including cap and trade programs, carbon taxes, performance standards, and reporting and monitoring programs. Internationally, the United Nations-sponsored Paris Agreement (“Paris Agreement”) requires member states to individually determine and submit non-binding emissions reduction targets every five years after 2020. President Biden recommitted the United States to the Paris Agreement and, in April 2021, announced a goal of reducing the United States’ emissions by 50-52% below 2005 levels by 2030. Various U.S. states and local governments have also publicly committed to furthering the goals of the Paris Agreement. The international community continues to gather annually to develop and negotiate international climate initiatives, pledges, and frameworks. The impacts of these orders, pledges, agreements and any legislation or regulation promulgated to fulfill the United States’ commitments under the Paris Agreement or other international agreements cannot be predicted at this time.

12

Domestically, President Biden highlighted addressing climate change as a priority of his administration and has issued several executive orders addressing climate change, published a strategic roadmap to net-zero emissions in the United States by 2050, “The Long-Term Strategy of the United States: Pathways to Net-Zero Greenhouse Gas Emissions by 2050,” and directed federal agencies to include climate change considerations into their decision-making processes. For example, the Biden Administration temporarily paused federal oil and gas leasing, and is currently pausing authorizations for new LNG exports to certain countries, for federal agency-led reviews of these programs, which incorporate climate-impact analyses.

Emerging climate-change focused legislation and regulation, policy directives, and related initiatives have the potential to increase our and our customers’ operating costs and reduce demand for our customers’ products and thereby our services. Further, any limitations or restrictions on the development of fossil fuel-specific infrastructure and our customers’ ability to access capital, develop their assets, and market their products may adversely affect our business and results of operations. For more information on applicable climate change-related regulatory matters, developments and risks affecting our business, please see our “Risk Factors—Risks Related to Environmental, Mining and Other Regulations—Our and our customers’ operations are subject to a number of risks arising out of the threat of climate change, including regulatory, political, litigation and financial risks, which could result in increased operating and capital costs for our customers and reduced demand for our products and services” and “Risk Factors—Risks Related to Our Business and Operations— Increased stakeholder and market attention to ESG and conservation matters may adversely impact our business and access to capital.”

Water Discharges

The federal Clean Water Act (“CWA”) and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into waters of the United States. The discharge of pollutants into regulated waters, including jurisdictional wetlands, is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA also prohibits the discharge of dredge and fill material in regulated waters, including wetlands, unless authorized by a permit issued by the U.S. Army Corps of Engineers (the “Corps”). Federal and state regulatory agencies can impose administrative, civil and criminal penalties, as well as require remedial or mitigation measures, for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations. In the event of an unauthorized discharge of wastes, we may be liable for penalties and costs.

The scope of waters subject to federal jurisdiction has been subject to substantial controversy. In 2015 and 2020, respectively, the Obama and Trump Administrations each published final rules attempting to define the federal jurisdictional reach over waters of the United States (“WOTUS”). However, both of these rulemakings were subject to legal challenge. In January 2023, the EPA and the Corps published a final rule based on the pre-2015 definition of WOTUS, with updates to incorporate existing Supreme Court decisions and regulatory guidance. However, the January 2023 rule was challenged and is currently enjoined in 27 states. In May 2023, the U.S. Supreme Court released its opinion in Sackett v. EPA, which involved issues relating to the legal tests used to determine whether wetlands qualify as WOTUS. The Sackett decision invalidated certain parts of the January 2023 rule and significantly narrowed its scope, resulting in a revised rule being issued in September 2023. However, due to the injunction on the January 2023 rule, the implementation of the September 2023 rule currently varies by state. In the 27 states subject to the injunction, the agencies are interpreting the definition of WOTUS consistent with the pre-2015 regulatory regime and the changes made by the Sackett decision, which utilizes the “continuous surface connection” test to determine if wetlands qualify as WOTUS. In the remaining 23 states, the agencies are implementing the September 2023 rule, which did not define the term “continuous surface connection.” Therefore, some uncertainty remains as to how broadly the September 2023 rule and the Sackett decision will be interpreted by the agencies. To the extent the implementation of the final rule, results of the litigation or any action further expands the scope of the CWA’s jurisdiction in areas where we operate, we could face increased costs and delays with respect to obtaining permits for dredge and fill activities in wetland areas.

Additionally, the process for obtaining permits has the potential to delay our operations. Spill prevention, control and countermeasure requirements of federal laws require appropriate containment berms and similar structures to help prevent the contamination of navigable waters by a petroleum hydrocarbon tank spill, rupture or leak. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Federal and state regulatory agencies can impose administrative, civil and criminal penalties as well as other enforcement mechanisms for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations. The CWA and analogous state laws provide for administrative, civil and criminal penalties for unauthorized discharges and, impose rigorous requirements for spill prevention and response planning, as well as substantial potential liability for the costs of removal, remediation, and damages in connection with any unauthorized discharges.

13

Hydraulic Fracturing

We supply proppant to the oil and natural gas industry. Hydraulic fracturing is an important common practice that is used to stimulate production of oil and natural gas from low permeability hydrocarbon bearing subsurface rock formations. The hydraulic fracturing process involves the injection of water, proppant and chemicals under pressure into the formation to fracture the surrounding rock, increase permeability and stimulate production. Although we do not directly engage in hydraulic fracturing activities, our customers purchase our proppant for use in their hydraulic fracturing activities. Hydraulic fracturing is typically regulated by state oil and natural gas commissions and similar agencies; however, the EPA has asserted jurisdiction over hydraulic fracturing activities in some circumstances. Separately, the EPA released a final report in December 2016 assessing the potential adverse impact of hydraulic fracturing to water resources, concluding that activities relating to water consumption, use and disposal associated with hydraulic fracturing may impact drinking water resources under certain circumstances. To date, EPA has taken no further action in response to the December 2016 report. Some states have adopted, and other states are considering adopting, regulations that could impose new or more stringent permitting, disclosure or well construction requirements on hydraulic fracturing operations. State and federal regulatory agencies have also recently focused on a possible connection between the operation of injection wells used for oil and natural gas waste disposal and seismic activity. Similar concerns have been raised that hydraulic fracturing may also contribute to seismic activity. Aside from state laws, local land use restrictions may restrict drilling in general or hydraulic fracturing in particular. Municipalities may adopt local ordinances attempting to prohibit hydraulic fracturing altogether or, at a minimum, allow such fracturing processes within their jurisdictions to proceed but regulating the time, place and manner of those processes. At the same time, certain environmental groups have suggested that additional laws may be needed to more closely and uniformly limit or otherwise regulate the hydraulic fracturing process, and legislation has been proposed by some members of Congress to provide for such regulation.

The adoption of new laws or regulations at the federal or state levels imposing reporting obligations on, or otherwise limiting or delaying, the hydraulic fracturing process could make it more difficult to complete natural gas wells, increase our customers’ costs of compliance and doing business and otherwise adversely affect the hydraulic fracturing services they perform, which could negatively impact demand for our proppant. In addition, heightened political, regulatory and public scrutiny of hydraulic fracturing practices could expose us or our customers to increased legal and regulatory proceedings, which could be time-consuming, costly or result in substantial legal liability or significant reputational harm. We could be directly affected by adverse litigation involving us, or indirectly affected if the cost of compliance limits the ability of our customers to operate. Such costs and scrutiny could directly or indirectly, through reduced demand for our proppant, have an adverse effect on our business, financial condition and results of operations.

Non-Hazardous and Hazardous Wastes

The Resource Conservation and Recovery Act (“RCRA”) and comparable state laws control the management and disposal of hazardous and non-hazardous waste. These laws and regulations govern the generation, storage, treatment, transfer and disposal of wastes that we generate. In the course of our operations, we generate waste that are regulated as non-hazardous wastes and hazardous wastes, obligating us to comply with applicable standards relating to the management and disposal of such wastes. In addition, drilling fluids, produced waters and most of the other wastes associated with the exploration, development and production of oil or natural gas, if properly handled, are currently exempt from regulation as hazardous waste under RCRA and, instead, are regulated under RCRA’s less stringent non-hazardous waste provisions, state laws or other federal laws. However, it is possible that certain oil and natural gas drilling and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. A loss of the RCRA exclusion for drilling fluids, produced waters and related wastes could result in an increase in our customers’ costs to manage and dispose of generated wastes and a corresponding decrease in their drilling operations, which developments could have an adverse effect on our business.

Site Remediation

The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and comparable state laws impose strict, joint and several liability on certain classes of persons that contributed to the release of a hazardous substance into the environment without regard to fault or the legality of the original conduct. These persons include the owner and operator of a disposal site where a hazardous substance release occurred and any company that transported, disposed of or arranged for the transport or disposal of hazardous substances released at the site. Under CERCLA, such persons may be liable for the costs of remediating the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. In addition, where contamination may be present, it is not uncommon for the neighboring landowners and other third parties to file claims for personal injury, property damage and recovery of response costs. We have not received notification that we may be potentially responsible for cleanup costs under CERCLA at any site.

14

Endangered Species

The ESA restricts activities that may affect endangered or threatened species or their habitats. Similar protections are offered to migratory birds under the Migratory Bird Treaty Act (“MBTA”) and analogous state laws. Compliance with these laws may require the implementation of avoidance or mitigation measures or time and place restrictions on certain operations during migration or breeding seasons. The listing of new species as endangered or threatened and the designation of such species’ habitat as critical under the ESA or related laws in areas where we or our customers operate, we or our customers may incur increased costs arising from required species protection measures or experience operational delays or limitations, either of which could adversely affect our and our customers operations or reduce demand for our services. For more information regarding risks associated with compliance with endangered species laws and regulations, including discussion of certain risks related to the DSL and lesser prairie chicken, please see our “Risk Factors—Risks Related to Environmental, Mining and Other Regulations—Restrictions on our operations and those of our customers intended to protect certain species of wildlife could have an adverse impact on our ability to expand some of our existing operations or limit our customers’ ability to develop new oil and natural gas wells.”

Mining and Workplace Safety

Our proppant production operations will be subject to mining safety regulation. Mine Safety and Health Administration (“MSHA”) is the primary regulatory organization governing proppant mining and processing. Accordingly, MSHA regulates quarries, surface mines, underground mines and the industrial mineral processing facilities associated with and located at quarries and mines. The mission of MSHA is to administer the provisions of the Federal Mine Safety and Health Act of 1977 and to enforce compliance with mandatory miner safety and health standards. As part of MSHA’s oversight, representatives perform at least two unannounced inspections annually for each above-ground facility. Failure to comply with MSHA’s regulations could result in the imposition of civil or criminal penalties and fines.

In addition, our operations are subject to a number of federal and state laws and regulations, including the OSHA and comparable state statutes, whose purpose is to protect the health and safety of workers. Also, OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. Violations of OSHA can result in OSHA civil and criminal enforcement. Moreover, the inhalation of respirable crystalline silica is associated with the lung disease silicosis. There is recent evidence of an association between crystalline silica exposure or silicosis and lung cancer and a possible association with other diseases, including immune system disorders such as scleroderma. These health risks have been, and may continue to be, a significant issue confronting the silica industry. In response to these potential concerns, OSHA promulgated a new rule seeking to lower work exposure to crystalline silica. The rule became effective for general industry in 2018. In June 2022, MSHA launched a new enforcement initiative to better protect U.S. miners from health hazards resulting from repeated overexposure to respirable crystalline silica. For more information, please see our “Risk Factors—Risks Related to Environmental, Mining and Other Regulations— Silica-related health issues and legislation, including compliance with existing or future regulations relating to respirable crystalline silica, or litigation could have an adverse effect on our business, reputation or results of operations.”

In addition, concerns over silicosis and other potential adverse health effects, as well as concerns regarding potential liability from the use of silica, may have the effect of discouraging our customers’ use of our silica products and discouraging our insurers from risk. The actual or perceived health risks of mining, processing and handling silica could adversely affect silica producers, including us, through reduced use of silica products, the threat of product liability or employee lawsuits, increased scrutiny by federal, state and local regulatory authorities of us and our customers or reduced financing sources available to the silica industry.

Environmental Reviews

If permits or other authorizations from the federal government are required, our future operations may be subject to broad environmental review under the National Environmental Policy Act, as amended (“NEPA”). NEPA requires federal agencies to evaluate the environmental impact of all “major federal actions” significantly affecting the quality of the human environment. The granting of a federal permit for a major development project, such as a proppant production operations, may be considered a “major federal action” that requires review under NEPA. As part of this evaluation, the federal agency considers a broad array of environmental impacts, including, among other things, impacts on air quality, water quality, wildlife (including threatened and endangered species), historic and archeological resources, geology, socioeconomics and aesthetics. NEPA also requires the consideration of alternatives to the project. The NEPA review process, especially the preparation of a full environmental impact statement, can be time consuming and expensive. The purpose of the NEPA review process is to inform federal agencies’ decision-making on whether federal approval should be granted for a project and to provide the public with an opportunity to comment on the environmental impacts of a proposed project. Though NEPA requires only that an environmental evaluation be conducted and does not mandate a particular result, a federal agency could decide to deny a permit or impose certain conditions on its approval, based on its environmental review under NEPA, or a third party could challenge the adequacy of a NEPA review and thereby delay the issuance of a federal permit or approval, which could have an adverse effect on our business. For more information, please see “Risk Factors—Risks Related to Environmental, Mining and Other Regulations—Any restrictions on oil and natural gas development on federal lands have the potential to adversely impact our operations and the operations of our customers.”

15

Motor Carrier Operations

Among the services we provide, we operate as a motor carrier and therefore are subject to regulation by the DOT and various state agencies. These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations; regulatory safety; hazardous materials labeling, placarding and marking; financial reporting; and certain mergers, consolidations and acquisitions. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment and product handling requirements. The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand for common or contract carrier services or the cost of providing truckload services. Some of these possible changes include increasingly stringent environmental regulations, changes in the hours of service regulations which govern the amount of time a driver may drive in any specific period and requiring onboard black box recorder devices or limits on vehicle weight and size.

Interstate motor carrier operations are subject to safety requirements prescribed by the DOT. Intrastate motor carrier operations are subject to safety regulations that often mirror federal regulations. Such matters as weight and dimension of equipment are also subject to federal and state regulations. The DOT regulations also mandate drug testing of drivers. From time to time, various legislative proposals are introduced, including proposals to increase federal, state or local taxes, including taxes on motor fuels, which may increase our costs or adversely impact the recruitment of drivers. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted.

State and Local Regulation

We are subject to a variety of state and local environmental review and permitting requirements. In some cases, the state environmental review may be more stringent than the federal review. Our operations may require state-law based permits in addition to federal permits, requiring state agencies to consider a range of issues, many the same as federal agencies, including, among other things, a project’s impact on wildlife and their habitats, historic and archaeological sites, aesthetics, agricultural operations and scenic areas. The development of new sites and our existing operations also are subject to a variety of local environmental and regulatory requirements, including land use, zoning, building and transportation requirements.

Demand for proppant in the oil and natural gas industry drove a significant increase in the production of proppant. As a result, some local communities expressed concern regarding silica sand mining operations. These concerns have generally included exposure to ambient silica sand dust, truck traffic, water usage and blasting. In response, certain state and local communities have developed or are in the process of developing regulations or zoning restrictions intended to minimize dust from becoming airborne, control the flow of truck traffic, significantly curtail the amount of practicable area for proppant production activities, provide compensation to local residents for potential impacts of proppant production activities and, in some cases, ban issuance of new permits for proppant production activities. To date, we have not experienced any material impact to the development of our proppant production facilities and do not anticipate an impact on future operations as a result of these types of concerns. We would expect this trend to continue as oil and natural gas production increases.

Competition

The market in which we operate is highly competitive. We compete with both public and private large, national producers and small, regional or local in-basin proppant providers, such as Covia Corp., High Roller Sand, Black Mountain Sand, Freedom Proppants, Hi-Crush, U.S. Silica Inc., Alpine Silica, Badger Mining Corporation, Vista Proppants and Logistics and Capital Sand Company, among others. Competition in the proppant production industry is based on a number of factors, including product and service quality, reliability of the service provider, the geographic location of facilities and the associated logistics costs of transporting proppant from the supplier to the customer, innovation, etc.

Human Capital and Employees

Our employees are a critical asset to our innovative culture and overall success. We are focused on sustaining a high-performance culture through attracting, engaging, developing, retaining and rewarding top talent. We strive to enhance the economic and social wellbeing of our employees and the communities in which we operate. We seek to provide a welcoming, inclusive environment for our workforce, with best-in-class training and career development opportunities to enable employees to thrive and achieve their career goals.

As of December 31, 2023, we had a total of 490 employees, of which 111 service our corporate headquarters and 379 work in field locations. None of our employees are represented by labor unions or subject to collective bargaining agreements. We consider our employee relations to be good.

16

Health and Safety

The health, safety, and wellbeing of our employees is of the utmost importance. We believe that we are an industry leader with a proven track record in safety.

We provide employees the option to participate in health and welfare plans, including medical, dental, life, accidental death and dismemberment and short-term and long-term disability insurance plans. We also offer a number of health and wellness programs, including telemedicine, health screens and fitness reimbursement as well as access to the Employee Assistance Program which provides employees and their family members access to professional providers to help navigate challenging life events 24 hours a day, 365 days a year.

Available Information

Our headquarters office is located at 5918 W. Courtyard Dr., Suite 500, Austin, TX 78730, and our telephone number at that address is (512) 220‑1200. Our website address is https://atlas.energy. Our periodic reports and other information filed with or furnished to the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to such filings, are available free of charge through our website under the “Investors” link as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. The SEC also maintains an internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, including us, that file electronically with the SEC. In addition to its reports filed or furnished with the SEC, the Company publicly discloses material information from time to time in its press releases, at annual meetings of shareholders, in publicly accessible conferences and Investor presentations, and through its website (principally in its Press Room and Investor Relations pages). Information on our website or any other website is not incorporated by reference into this Annual Report and does not constitute a part of this Annual Report.

17

Item 1A. Risk Factors.

There are numerous factors that affect our business and operating results, many of which are beyond our control. The following is a summary of significant factors that might cause our future results to differ materially from those currently expected. The risks described below are not the only risks facing our Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. If any of these risks actually occur, our business, financial position, operating results, cash flows, reserves or our ability to pay our debts and other liabilities could suffer, the trading price and liquidity of our securities could decline and you may lose all or part of your investment in our securities.

Risks Related to Our Business and Operations

Our proppant production and logistics operations depend on the level of activity in the oil and natural gas industries, which experience substantial volatility.

Our operations that produce and transport proppant are materially dependent on the levels of activity in oil and natural gas exploration, development and production. More specifically, the demand for the proppant we produce is closely related to the number of oil and natural gas wells completed in geological formations where sand-based proppant is used in fracture treatments. These activity levels are affected by both short- and long-term trends in oil and natural gas prices. In recent years, oil and natural gas prices and, therefore, the level of exploration, development and production activity, have experienced significant volatility.

When oil and natural gas prices decrease, exploration and production companies may reduce their exploration, development, production and well completion activities. During such periods, demand for our products and services, which supply oil and natural gas wells, including our transportation and logistics solutions, may decline, and may lead to a decline in the market price of proppant, if the supply of proppant is not similarly reduced. When demand for proppant increases, there may not be a corresponding increase in the prices for our products or our customers may not increase use of our products, which could have an adverse effect on our business, financial condition and results of operations.

Worldwide economic, political and military events, including war, terrorist activity, events in the Middle East and initiatives by OPEC+, have contributed, and are likely to continue to contribute, to oil and natural gas price volatility. For example, the ongoing armed conflicts between Russia and Ukraine and Israel and Hamas and the continuation of, and the escalation in the severity of, these conflicts has led to extreme regional instability, caused dramatic fluctuations in global financial markets and has increased the level of global economic uncertainty, including uncertainty about world-wide oil supply and demand, which in turn has caused increased volatility in commodity prices. Further, the Houthi movement, which controls parts of Yemen, has targeted and launched numerous attacks on Israeli, American and international commercial marine vessels in the Red Sea as the ships approach the Suez Canal, resulting in many shipping companies re-routing to avoid the region altogether and worsening existing supply chain issues, including delays in supplier deliveries, extended lead times and increased cost of freight, impacts to the shipping of oil and gas, insurance and materials. The potential for conflict with Iran, a major oil producer, the Houthi movement in Yemen or the Hezbollah movement in Lebanon has increased as a result of continued, increasing hostilities in the Middle East.

Additionally, warmer than normal winters in North America and other weather patterns may adversely impact the short-term demand for natural gas and, therefore, demand for our products. Reduction in demand for natural gas to generate electricity could also adversely impact the demand for proppant. In addition, any future decrease in the rate at which oil and natural gas reserves are discovered or developed, whether due to increased governmental regulation, limitations on exploration and drilling activity, technological innovations that result in new processes for oil and natural gas production that do not require proppant or other factors, could adversely affect the demand for our products, even in a stronger oil and natural gas price environment. Moreover, the energy transition to a low carbon economy, increased deployment of renewable power generation, renewable fuels and electric vehicles all have the potential to reduce demand for oil and natural gas and consequently the services we provide. The continued or future occurrence of any of these risks could have an adverse effect on our business, financial condition and results of operations.

Our business is subject to the cyclical nature of our customers’ businesses and on the oil and natural gas industry.

Our business is directly affected by capital spending to explore for, develop and produce oil and natural gas in the United States. The oil and natural gas industry is cyclical and historically has experienced periodic downturns in activity. During periods of economic slowdown in one or more of the industries or geographic regions we serve or in the worldwide economy, our customers often reduce their production and capital expenditures by deferring or canceling pending projects, even if such customers are not experiencing financial difficulties. These developments can have an adverse effect on sales of our products and our results of operations.

Weakness in the industries we serve has had, and may in the future have, an adverse effect on our sales and results of operations. A continued or renewed economic downturn in one or more of the industries that we serve, or in the worldwide economy, could cause actual results of operations to differ materially from historical and expected results.

Industry conditions are influenced by numerous factors over which we have no control, including:

18

Decreased demand for proppant or the development of technically- and cost-effective alternative proppants or new processes to replace hydraulic fracturing would negatively impact our business.

Frac sand is the most commonly used proppant in the completion and re-completion of oil and natural gas wells through hydraulic fracturing. A significant shift in demand from frac sand to other proppants, such as ceramic proppant, the development and use of other effective alternative proppants, or the development of new processes to replace hydraulic fracturing altogether, could cause a decline in demand for frac sand that we produce and would have an adverse effect on our business, financial condition and results of operations.

In addition, fuel conservation measures, alternative fuel requirements and increasing consumer demand for alternatives to oil and natural gas could reduce demand for oil and natural gas. The impact of the reduced demand for oil and natural gas may have an adverse effect on our business, financial condition, prospects, results of operations and cash flows. Additionally, the increased competitiveness of alternative energy sources (such as wind, solar, geothermal, tidal and biofuels) could reduce demand for oil and natural gas and therefore for our products and services, which would lead to a reduction in our revenues and negatively impact our business, financial condition and results of operations.

Our future performance will depend on our ability to succeed in competitive markets and on our ability to appropriately react to potential fluctuations in demand for, and supply of, our products and services.

We operate in a highly competitive market that is characterized by a small number of large, national producers and a larger number of small, regional or local producers. Transportation costs are a significant portion of the total cost to customers of proppant (in many instances, transportation costs can represent more than 50% of delivered cost), the proppant market is typically local, and competition from beyond the local area is limited. Further, competition in the industry is based on customer relationships, reliability of supply, consistency and quality of product, customer service, site location, distribution capability, breadth of product offering, technical support and price.

Some of our competitors may have or may develop greater financial, natural and other resources than we have. Periodically, some of our competitors may reduce the pricing that they offer to our customers for a variety of reasons. One or more of our competitors may develop technology superior to ours or may have production facilities located in closer proximity to certain customer locations than we do. For example, mobile mines may be able to mine resources in close proximity to wells, enabling them to deliver sand with significantly lower transportation costs.

19

When the demand for hydraulic fracturing services decreases or the supply of proppant available in the market increases, prices in the proppant market can materially decrease. Our competitors may choose to consolidate, which could provide them with greater financial and other resources than we have and improve their competitive positioning. Furthermore, oil and natural gas exploration and production companies and other providers of hydraulic fracturing services have acquired, and in the future may acquire, their own proppant reserves to fulfill their proppant requirements, and these other market participants may expand their existing proppant production capacity, all of which would negatively impact demand for our proppant. In addition, increased competition in the proppant industry could have an adverse impact on our ability to enter into long-term contracts or to enter into contracts on favorable terms.

Past performance by members of our management team, our directors or their respective affiliates may not be indicative of our future performance or an investment in us.

Information regarding performance by, or businesses associated with, our management team, our directors and their affiliates is presented for informational purposes only. Past performance of our management team, our directors and their affiliates is not a guarantee of our future success or similar results. You should not rely on the historical record of the performance of our management team, our directors or their affiliates as being indicative of the future performance of an investment in us or the returns we will, or are likely to, generate going forward.

Increasing costs, a lack of dependability or availability of transportation services or infrastructure or an oversupply of transportation services could have an adverse effect on our business, financial condition and results of operations.

The transportation industry is subject to possible legislative and regulatory changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand or the cost of providing truckload services.

Transportation and related costs tend to be a significant component of the total delivered cost to our customers purchasing our proppant. The high relative cost of transportation related expense tends to favor manufacturers located in close proximity to the customer. Additionally, increases in the price of transportation costs, including freight charges, fuel surcharges and demurrage costs, could negatively impact operating costs if we are unable to pass those increased costs along to our customers. Failure to find long-term solutions to these logistical challenges could adversely affect our ability to respond quickly to the needs of our customers or result in additional increased costs, and thus could negatively impact our business, results of operations and financial condition.

Our operations are subject to operational hazards and inherent risks, some of which are beyond our control, and some of which may not be fully covered by insurance.

Our business and operations may be affected by natural or man-made disasters and other external events, many of which are not in our control. In addition to the other risks described in these risk factors, risks include:

These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage and suspension or cancellation of operations. Any prolonged downtime or shutdowns at our mining properties or production facilities could have an adverse effect on our business, financial condition and results of operations. In addition, our operations are subject to, and exposed to, employee/employer liabilities and risks such as wrongful termination, discrimination, labor organizing, retaliation claims and general human resource related matters.

Not all of these risks are reasonably insurable, and our insurance coverage contains limits, deductibles, exclusions and endorsements. Our insurance coverage may not be sufficient to meet our needs in the event of loss and any such loss may have an adverse effect on our business, financial condition and results of operations.

20

Our ability to produce our products economically and in commercial quantities could be impaired if we are unable to acquire adequate supplies of water for our dredging operations.

The dredging process that we currently employ to produce from our Kermit, Texas and Monahans, Texas proppant production and processing facilities requires significant quantities of water from the aquifer underlying our acreage. If in the future there is insufficient capacity available from this aquifer to provide a source of water for our dredging and associated processes as a result of drought or similar conditions affecting the environment, we will be required to obtain water from other sources that may not be readily available, or may be too costly, and we may be unable to continue our dredge mining operations entirely. The effects of climate change may also further exacerbate water scarcity in certain regions, including at the aquifer on our acreage. If an environmental, weather or other event were to require us to discontinue dredging and resume operations using traditional proppant production processes, this could impair our cost of operations and ability to economically produce our product and would have an adverse effect on our financial condition, results of operations and cash flows.

Failure to maintain effective quality control systems at our mining and production facilities could have an adverse effect on our business, financial condition and operations.

The quality and safety of our products are critical to the success of our business. These factors depend significantly on the effectiveness of our quality control systems, which, in turn, depend on a number of factors, including the design of our quality control systems, our quality-training program and our ability to ensure that our employees adhere to the quality control policies and guidelines. Any significant failure or deterioration of our quality control systems could have an adverse effect on our business, financial condition, results of operations and reputation.

Given the nature of our proppant production operations, we face a material risk of liability, delays and increased cash costs of production from environmental and industrial accidents and operational breakdowns.

Our business involves significant risks and hazards, including environmental hazards, industrial accidents and breakdowns of equipment and machinery. Our electric dredge mining operations are subject to delays and accidents associated with electrical supply, repositioning and maintenance. Furthermore, during operational breakdowns, the relevant facility may not be fully operational within the anticipated timeframe, which could result in further business losses. The occurrence of any of these or other hazards could delay production, suspend operations, increase repair, maintenance or medical costs and, due to the integration of our facilities, could have an adverse effect on the productivity and profitability of a particular facility or on our business as a whole. Although insurance policies provide limited coverage for these risks, such policies will not fully cover some of these risks.

The development of the Dune Express is a complex and challenging process that may take longer and cost more than estimated, or not be completed at all. In addition, successful development and operation of the Dune Express will depend on certain factors that may be outside of our control, and the storage and transportation capacity or other anticipated benefits of our Dune Express may not be achieved.

We may encounter adverse geological conditions, regulatory procedures or other legal requirements that could impede the construction or operation of the Dune Express. The inability to obtain any permits and other federal, state or local approvals that may be required, and any excessive delays in obtaining such permits and approvals due, for example, to litigation or third-party appeals, could potentially prevent us from successfully constructing and operating the Dune Express in a timely manner.

We engage qualified construction firms to perform work associated with the construction of the Dune Express. However, if such firms experience delays, if they perform sub-standard work or if we fail to properly monitor the quality of their work or the timeliness of their progress, we may not be able to complete construction or begin operation of the Dune Express by the date or at the cost currently estimated. In any such circumstance, we could also face difficulties meeting certain delivery obligations to our customers or incur additional costs in making such deliveries by truck or other alternative means. Any material delay caused by our construction firms and subcontractors could therefore ultimately impact our ability achieve the anticipated benefits of the Dune Express and its integrated mining facilities and have an adverse effect on our business, financial condition and results of operations.

Operation of the Dune Express will depend on transmission and distribution facilities. If transmission to the Dune Express or any of its integrated mining facilities were to be interrupted physically, mechanically or with cyber means, it may hinder our ability to mine, sell or deliver proppant to our customers, satisfy our contractual obligations or otherwise operate or fully realize the expected benefits of the Dune Express.

21

Increased stakeholder and market attention to ESG and conservation matters may adversely impact our business and access to capital.

Businesses across all industries face scrutiny from stakeholders related to their ESG approach and practices. Businesses that are perceived to be operating in contrast to investor or stakeholder expectations and standards, which are continuing to evolve, or businesses that are perceived to have not responded appropriately to the growing concern for ESG issues, regardless of whether there is a legal requirement to do so, may suffer from reputational damage and the business, financial condition, access to capital, and/or stock price of such business entity could be materially and adversely affected. Increasing societal, investor, regulator, and stakeholder attention to climate change, natural capital, and other ESG matters along with changes in consumer demand for alternative sources of energy may result in increased costs (including but not limited to increased costs related to compliance, stakeholder engagement, contracting, and insurance) and reduced demand for our customers’ hydrocarbon products and our products and services. Increasing investor, lender, and societal expectations regarding voluntary ESG-related disclosures and trends towards mandatory ESG-related disclosures could result in increased costs, heightened regulatory, judicial, and legislative scrutiny, governmental investigations, and litigation. From time to time, we may also be subject to ESG-specific activist campaigns as stockholders may attempt to effect changes to our business or governance practices.

In addition, organizations that provide information to investors on corporate governance and related matters have developed ratings processes for evaluating companies on their approach to ESG matters. Such ratings are used by some investors to inform their investment and voting decisions. Accordingly, we may receive pressure from investors, lenders or other groups to adopt climate or other ESG-related goals or participate in various voluntary frameworks or certification programs intended to improve our ESG profile. A failure or a perception (whether valid or not) of failure to implement ESG strategies or adopt ESG goals or commitments, including any voluntary GHG emission reduction or carbon intensity goals or commitments, could result in private litigation or reputational damage, cause investors or customers to lose confidence in us, harm our ability to effectively recruit or retain employees and negatively impact our operations and goodwill, all of which may adversely affect our financial performance. Moreover, even if we voluntarily elect to pursue climate or ESG goals, we cannot guarantee that we will be able to implement such goals because of potential costs, technical or operational obstacles, uncertainty in long-term assumptions and expectations or other market or technological developments beyond our control. Similarly, we cannot guarantee that participation in any sustainability, climate-related, or ESG certification program or framework will have the intended results on our ESG profile.

Separately, some members of the investment community have increased their focus on the ESG practices and disclosures of public companies, including practices and disclosures related to climate change and sustainability, diversity, equity, and inclusion, and heightened governance standards. Certain large institutional investors may also evaluate companies for ESG disclosure and performance prior to investing in our Company or including our Company’s stock in their investment products, and such evaluation criteria may not be made known to us. To the extent any of these large institutional investors choose not to invest in our Company on account of their evaluation of our ESG performance or a decision to allocate capital away from the fossil fuel production sector, we may lose investors, our cost of capital may increase, and our stock price may be negatively impacted.